Preface: This article targets readers from an overseas information community, who primarily focus on finance and technology content, and may not be very familiar with the gambling industry. The ultimate goal of reading this information product is business enhancement, transactions, and ultimately, profit generation.

Given the solid influence of the offline gambling industry, with high entry barriers and costs in various countries, this article mainly discusses relevant information about the online gambling industry in Peru.

Author|Panda Lil

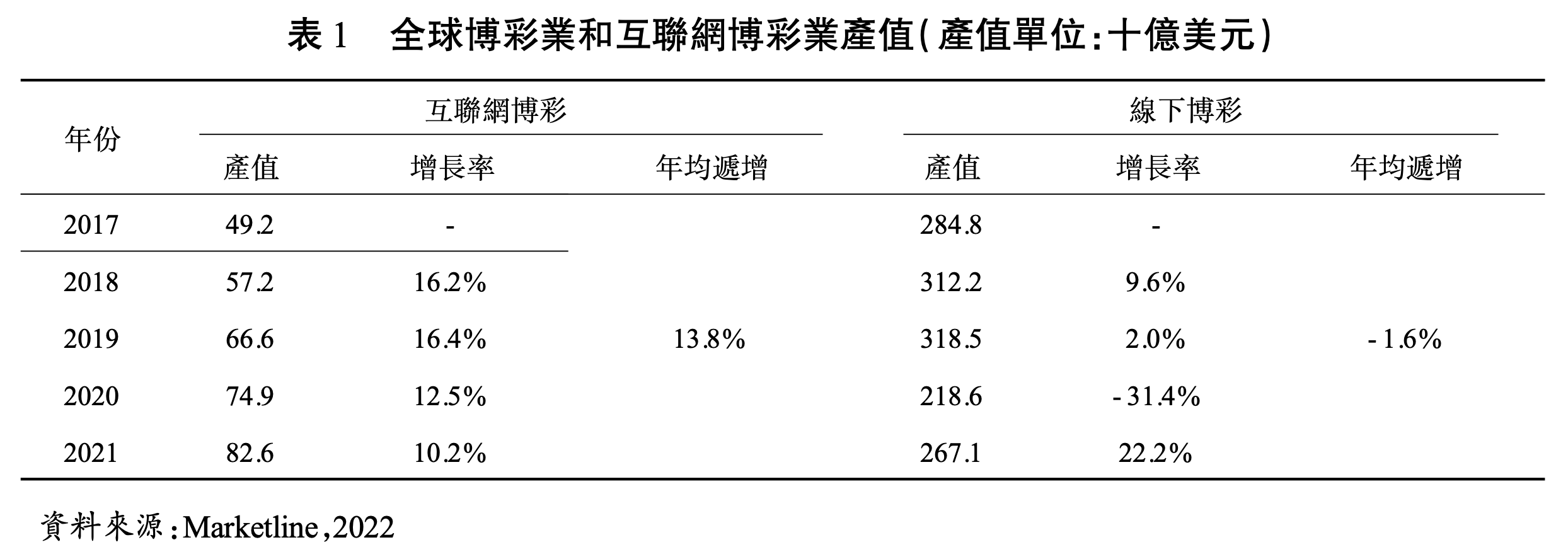

In recent years, the global online gambling industry has developed rapidly, especially after the baptism of the pandemic, which has led to a rapid increase in the industry's turnover. According to data from the World Gambling and Tourism Research Institute, the global online gambling (iGaming) industry has seen an average annual growth rate of 13.8%, reaching a staggering $82.6 billion; in contrast, the offline gambling industry has been decreasing at an average rate of 1.6% per year, with a value of about $267.1 billion. It is evident that with the continuous development of the internet, the market space for the online gambling industry is still vast.

In October 2023, Peru's Ministry of Foreign Trade and Tourism (Mincetur) approved new regulations for sports betting and online gambling. The legislation, effective from February 9, 2024, makes Peru the third country in South America to regulate the industry, following certain provinces in Colombia and Argentina. On June 26, 2024, Betsson obtained its first Peruvian gambling license, allowing it to offer sports betting and online casino services under the new regulatory framework. Other well-known operators have also been continuously approved recently.

How big is the overseas online gambling industry, and why is Peru, which has just passed regulatory schemes, worth our special attention? This article will attempt to unveil the "get-rich-quick" veil of overseas online gambling.

