Most people associate iGaming with casinos and lotteries. Over the years, sports betting has also been popular as an exciting form of entertainment. For centuries, all these types of games have fascinated Europeans, reflecting human curiosity, the pursuit of excitement, and the cultural and social values of different regions.

Most people associate iGaming with casinos and lotteries. Over the years, sports betting has also been popular as an exciting form of entertainment. For centuries, all these types of games have fascinated Europeans, reflecting human curiosity, the pursuit of excitement, and the cultural and social values of different regions.

Europe has a long history of online gambling, dating back to ancient Greece and Rome. For centuries, online gambling has been both a form of entertainment and a way to establish social and political connections, even serving as a means to resolve conflicts and conduct ceremonies. Gambling influenced medieval European culture, with England's 12th-century free lotteries raising funds for churches and bridges. By the 16th century, card games became a national pastime in France, and the first casino opened in Venice in the 17th century.

Over time, iGaming has become a part of European society, with famous resorts like Monte Carlo and Baden-Baden attracting numerous visitors in the 18th and 19th centuries. The 20th century brought technological innovations such as slot machines and online casinos, making iGaming an important economic factor and popular pastime in Europe today.

Today, Atlaslive is actively developing and expanding its technology, providing operators with a dynamic iGaming platform with customizable features. The platform offers adaptability and flexibility needed for today's ever-changing global and European markets through various delivery options such as Sportsbook API, White Label, and Turnkey solutions.

Factors Driving the Growth of the European Online Gaming Market

According to Statista, the European iGaming market size is expected to reach $46.94 billion in 2024 and grow to $56.48 billion by 2028, with an annual growth rate of 4.43%.

The market is expected to achieve significant growth due to the following key factors:

The market is expected to achieve significant growth due to the following key factors:

Mobile Accessibility: As more Europeans use the internet, online casino offers, lotteries, and betting services are becoming increasingly accessible. The widespread use of smartphones and mobile devices further drives this trend. Mobile gaming is now more popular than ever, with user-friendly apps and optimized websites making it easier for users to place bets anytime, anywhere.

Favorable Regulations: Many European countries have established a favorable regulatory environment, providing a safe and legal space for operators and players. These regulations boost consumer confidence and attract international operators looking to expand their influence.

Technological Advancements: Innovations such as live dealer games, virtual reality (VR), and augmented reality (AR) also enhance the online gaming experience, attracting a broader audience.

iGaming is increasingly accepted by society, leading to the growing popularity of sports betting, fantasy sports, and online casinos. Operators are using effective marketing and advertising strategies to increase brand awareness, attract new players, and foster customer loyalty. Targeted campaigns, attractive promotions, and sponsorships are driving market growth.

Broadly speaking, these opportunities are expected to stimulate the European online gambling and betting market to new heights in the coming years.

Atlaslive collaborates with top operators, game providers, and payment systems to ensure a high-quality experience. The Atlaslive platform allows end-users to enjoy games tailored to their regional preferences and regulations. For example, the Atlaslive casino product features over 10,000 games from global brands, offering a variety of choices to suit all tastes. This is just the beginning, as we continue to expand in all aspects.

The Three Pillars of the European Online Gambling Industry: Sports Betting, Casinos, Lotteries

Every industry has its essential internal components that have been crucial since its inception. It's interesting how these pillars have evolved and improved over time, adding new features and offering better things to the audience—more advanced and exciting than ever before. The European iGaming industry is built on three main pillars: online sports betting, online casinos, and online lotteries. These components collectively drive the region's vibrant and rapidly developing gaming market, characterized by technological innovations and a diverse selection of games.

Changes in the EU Online Lottery Market

Changes in the EU Online Lottery Market

In 2024, the EU's online lottery revenue is expected to reach $9.2 billion, growing to $11.47 billion by 2028, with a growth rate consistent with the trend shown in the first stacked bar chart. By 2028, the user base is expected to increase significantly, with a corresponding rise in user penetration. On average, each user will generate substantial revenue, reflecting the industry's engagement and growth increase.

