market expectation

The Brazilian board and card game market has strong development momentum and is expected to continue to grow in the next few years and become an important part of the global game market. With the further increase in Internet penetration and the promotion of 5G technology, the Brazilian gaming market has huge growth potential. Mobile gaming and cloud gaming are expected to become major growth points in the future.

The Brazilian government and related institutions have begun to pay attention to the development of the game industry, supporting local game development through various policies and subsidies to promote innovation and employment. As the Brazilian game market expands, more and more international game companies are turning their attention to this market, seeking cooperation and investment opportunities. This will further promote the development and internationalization of the Brazilian game market.

Brazil is one of the few blue oceans of chess and card games in the world. With the fifth-largest population in the world and a per capita GDP of nearly US$9,000, coupled with the increasing popularity of mobile payment, this is definitely a market worth exploring for chess and card game entrepreneurs overseas. . For some reasons, Brazilian chess and card players have gradually moved from offline to online. Coupled with a large number of advertising and marketing activities by chess and card operators, Brazilian online chess and card games have become more popular.

Brazilian players prefer to gain gaming experience from competition. They are not only keen on strategy games, racing games and shooting games, but also interested in competitive card games. Although Brazil is a country that prohibits gambling, the only legal activities are lottery and horse racing under the state monopoly. In 2012, card games were recognized as a skill game in Brazil, and skill games are allowed in Brazil, which is quite similar to India.

With the continuous improvement of payment and other infrastructure, a number of outstanding chess and card entrepreneurs have emerged. The mobile payment field in Brazil is gradually developing, and many payment companies have seen Brazil's huge mobile payment market. In May 2019, Brazil's Itaú Bank launched its mobile payment application iti. Users can transfer money to anyone for free through QR codes or address books. The payee will receive the money instantly. Users only need to pay after receiving the bill. Called the Brazilian version of Alipay.

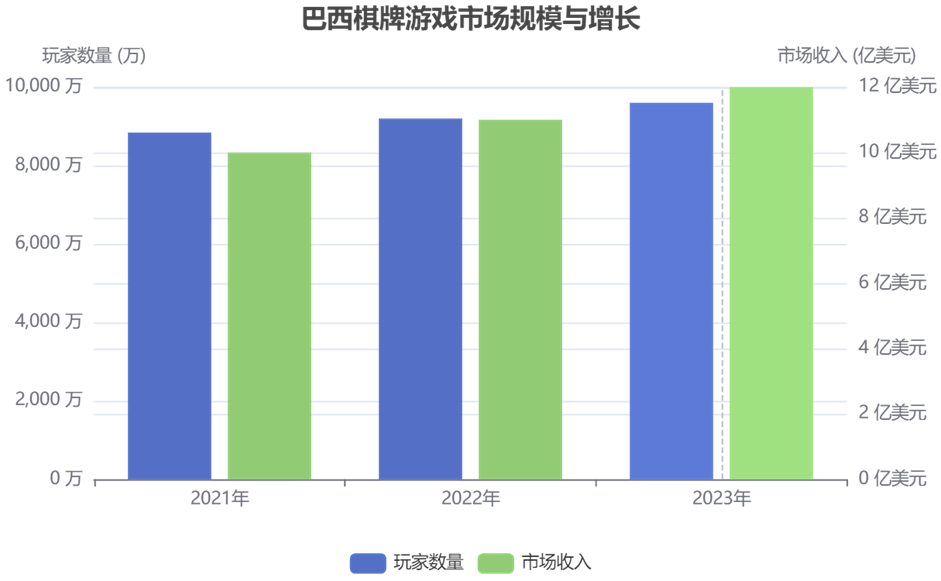

Brazil is the largest game market in South America and ranks among the top ten in the world. With a population of 210 million and a per capita GDP of nearly US$9,000, it provides a broad user base for the chess and card game market.

According to Newzoo data, the Brazilian game market is dominated by mobile games, accounting for 47% of the market share, with console and PC games accounting for 29% and 24% respectively. This shows that mobile games dominate the Brazilian market, and card and board games, as part of mobile games, have huge development potential.

With the popularity of mobile payment, the Brazilian card and board game market has ushered in a new growth point. The mobile payment application iti launched by Brazil's Itaú Bank allows users to transfer money for free through QR codes or address books, and the payee will receive the money instantly. This convenient payment method has greatly promoted the development of the board and card game market.

Light and medium-sized mobile games have become one of the important growth points of global mobile games due to their low R&D costs, flexible purchase operations, and rich monetization methods. The Brazilian market is no exception. The popularity of light mobile games has further promoted the popularity and growth of board games.

The popularity of the Internet and smartphones has further promoted the development of the Brazilian game market. Brazilians have a rich social life and like to share their views and activities through the Internet and social media, which provides a good environment for the spread and popularization of board games.

In summary, the Brazilian chess and card game market has a strong momentum of development and is expected to continue to grow in the next few years and become an important part of the global game market. With the continuous improvement of payment and other infrastructure, a group of excellent chess and card entrepreneurs have emerged, and the market prospects are broad.

market Overview

Brazil is the largest gaming market in South America and one of the largest globally. According to Newzoo, Brazil typically ranks in the top ten in the global gaming market.

With a population of 210 million, Brazil is the fifth most populous country in the world. Its per capita GDP is close to US$9,000, which gives Brazil a strong economic consumption power.

Brazil’s gaming market not only dominates Latin America, but also performs well globally. With the popularization of the Internet and smartphones, more and more Brazilians have joined the ranks of gamers, driving the rapid growth of the market.