Overseas Online Gambling Industry: Astonishing Market Size and Growth Rate

In 2017, the total output value of global online gambling was $49.2 billion, while offline gambling was $284.8 billion, with online gambling only accounting for 17.3% of offline gambling's output value. By 2021, the total output value of online gambling had reached $82.6 billion, equivalent to 30.9% of the same year's offline gambling output value, with a 13.8% increase in proportion over five years, showing strong growth momentum. According to Statista's data forecast, by 2027, the online gambling market is expected to expand to 233.7 million users, with market revenue projected to reach $124 billion. Meanwhile, the total output value of the offline gambling industry is showing negative growth.

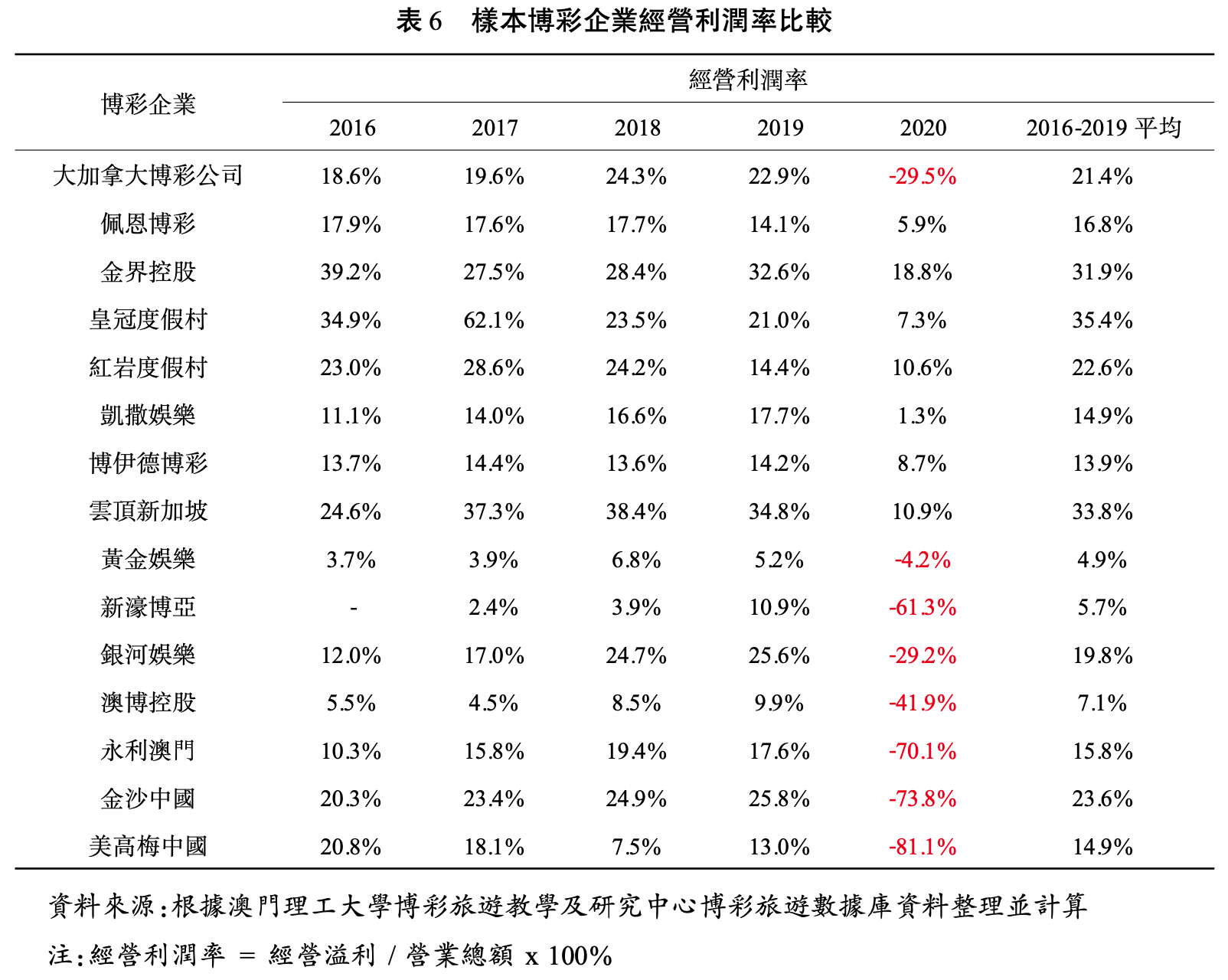

What attracts countless people, besides the still-to-be-divided "big cake" of online gambling, is its astonishing profit margin. From the annual reports of the world's top 10 gambling companies, it is evident that these companies, primarily operating traditional offline gambling businesses, have operating profit margins exceeding 30% for the first tier, 10%-30% for the second tier, and less than 10% for the third tier. Of course, it should be noted that in recent years, due to the impact of the pandemic, the operations of offline gambling companies have been significantly restricted, showing a downward trend overall.