However, it is noteworthy that the ARPU (Average Revenue Per User) for online lotteries has slightly decreased, from $1,340 in 2018 to an estimated $1,170 in 2028, indicating a change in consumer spending patterns.

Main Trends:

Mobile Lotteries: Due to user-friendly apps and websites providing a seamless experience, more and more people are using smartphones and tablets to purchase lotteries. This convenience allows players to participate anytime, anywhere.

Innovative Games: Online lotteries are introducing new, exciting game formats, such as cumulative jackpots and themed games, to attract more players and keep the market fresh and appealing.

European customers enjoy online lotteries because they are very convenient, allowing them to play domestic and international lotteries like Powerball, Mega Millions, and EuroMillions from home. This shift to digital platforms is driving market growth.

EU Online Sports Betting Trends and Statistics

In 2024, the EU's online sports betting revenue is estimated to be around $17.06 billion. By 2028, the market is expected to grow to $20.98 billion, with a stable growth rate. The number of users is expected to increase significantly, with user penetration rising from 7.4% in 2024 to 8.9% in 2029. On average, each user is expected to generate about $470 in revenue, reflecting a steady rise in ARPU from $450 in 2024 to $470 in 2028.

Growth Trends

Mobile Betting: More and more people are using their phones to place bets, easily betting on their favorite sports events anytime, anywhere. This convenience is a major reason why mobile betting is so popular and expected to continue growing.

In-Play Betting: This allows users to bet in real-time on live matches, adding more excitement and engagement. Betting during the game makes the user experience more interactive and thrilling.

Overall, thanks to changes in customer habits and favorable market conditions, Europe's online sports betting market is thriving. Football, basketball, tennis, cricket, and golf are just some of the sports driving this growth.

EU Online Casino Trends and Growth

The market is showing steady growth, expected to increase to $24.03 billion by 2028. As the market expands, we can anticipate more users joining, with user penetration rising from 6.7% in 2024 to 7.5% in 2029. On average, each user will contribute about $640 in revenue, reflecting a continuous rise in ARPU from $600 in 2024 to $640 in 2028.

Main Trends:

Mobile Gambling: As internet connections improve, games are accessible anytime, anywhere, and more players are starting to use smartphones to play casino games. This trend is expected to continue with advancements in mobile technology.

Live Dealer Games: These games are becoming increasingly popular because they offer an immersive experience, allowing players to interact in real time with real dealers and other players, blending the feel of online casinos with traditional casinos.

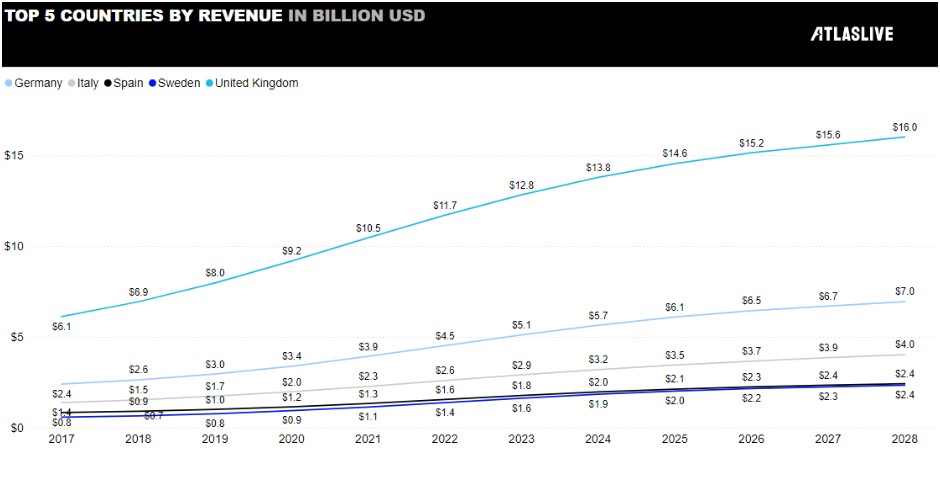

Top Five Online Gaming Countries in Europe

The European iGaming industry has experienced significant growth, mainly due to the widespread adoption of online platforms on mobile devices. To understand the diverse iGaming environment and player preferences, we analyzed the best-performing countries across Europe.

