.png)

In today's rapidly evolving esports industry, operators are faced with a critical decision — which esports games deserve their focus and management.

As the esports market continues to expand, the audience and participant numbers for various games are increasing. From traditional popular games like "League of Legends" and "Dota 2", to emerging hits like "Valorant" and "Apex Legends", selecting the right games as operational focuses is crucial not only in the battle for market share but also in retaining and engaging users to ensure long-term stable development.

This time PASA will combine Q1 2024 esports market data to deeply analyze the market potential, audience base, and future development trends of various esports games, helping operators make wise decisions in the competitive esports arena.

Review of Q1 2024

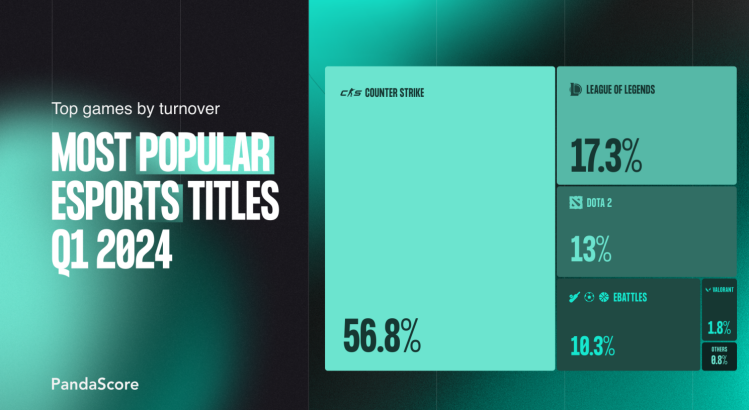

The most popular esports game in Q1 2024, without any suspense, was the world's top shooting game "Counter-Strike".

According to data from esports data provider PandaScore, in 2023, Dota 2 replaced LOL as the second most popular esports game in terms of betting turnover.

However, with the start of the new season in 2024, the strong interest in domestic competitions in China and Korea, as well as the recovery of the North American region, allowed "League of Legends" to jump back to second place at the beginning of 2024, while "Counter-Strike" continued to hold the top spot.

PandaScore's Q1 esports betting data shows that, with the new season championships reigniting interest, there was a slight change in player preferences.

Considering the disparity in player numbers across all games, Q1 results indicate that the three major games ("Counter-Strike", "League of Legends", "Dota 2") continued to lead with their strong user bases providing many betting options.

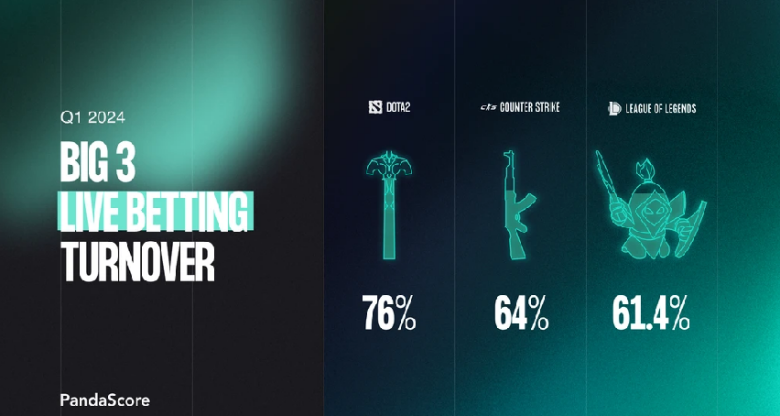

In terms of game betting, the ratio of in-play to pre-match betting in esports remains at 60:40, but "Counter-Strike" and "League of Legends" have a higher share of pre-match betting, while "Dota 2" relies more on in-play betting.

Several factors have led to the increase in in-play betting on Dota 2.

Firstly, the complexity of the game suits bettors who are familiar with the gameplay and confident in their in-match decisions. The match duration (usually between 40-60 minutes) means that there is more time for the in-play betting market to remain open.