Compared to the offline gambling industry, online gambling does not need to bear the costs of land, buildings, a large workforce, and fixed asset investments, making it a more light-asset investment approach. Additionally, its convenience of being able to "play a round" anytime and anywhere via mobile networks has significantly increased the average consumption amount of online gambling. So, how exactly does the online gambling industry operate?

How Does the Overseas Online Gambling Industry Operate?

If you need to set up an overseas online gambling platform, it can be simply divided into the following steps:

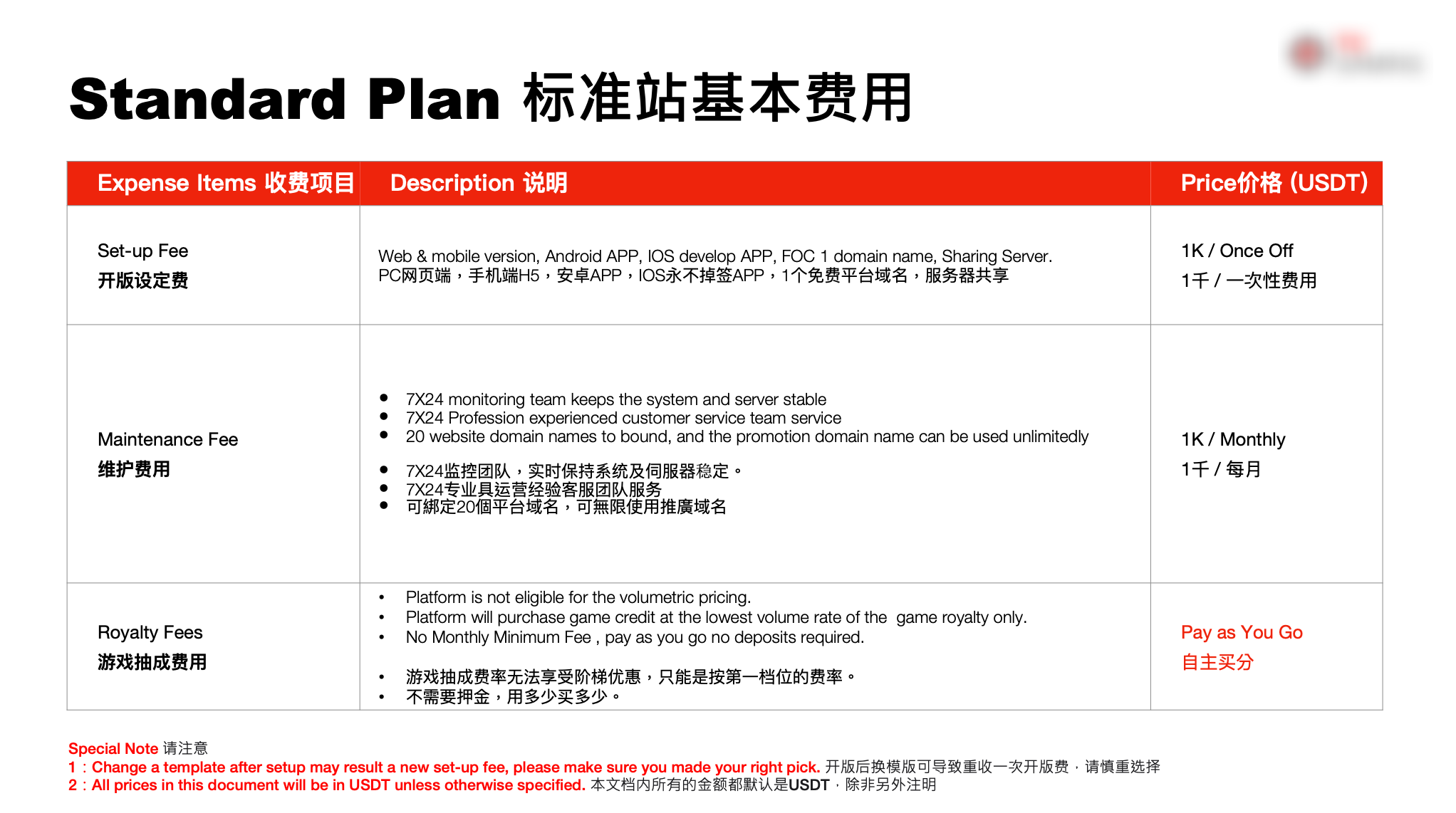

Among them, "package network" refers to a unique service provider in the development of the online gambling industry, specifically developing betting systems and providing basic functions such as member registration, recharge, withdrawal, and report bill inquiry. It can be understood as integrating the products of game merchants, payment merchants, and support merchants into its betting platform and selling complete solutions to businesses in need.