United Kingdom: The Heart of Online Gaming

United Kingdom: The Heart of Online Gaming

The UK's strong online gambling culture stems from a long history of gambling, with activities like horse racing and sports betting deeply rooted in society. The UK's sound regulatory framework has established trust, making online gambling a safe and attractive option for many. Coupled with a strong economy and high disposable income, these factors make the UK a leading market for thriving online gambling.

The UK's iGaming market is steadily growing, with penetration expected to reach 27.9% in 2024 and climb to 28.47% in 2025. This indicates that online gambling is becoming increasingly popular, thanks to its convenience and wide variety of games. As more people participate, the UK's online gambling industry is sure to flourish.

Germany: iGaming Market Focused on Sports Betting

Germany's iGaming market is growing rapidly, rooted in Germany's long-standing enthusiasm for various forms of gambling, from lotteries to sports betting. Germans particularly enjoy sports betting, which remains one of the most popular activities, followed by online casino games. Online lotteries are especially popular, as they have a long tradition and the excitement of large jackpots can be life-changing. With the market's rapid development, online gambling penetration is expected to rise from 10.39% in 2024 to 11.07% in 2025, reflecting the country's growing interest in digital gaming platforms.

Sweden's Digital Casino Transformation

Sweden has a long gambling history, with strong traditions in lotteries and physical casinos. Today, the demand for live dealer games is particularly evident, driven by the desire for a more authentic, engaging experience. As operators continue to improve their casino and sports betting offerings, Sweden's online gambling penetration is expected to rise from 9.51% in 2024 to 10.02% in 2025, indicating a booming market and increasing popularity of mobile gaming among Swedish players.

Italy: A Major Player in the EU iGaming Arena

Italy is a Western European country with a gambling history dating back to the Roman Empire, long being a significant player in the gambling world. Today, it remains one of Europe's largest gambling markets, regulated by the ADM to ensure fairness and safety.

Italians prefer online sports betting and poker, while online casinos are also becoming increasingly popular. The market is showing steady growth, with online gambling penetration expected to rise from 5.12% in 2024 to 5.44% in 2025.

Spain Invests Heavily in Sports

Today, Spain's iGaming market is more focused on sports betting, which remains one of the most popular activities among Spanish players. Interestingly, Spain is one of the few countries where state-run lotteries still hold a strong position even in the digital age. Online gambling is thriving, with Spain's penetration expected to grow from 6.16% in 2024 to 6.52% in 2025.

Atlaslive Provides iGaming Features for the European Market

Atlaslive focuses on providing top-notch user experiences and personalized solutions to meet the specific needs of the European market. The Atlaslive platform is designed to be faster, more scalable, and more reliable than most traditional systems on the market today. Built on a diverse and flexible toolkit, Atlaslive can quickly adapt and customize to meet the specific needs and requirements of any market. With the support of its proprietary core platform, Atlaslive can automate processes for its partners, helping them maximize profits while improving product quality.

Emphasizing gamification features and expanding the variety of casino games and customizable betting options creates new opportunities for partners to attract a broader audience and improve retention rates. A key feature driving this innovation is the Atlaslive Bet Builder, which allows users to create personalized bets across multiple markets in a single event, enhancing engagement and user satisfaction. The platform's internal customization options enable partners to tailor bonuses and betting experiences to individual users, ensuring satisfaction and expanding user expectations.

Atlaslive's approach focuses on adapting to the needs of partners and keeping up with the growing EU market, providing dynamic and real-time technology tailored to the needs of partners and the market.