Sportradar announced its financial results for the second quarter of 2024. Overall, the sports betting technology company earned 278.4 million euros (304.2 million US dollars) in the second quarter, up 29% year-over-year, with an adjusted EBITDA of 48.8 million euros, a 22% increase compared to the previous year.

Sportradar announced its financial results for the second quarter of 2024. Overall, the sports betting technology company earned 278.4 million euros (304.2 million US dollars) in the second quarter, up 29% year-over-year, with an adjusted EBITDA of 48.8 million euros, a 22% increase compared to the previous year.

Nevertheless, Sportradar reported a loss of 1.5 million euros this quarter, whereas last year it achieved a "slight" profit.

By business segment

In terms of revenue by division, Sportradar's gaming technology and solutions made 229.1 million euros in the second quarter, up 30% year-over-year, accounting for 82% of the total business revenue, compared to 81% last year.

This includes an increase in streaming and betting engagement revenue by 26.2 million euros, or 41%, live data and odds by 18.6 million euros, or 27%, and managed betting services by 8.5 million euros, or 21%.

Meanwhile, revenue from sports content, technology, and services was 49.3 million euros, up 22% year-over-year. However, the growth rate for technology and solutions meant it only represented 18% of Sportradar's total revenue, down from 19% last year.

Marketing and media services grew by 28%, while the sports performance segment was roughly consistent with the previous year.

By geography

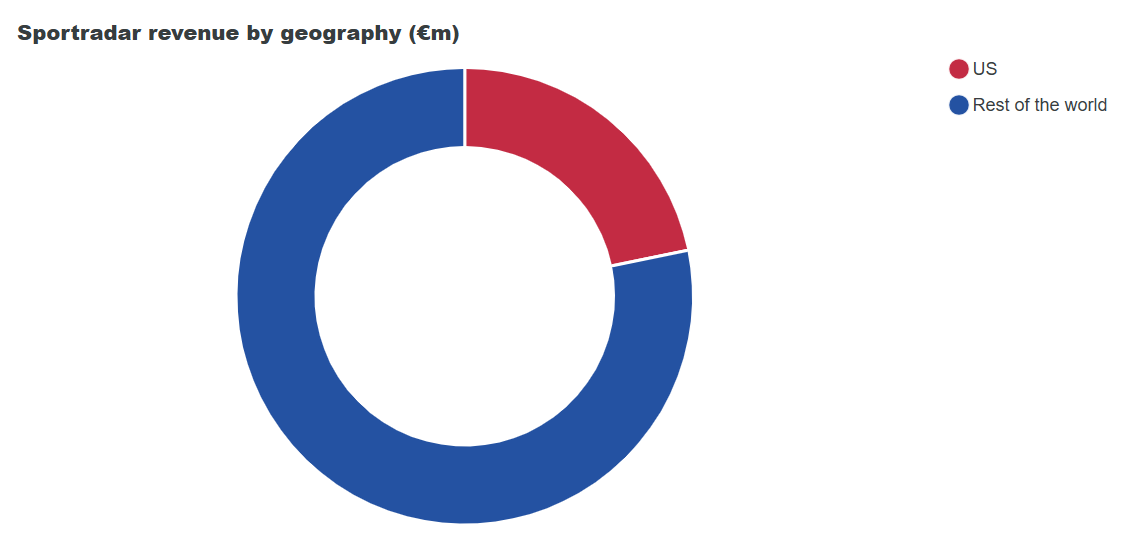

The US market accounted for 22% of Sportradar's second-quarter revenue, or 60.6 million euros, representing a substantial 59% growth over the same period last year when it constituted only 18% of the company's revenue.

The remaining 78% (or 217.8 million euros) came from business outside the US, reflecting a 22% growth year-over-year. This figure represents a slight decrease from last year's 82%, highlighting the relatively larger growth of the US operations.

Costs and Expenses

Costs and Expenses

Service and license acquisitions in the second quarter grew 44% year-over-year, totaling 72.6 million euros. Of this, 28.9 million euros were spent on sports broadcasting rights. The remaining amount spent on purchased services totaled 43.7 million euros, up 32%.

Personnel expenses increased by 6%, totaling 89.1 million euros. Other operating expenses were 22.6 million euros, an 8% increase. The total costs for sports broadcasting rights saw a significant rise of 83%, mainly due to Sportradar's agreements with ATP and NBA, summing up to 95.9 million euros.

This Quarter

In early May, Sportradar appointed Behshad Behzadi as its Chief Technology Officer and Chief Information Officer. Later that month, UTR Sports agreed to establish a long-term partnership with Sportradar, whose data set will cover more than 20,000 professional tennis tournaments. Besides, Sportradar unveiled new auditory and digital outdoor marketing technologies to enhance sports betting advertising this quarter.

Performance Evaluation

Regarding performance, Sportradar's CEO Carsten Koerl stated, "Our second-quarter performance was robust, including setting a new quarterly revenue record, demonstrating the operational momentum we have built across our business and our clear execution strategy to drive performance beyond the market.

"Our high-value product portfolio and strong client draw achieved solid growth, while continuing to strengthen our business through improved efficiency and substantial cash flow.

"I am pleased to again revise our full-year earnings forecast upwards, and we will continue to create long-term shareholder value through strong revenue growth, focused operational leverage, and increased cash flow."

Outlook for 2024

Based on this quarter's performance, Sportradar has adjusted its forecast for the fiscal year. The company now expects annual revenue to reach 1.07 billion euros, up 10 million euros from its previous forecast, representing a 22% year-over-year increase. Adjusted EBITDA is expected to be 204 million euros, up 2 million euros from Sportradar's prior forecast, also growing by 22%.

Sportradar expects the adjusted EBITDA margin to be about 19%.