For startups without development capabilities, lacking supplier information, and negotiation skills, package network providers largely provide a complete supply service solution, facilitating market expansion for startups. Generally, package network providers charge operators a one-time access fee and a monthly maintenance fee, and earn a differential by adding points on the commission charged by various suppliers. However, companies with independent development capabilities and rich supplier information usually choose to develop their betting systems (i.e., self-built platforms). Such platforms, known as "independent operators," tend to have higher profits compared to those using package network providers.

From this, we can roughly figure out the cost composition of preparing an online gambling platform, taking package network access as an example. Before starting, you first need to obtain a local license, generally accounting for 10-30% of the overall budget, with significant fluctuations depending on the region. Then, access the package network, generally accounting for 35-35%, and finally, the marketing expenses account for 15-30%. Once the online gambling platform begins operations, you may even need to allocate more than half of the budget for marketing promotion, as the conversion of user registration is crucial.

Peru, the Next Hotspot for Online Gambling

Global Market Size

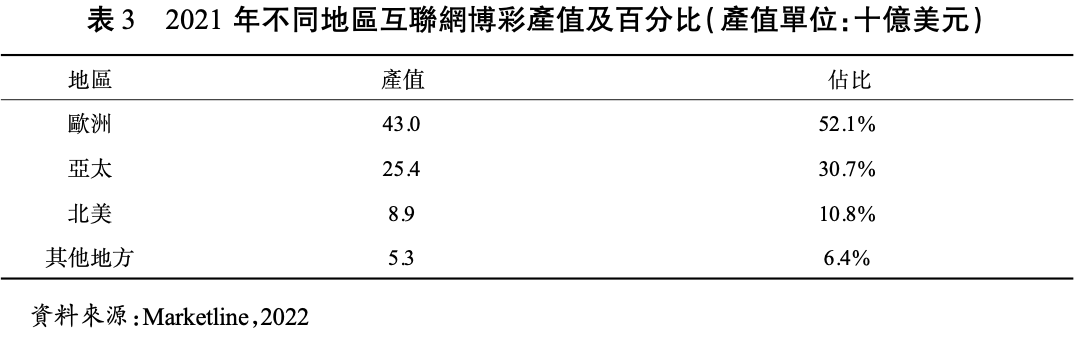

Before we turn our attention to Peru, let's first discuss whether you would prefer to target a large, mature market or focus on a new market when choosing your target market. Currently, Europe accounts for 50% of the entire online gambling industry's output value globally, followed by Asia-Pacific, North America, and other regions. In the other regions, which only account for 6.4% of the global output value, Africa and Latin America are particularly noteworthy. As you can see, given the first-mover advantage and high industry barriers of the gambling industry, more practitioners choose to explore emerging markets in Africa and Latin America when expanding.

Latin America has several prominent features compared to Africa. As the global core Spanish-speaking region, Latin Americans are not only distributed in South America but even in North America, which determines the universality of platform language and customs. Secondly, Latin America is a globally renowned sports powerhouse, with the entire population having a high level of attention to sports competitions. This provides a solid foundation for sports-type gambling games. Among all types of online gambling games, sports betting often accounts for 30-60% of the turnover, and this point also has successful landing cases in the European region.