Furthermore, the rapid rise of eBattles (electronic football and basketball) cannot be ignored; their performance and popularity in Q1 highlight their strong correlation with traditional sports seasons. As the NBA season draws to a close, electronic basketball accounted for one third of the total eBattles betting turnover.

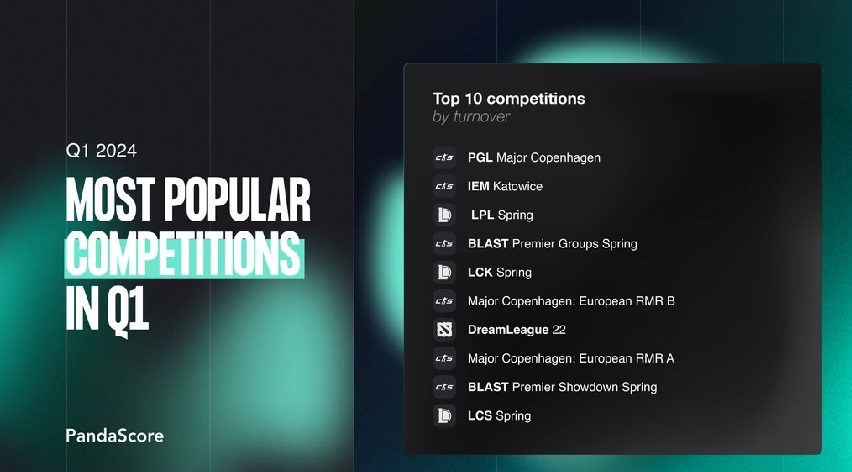

Most Popular Tournaments of Q1

In terms of total turnover, the "Counter-Strike" PGL Major was undoubtedly the highlight of the quarter, with its main event and European qualifiers ranking within the top ten in total betting turnover.

This tournament was the first major tournament held on "Counter-Strike 2" rather than the old game "CS:GO". For fans, it was a thrilling match, far surpassing the second ranked IEM Katowice, which is one of the biggest annual sources of betting turnover.

In the case of Dota 2, the DreamLeague has always been popular with bettors, but, with its move away from the structured Dota Pro Circuit, this competition has begun to offer more of what fans and bettors want.

"League of Legends" had a strong overall performance this quarter thanks to its top tournaments: China's LPL consistently performed well, while Korea's LCK usually also ranked high.

The surprise of the quarter was North America's LCS returning to the top ten. Last year, making the league mid-week affected ratings and turnover, but moving it back to weekends helped the matches almost recover to their previous state.

With major tournaments like the "League of Legends" Mid-Season Invitational, "Valorant" regional leagues, the Shanghai Masters, and the Seoul Championship taking place in the second quarter, the performance of operators' esports product portfolios is expected to be more diversified.

Based on the data from the first quarter of the esports industry, PASA roughly forecasts the industry outlook for the coming year.

Firstly, the positions of the three major games ("Counter-Strike", Dota2, LOL) will not change, and these are the three key user bases that operators cannot afford to overlook.

"Counter-Strike" will still hold first place, but with in-play betting in esports becoming increasingly popular, Dota2 is likely to surpass LOL and return to the second position.

Compared to other popular games, Dota 2 especially has a higher demand for real-time betting. Its dynamic gameplay and unpredictable outcomes provide the perfect environment for users to utilize their knowledge and intuition for real-time betting.

This is crucial for operators, as in-play real-time betting will inevitably become a focal feature, and the market for Dota2 will grow accordingly.

Additionally, we must also pay attention to the cyclical performance of eBattles, which has a strong correlation with regular sports seasons;

The latest research shows that this phenomenon is particularly evident in the field of electronic basketball. Electronic basketball indicators show significant consistency with the peaks and troughs of the traditional basketball season.

This trend may be due to increased audience engagement and player enthusiasm during regular sports seasons, effectively translating into the virtual domain of electronic basketball.

Operators need to be flexible in handling these patterns