Diversified payment methods are an effective means to deal with supervision and risk control. The following are four common payment models that circumvent supervision: running points model, virtual goods trading model, enterprise merchant collection model and virtual currency model.

Running Points Mode

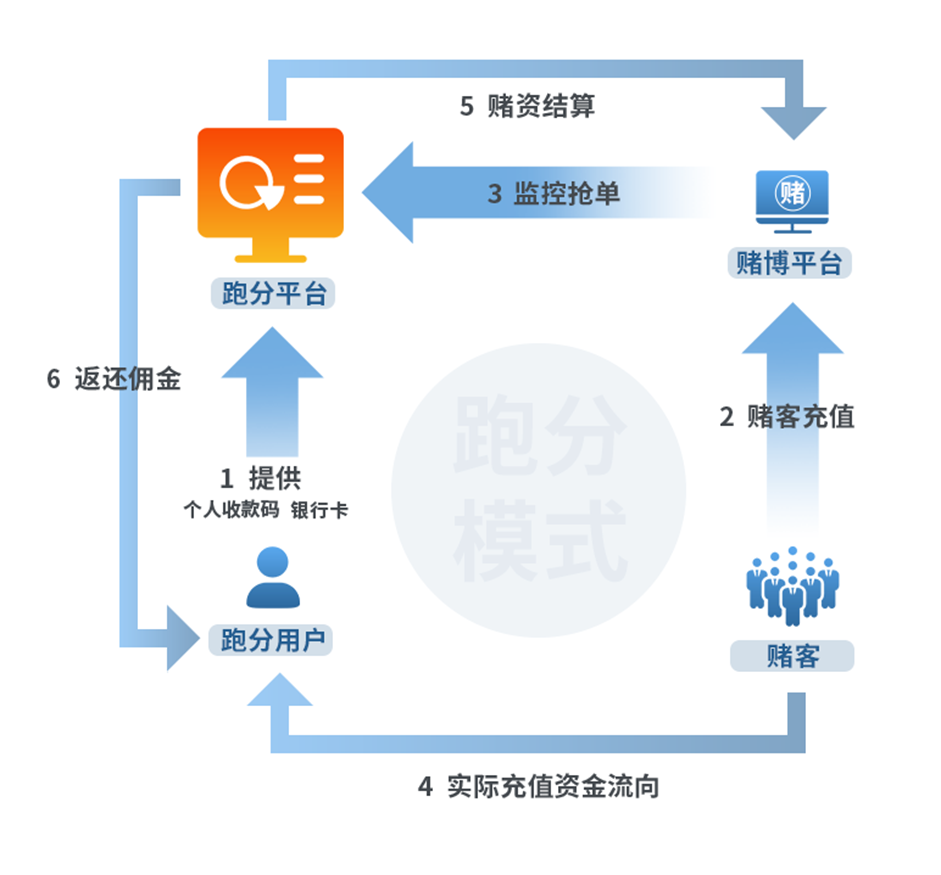

The running point platform is like a large-scale crowdsourcing platform, attracting ordinary users to register. Users provide personal payment codes and bank card information, and the platform connects with gambling websites. After successful payment, users can receive high commissions. The running point platform acts as a payment intermediary, and by using the financial accounts of many users to collect payments, it hides gambling funds in normal capital flows and evades supervision. The following is a screenshot of the use of a running point platform.

The steps are as follows:

- Bind bank card information:Users need to bind their bank cards, including the bank where the account is opened, branch name, name and card number.

- Monitor and grab orders:Users monitor orders on the platform, grab orders and confirm receipt of payments, and then they can get commissions.

operation flow:

- Recruiting staff:The scoring platform recruits people through social software, forums and offline channels, and attracts people with tight financial situation to join because of its high returns and easy features.

- Upload information: After becoming a member, personnel need to upload the payment code and bank card information, and pay a deposit equal to the upper limit of the order amount.

- Monitor orders:The platform monitors the recharge orders of gambling websites. Once there is an order, it will be immediately posted to the platform. After the member grabs the order, his/her payment account information will be displayed on the gambling website.