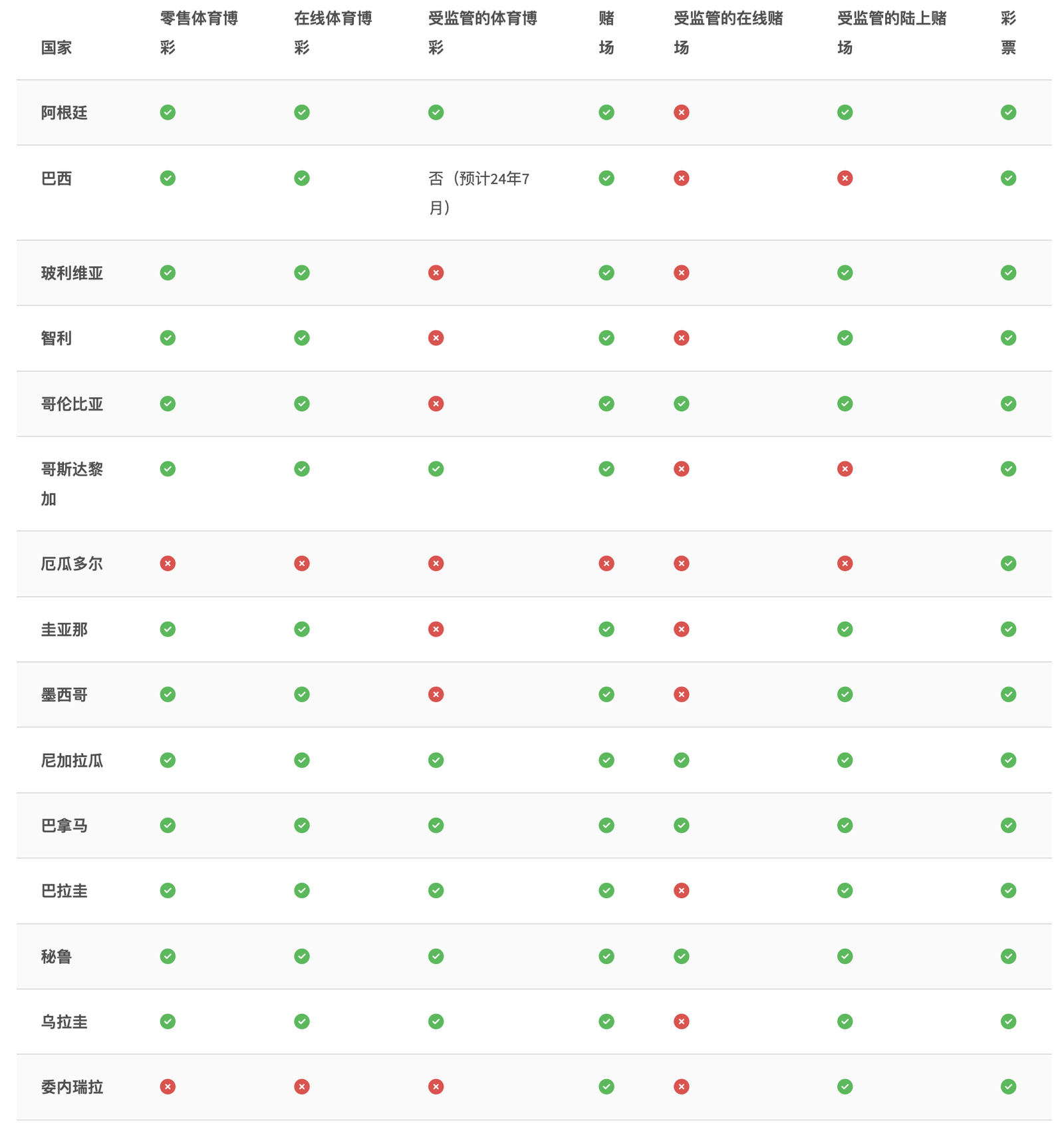

Returning to Peru's online gambling industry, why is this country worth our special attention? It should be noted that Peru is not the only country in the Latin American region that has included the online gambling industry in its related plans.

From the table above, it can be seen that although many Latin American countries have different degrees of openness to the gambling industry, including Brazil, the largest market in Latin America, many countries' regulations are still not well-developed. Only Nicaragua, Panama, and Peru have the highest degree of openness.

We all know that to operate the online gambling industry in a country or region, regulations are an important foundation. This determines the government's attitude towards the online gambling industry and whether the platform can operate smoothly and continuously make profits in the long run. In addition to this, when deciding whether to establish the online gambling industry in a certain overseas market, we still need to consider the local market size, economic situation, political situation, currency stability, population situation, internet development (including network infrastructure, online payments, etc.), and more.

Peru's Economy

Peru, located in the western part of South America, is known for its diverse natural landscapes and rich resources that have civilized the world. However, like many developing countries, Peru's economy has experienced long-term fluctuations over the past decades. It was not until 2000 that Peru's economy stood out with a strong growth rate. The country has gradually achieved sustainable and inclusive economic growth by diversifying its economy, reducing inequality, developing tourism, and maintaining political stability.

As can be seen from the chart above, Peru's GDP per capita has been growing rapidly since 2000, currently reaching a level similar to Colombia and Ecuador. At the same time, its absolute GDP value is twice that of another popular market for the online gambling industry—Vietnam.

In recent years, Peru's gambling industry has developed rapidly, with at least 5 million Peruvians playing online in 2020 alone, with a market size of about $1.5 billion, accounting for 3% of the Latin American region. It is expected to reach $2 billion by 2025, with a gambling user base of 10 million.