According to 2023 data released by Newzoo, the Brazilian game market is dominated by mobile games, accounting for 47% of the market share, with console and PC games accounting for 29% and 24% of the market share respectively.

Brazil’s gaming market is very active. According to Newzoo data, Brazil has nearly 80 million players with a total annual consumption of US$1.5 billion, making Brazil the 13th largest gaming market in the world.

Policy Support

In recent years, the Brazilian government has adopted a series of policy support for the board game industry, aiming to promote the healthy development and international competitiveness of the industry. The following are specific policy support measures:

Legal and Regulatory Policies

Online Casino Legalization: In 2023, the Brazilian government passed the "Online Casino Legalization" bill, allowing more real money games (including card games) to be listed in the Brazilian market. This policy provides legal protection for the legal operation of card games and promotes the standardization of the market.

Legalization of gambling games:In 2022, Brazil passed a bill to legalize gambling games, making a variety of gambling games including casino games, bingo games, video bingo games, online games, animal betting games and horse racing legal in Brazil. This bill abolished the 1946 law prohibiting gambling games and created a more relaxed legal environment for the board game industry.

Support measures for local game developers

tax deduction:The Brazilian government has reduced the industrial product tax rate on video game consoles and video game controllers, and even reduced the tax rate on video game consoles with built-in screens and their components to zero. These measures have reduced the tax burden on local game developers and encouraged more companies to enter the field of board game development.

Talent development and employment opportunities:The Brazilian government has promoted the development of local game studios and created job opportunities through legislation and policy support. In 2023, the number of studios in the Brazilian game industry increased by 3.2%, and the number of practitioners reached 13,225.

Cooperation and investment policy with international gaming companies

Market access and investment facilitation:The Brazilian government has provided international gaming companies with greater market access convenience and legal certainty through a series of legislative initiatives. For example, the sports betting legalization bill passed in 2018 attracted a large number of investments from international gaming companies.

Network infrastructure construction: The Brazilian government is vigorously promoting 5G network coverage, which provides a better network environment for online chess and card games. In addition, convenient online payment systems (such as PIX) also provide convenience for international companies to operate in the Brazilian market.

Overall, the Brazilian government has provided strong support for the development of the board game industry through legal and regulatory policies, local developer support measures, and international cooperation and investment policies. These measures have not only promoted the prosperity of the local market, but also attracted a large number of international investors to enter the Brazilian market.

How to successfully enter and operate the Brazilian board game market?

Localization strategy

Language localization: 97% of Brazilian players speak Portuguese, so language localization of the game is crucial.

Payment method localization: Brazil mainly uses cash payment and transfer. Common payment methods include Boleto, credit card, Aura and Hipercard. Understanding and supporting these local payment methods can help increase user conversion rates.

Device Adaptation: Brazil is the world's major Android mobile phone market, with Android devices accounting for 83%. Therefore, it is more important to prioritize the development and optimization of Android versions of games.

Marketing and Promotion

Advertising: Facebook and Google ads are very effective in Brazil and are important tools for remote promotion. Using these platforms for precise advertising can effectively attract target users.

Internet celebrity cooperation: Brazil has a well-developed amateur culture. Cooperating with KOL companies to attract traffic and create word-of-mouth through Internet celebrities is an extremely effective way of promotion.

Social Features:Brazilian users are keen on socializing. Adding social features to the game (such as guilds, alliances, etc.) can increase user stickiness and improve user retention rate.

Operation and monetization strategy

Low user acquisition cost:The user acquisition cost in Brazil is low, but the in-app purchase conversion rate is relatively low, and revenue needs to be increased by optimizing the monetization model.

Games for women:Female players occupy an important position in the Brazilian mobile game market, but there are relatively few games targeting female players, which is a potential market opportunity.

Cooperate with local KOLs in Brazil to promote card games

Choose the right KOL

Platform Selection: Search related industry keywords on platforms such as YouTube, Instagram and TikTok to find active game bloggers and content creators.

Audience Matching: Select those KOLs whose audience matches your game’s target users. For example, if your game is mainly for young people, you can choose KOLs who have high influence among young people.

Content style: Make sure the KOL’s content style is consistent with your game brand image. This can be assessed by watching their past videos and posts.

cooperation method

Game Trial Review: Invite KOLs to try out and review the game and share their experiences and opinions. This is not only possible with the help of their

Authoritative reputation and wide influence will bring the game to a wider audience, and can also deeply explore the core value of the game and satisfy players' pursuit of game quality and gameplay experience.

Live Broadcast: Cooperating with well-known game KOLs to conduct live broadcasts of interactive games with multiple people, which can attract a large number of viewers, increase the popularity of the game, and stimulate players' interest. There are many popular game live streaming platforms in Brazil, such as Twitch, Nimo TV, BOOYAH! and YouTube.

Real-life footage shooting: Cooperate with KOLs to shoot real-life materials, produce game promotional videos or promotional activities, show the game's features, gameplay and storyline, and interact on social media, such as cooperation activities, event promotions or games on Instagram, Twitter and other platforms Discussion of related topics.

effect evaluation

data analysis:Evaluate the promotion effect by analyzing the interactive data on social media (such as likes, comments, shares, etc.). You can use social media analysis tools to obtain this data.

customer feedback: Collect players’ feedback on the game, understand the channels through which they learned about the game, and what they think of the content promoted by KOLs.

Conversion rate: Monitor the number of game downloads and active users, and evaluate the impact of KOL promotion on actual user growth and retention rates.