- Seal the deal: After the gambler completes the recharge, the platform will transfer the deposit to the gambling platform, and the user who grabs the order will receive a commission.

Virtual commodity trading model

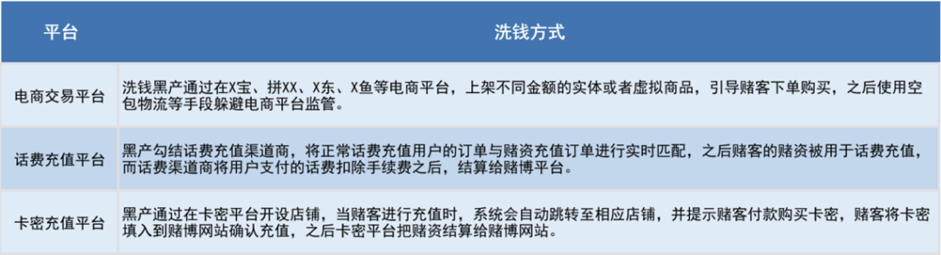

This model conducts fake commodity transactions through platforms such as phone bill recharge, e-commerce transactions, and card password recharge, and hides the flow of gambling funds by taking advantage of the large transaction flows and weak risk control of capital flows on these platforms.

operation flow:

- Choose a Platform: Gambling platforms use platforms such as phone bill recharge, e-commerce transactions, and card password recharge to conduct false transactions.

- Hidden cash flow: Conceal the flow of gambling funds through platform transaction flows and evade supervision by taking advantage of platform risk control loopholes.

The following figure shows the characteristics of the three platforms in this mode:

Platform features:

- Phone recharge platform: Hiding gambling funds through fake phone recharge transactions.

- E-commerce trading platform: Disguised as commodity transactions to hide the flow of gambling funds.

- Card recharge platform: Transferring funds through false card code transactions.

Enterprise merchant acquiring model

This model takes advantage of the inadequate supervision of capital flows by third-party payment institutions, opens a large number of shell companies, and conceals gambling funds through trade flows of forged contracts. Enterprise merchants register false business licenses, aggregate the acquiring functions, form a unified online acquiring and settlement platform, and provide it to the gaming platform in the form of API.

operation flow:

- Registering a fake business: Register a large number of fake corporate merchant accounts.

- Aggregate acquiring function: Aggregate the payment collection functions of these merchants to form a unified online settlement platform.

- Provide API interface: Provide an API interface to the gaming platform for gamblers to recharge.

- Transferring funds: After the recharge is successful, the aggregation platform will take a commission and then transfer the funds to the gambling website.

Virtual currency model

Virtual currency has become a preferred method for transferring funds due to its anonymity and decentralization. Gambling platforms provide virtual currency payment interfaces to guide gamblers to purchase and use virtual currency for payment.

operation flow:

- Provide payment interface: The gambling platform provides a virtual currency payment interface.

- Guide to purchase: Guide gamblers to purchase and use virtual currency to complete payment.

Virtual currency features:

- Anonymity: Transactions are anonymous and difficult to trace.

- Decentralization: There is no central agency to control it, making supervision difficult.

- Global Circulation: Not restricted by geographical location, convenient for cross-border fund transfer.

Summarize

After in-depth analysis, the current dominant model is the running point model, which accounts for about 80% of the payments on online gambling platforms. Compared with the other three models:

- Virtual currency model:Due to the high payment threshold, it is difficult to popularize in the short term.

- Enterprise merchant acquiring model: It is necessary to forge merchants and contracts, which is too costly.

- Virtual commodity trading model:The payment amount is small, it is easy to be monitored, and it is difficult to become mainstream.

To sum up, although each model has its own advantages and disadvantages, the running point model is still the main payment method for online gambling platforms because of its convenient operation and strong concealment.

In general, the running point model is dominant due to its simplicity and strong concealment, accounting for about 80% of the payments on online gambling platforms. Other models are difficult to become mainstream due to their own limitations.

The monitoring of abnormal funds is relatively sensitive, so this mode of payment is unlikely to become mainstream.