In a conversation with Peru's Minister of Foreign Trade and Tourism, Luis Fernando Helguero, he announced that the government expects this year (2023) to generate tax revenue of S/210 million from casinos and slot machines, an increase of 5% compared to the amount in 2022.

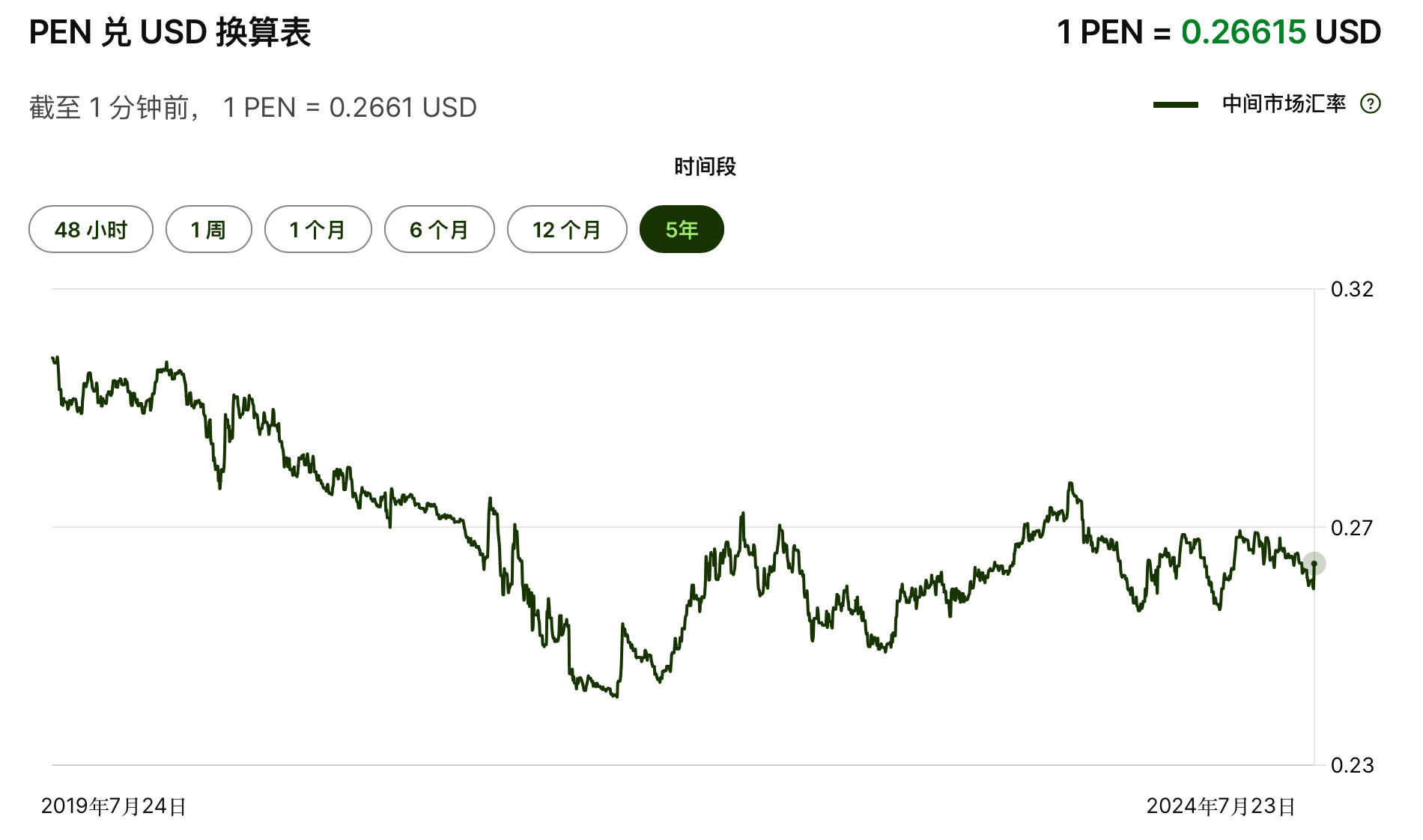

Additionally, in 1991, Peru replaced its currency with the Nuevo Sol, and under the influence of the Fujimori government's new economic policy, the Nuevo Sol became one of the most stable currencies in Latin America, with an exchange rate fluctuating around 3.7 Nuevo Sol to 1 US dollar. In recent years, even against the backdrop of economic crises, the Nuevo Sol has maintained low volatility.

