Moreover, the number of users is expected to increase to 4.3 million by 2029, with a user penetration rate projected to reach 6% in 2024. These statistics highlight the increasing engagement of Italian consumers with online gambling platforms.

Analysts say there are many factors contributing to the rapid expansion of the Italian online gambling market. One major driving factor is the convenience and accessibility offered by online platforms. More and more Italians are choosing online gambling as they can comfortably place bets or play casino games from home or on mobile devices. This shift in consumer behavior is supported by a variety of betting options to suit different preferences.

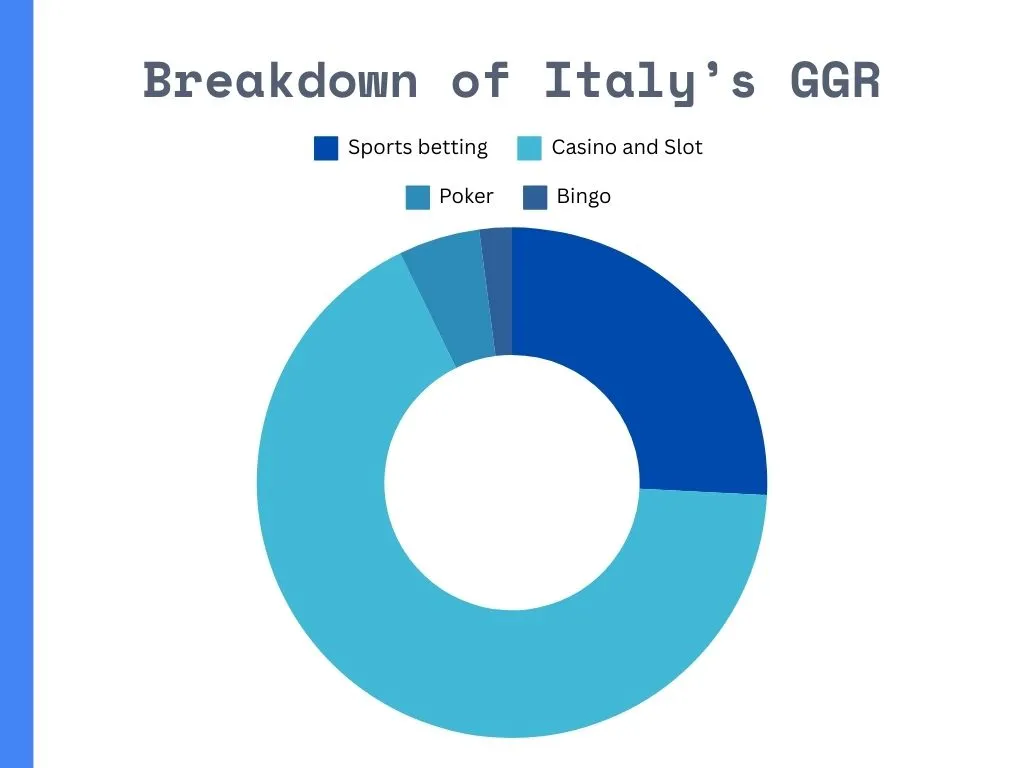

A significant trend in the Italian market is the increasing popularity of sports betting (especially football betting). The deep-rooted love of Italians for this sport translates into high demand for sports betting opportunities. Online platforms capitalize on this trend by offering a wide range of sports betting options, including live betting and virtual sports. The appeal of traditional casino games like blackjack, roulette, and slot machines also contributes to market growth. The emergence of live dealer games, allowing players to interact with real dealers via video stream, further enriches the online casino experience.

Licensing Framework to Undergo Changes

In addition to market growth, Italy is also advancing a revised online gambling licensing framework. The European Commission (EC) is currently reviewing this new framework as part of the EU's legislative process. The review phase includes a three-month "standstill period," which will end on October 18, 2024, during which EU member states and other stakeholders can provide feedback on the proposed regulations.

The Italian government plans to initiate a new tender procedure for remote gambling licenses after the standstill period, with an expected start date of late December 2024 or early January 2025. If the new regulations are approved, each online gambling license will carry a fee of 7 million euros, valid for nine years. Technical rules will outline the performance standards and technical requirements that operators must meet to provide remote gambling services.

The updated regulations will also emphasize consumer protection, introducing mandatory self-exclusion tools and options for users to limit their gambling activities. Additionally, all gambling platforms must host their IT infrastructure within the European Economic Area (EEA), including cloud-based solutions, to comply with EU data protection standards. The new rules will prohibit affiliated websites (also known as "skins") and allow separate applications for different types of gambling (including betting, casino games, poker, and bingo games).

This regulatory update marks the end of the first phase of the "Gambling Reorganization Decree," which is the first comprehensive review of Italian gambling regulations since the legalization of online gambling in 2011. The future phases of the decree will focus on updating the regulations for land-based gambling operations across various regions and municipalities in Italy.