For example, under the influence of the 2008 financial crisis, Peru's Nuevo Sol remained strong. According to the Central Bank of Peru in 2008, the Nuevo Sol had become one of the currencies least affected by the international financial crisis. Compared to other countries' currencies, the Sol's depreciation was only 1.1%. The Colombian peso depreciated by 12.8%, the Mexican peso by 62%, and currencies outside the Latin American region, such as the euro against the US dollar, fell by 3.9%, the British pound by 2.1%, and the Korean won by 10.8%. Therefore, Peru's Nuevo Sol can be said to be the hard currency of the Latin American region, and currency stability is quite important for overseas investors.

Peru's Political and Regulatory Environment

As a politically relatively stable country, Peru provides favorable conditions for the healthy development of the gambling market. Political stability means that the legal system and regulatory agencies can better maintain market order, creating a predictable environment for investors and operators. The Peruvian government actively participates in the regulation of the gambling market. The gambling market has also seen rapid growth, bringing economic benefits to Peru. Increased tax revenue and job opportunities have contributed to Peru's economic health. Not to mention that Peru has now clearly declared its entry into legalization. This has brought global attention to Peru, making it one of the seven attractive markets in the Latin American region, alongside Brazil, Mexico, Argentina, Colombia, Venezuela, and Chile.

In July 2022, the President of Peru signed a new gambling law, officially legalizing sports betting and online gambling, which took effect in April 2024. Suppliers or operators need to obtain a legal license (permit/authorization) in Peru and pay a tax of 12% of net profits to legally participate in online gambling-related businesses in the country.

The Peruvian government's attitude towards this initiative is positive. The law will help promote Peru's economic growth and job opportunities. Additionally, with the legalization of online gambling, the Peruvian government will be able to better regulate the industry, which will also bring more tax revenue.

Peru's Internet Situation

Peru, a country with a population of over 30 million (as of January 2023, Peru's total population was 34.19 million), has a stable and growing middle class that provides huge potential for the gambling market. Among Peru's population, women account for 50.5% and men for 49.5%. As of early 2023, 78.8% of Peru's population lives in urban centers, and 21.2% in rural areas.

Peru's diverse population composition, integrating different cultures, languages, and traditions, brings a wide range of demands to the gambling market. Additionally, Peru's rich sports culture allows gambling companies to use sports events as an entry point to attract more gambling players.

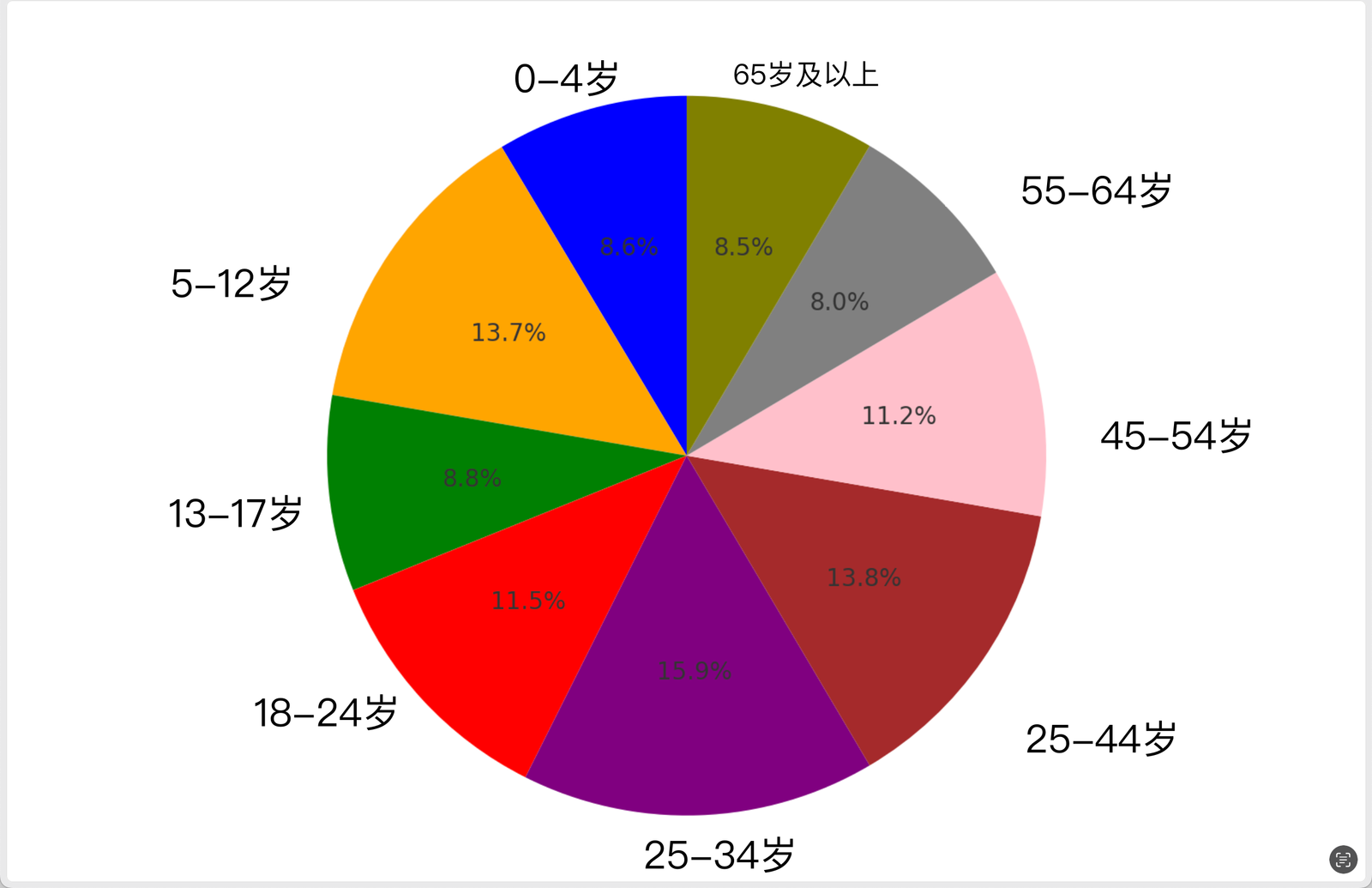

According to the latest data, the average age of Peru's total population is 28.7 years. An analysis of Peru's total population's age structure is roughly as follows:

From the chart, it is not difficult to see that Peru's population structure is relatively balanced, with the proportion of people in each age group roughly around 10%, with the adult group having the highest proportion.

Among these people, about 24.31 million are internet users, with an internet penetration rate of 71.1%. In January 2023, the number of social media users in Peru reached 2.05 million, equivalent to 73.3% of the country's total population. Moreover, according to the latest data, Peru's cellular mobile connections are also continuously increasing, having reached 40.03 million, equivalent to 117.1% of the total population.

According to data released by Ookla, the mobile internet connection speed in Peru via cellular networks at the beginning of 2023 was 16.62 Mbps, an increase of 13.6% from the previous year. Additionally, due to the popularity of mobile phones, the use of mobile internet is also increasing year by year.

The fixed internet connection speed is 65.73 Mbps, an increase of 55.5% from the previous year. The Peruvian government has been committed to increasing the national fixed broadband penetration rate to promote the country's informatization and digitalization process.

It is understood that in the past 12 months, the Peruvian government has taken a series of measures to improve the national internet connection speed, including but not limited to strengthening internet infrastructure construction and reducing network costs. The implementation of these measures has injected new vitality into the development of Peru's internet industry.

In the area of electronic payments, Peru has up to 7 different mainstream electronic payment options, including Yape, Tunki BIM, Visa & MasterCard, Paysafecard, SafetyPay, PagoEfectivo, RapiPago, etc. A well-developed electronic payment system facilitates the rapid and smooth integration of online gambling.

With a high-quality population structure, continuously improving internet infrastructure, and a strong sports tradition, Peru has become the next hot spot for offline gambling.

Peru's Online Gambling Prospects: Greed and Thrills

Having read this far, you should have a certain understanding of the overseas online gambling industry and the Peruvian market. Overall, Peru's online gambling industry has a broad prospect under the guidance of new regulations. Politically relatively stable, the authorities' positive attitude towards online gambling and sports betting gives investors greater confidence in long-term operations. At the same time, Peru also has a steadily growing economy and stable currency, excellent population structure, internet infrastructure, and a well-developed mobile gaming market education and electronic payment system, making it easier for overseas investors to quickly enter the local market.

As it stands, everything looks so promising. But don't forget, when entering any overseas market, don't underestimate the challenges you will face, especially in the gambling industry, which has higher localization requirements. Before diving headfirst into the Peruvian market, perhaps you should first ask yourself the following questions:

1. Do you have the ability to obtain a Peruvian license? Although Peru has already legalized online gambling and licenses are being gradually issued, applying for a license still requires strong communication skills and government relations locally;

2. Do you have professional language translation? This is basic for every company entering an overseas market, but it should not be overlooked;

3. Can you achieve deep cultural integration? The religion, language, beliefs, and culture of each target market are crucial. You must integrate local elements through design, content, and marketing strategies to make users feel familiar