"To succeed in the Indian gaming market, the best approach is to let data speak for the strategy." —— Insights after analyzing 100 gambling ad materials

Preface:

In previous articles, PASA has analyzed that the online gambling industry in India is in a rapid growth phase, due to the local policies creating a grey area for online gambling markets—although gambling is not legal in India, games of "skill" are not classified as gambling.

In India, card games can generally evade the existing Indian legal supervision, including some other types of "skill-based" games such as fantasy sports, quiz and puzzle games, etc. The classification can be reviewed in past articles: The Real Money Gaming Market in India.

This article focuses on card games in India, as they are the most popular category of games, with gambling elements accounting for 25% of the entire Indian gaming market.

According to PASA's forecast, by 2028, the market size of card games in India will reach 3 billion US dollars.

Therefore, card games have become the first choice for many businesses entering the Indian market; since entering a new market, the most important thing is to attract local users, i.e., promotion on the delivery side.

In this article, PASA will use India's most successful Rummy game "RUMMY CIRCLE" as a case template, anchoring on various brands' delivery data, gradually guiding everyone on how to achieve successful product launches in India.

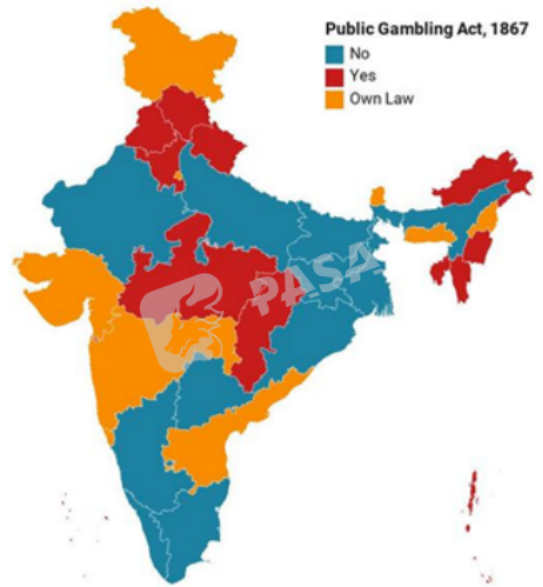

Targeted regional delivery, different control policies between states in India

Just looking at the delivery of card games, one cannot generalize based on the Indian government's policies. To avoid pitfalls when entering India, it is extremely necessary to understand the specific policies on card games in different regions of India.

In India, currently, two types of card games occupy more than 90% of the market, namely Rummy and Teen Patti (Indian version of poker).

These two games are not both classified as "skill-based" games; Rummy is skill-based while Teen Patti is probability-based.

As mentioned in our past articles, each state in India has its specific laws, so the laws enacted by the central government of India do not necessarily apply everywhere: in various regions of India, probability-based games are not entirely prohibited, and skill-based games are not entirely allowed.

So first, we need to understand which regions allow which type of games, in order to make targeted regional ad placements.

1. Probability-based games

Probability-based games are prohibited in most states of India, but in Goa and Sikkim, these games are legal, provided that a license is obtained.

At the same time, the governments of Sikkim and Goa have issued related "Regulatory Regulations" and introduced gaming industry experts to participate, and these regulations are regularly revised.

Hard requirements for obtaining a business license:

1. The applicant must be an Indian national or an independent company entity registered in India;

2. The applicant must not have any criminal record;

3. The controlling interest and decision-making power of the company's main applicant must be within India;

2. Skill-based games

These games are allowed in most states of India and do not require any license. This means that gaming companies can not only offer these games but also promote them legally and compliantly through various social media, television, and websites.

For example, in 2016, the state of Garan enacted an online gaming law, which stipulates that gambling is prohibited in Garan, but skill-based online games are allowed, despite their elements of chance, but still primarily rely on skill to win. The familiar card games, such as Rummy, are within the allowed range, including Texas Hold'em and other card games.

3. States where all games are prohibited

Orissa and Assam completely prohibit related games;

In Maharashtra, Mumbai, the Gambling Law defines online games (whether skill-based or probability-based) as a prohibited criminal act;

Telangana prohibits all online and offline gambling activities through the "Telangana Gambling Regulation" of 2017;

As can be seen, this is also one of the reasons why Rummy games are so popular in India; based on its historical tradition in India, coupled with the "skill" factor, therefore, we can see gambling real money game ads in India are basically Rummy games.

In related placements, we need to avoid specific areas—Orissa, Assam, Maharashtra, Mumbai, and Telangana.

Strategy driven by data, detailed explanation of the secrets of game placement in India

Then we need to move on to the actual placement stage, PASA summarizes several key points of ad placement for everyone, gradually analyzing.

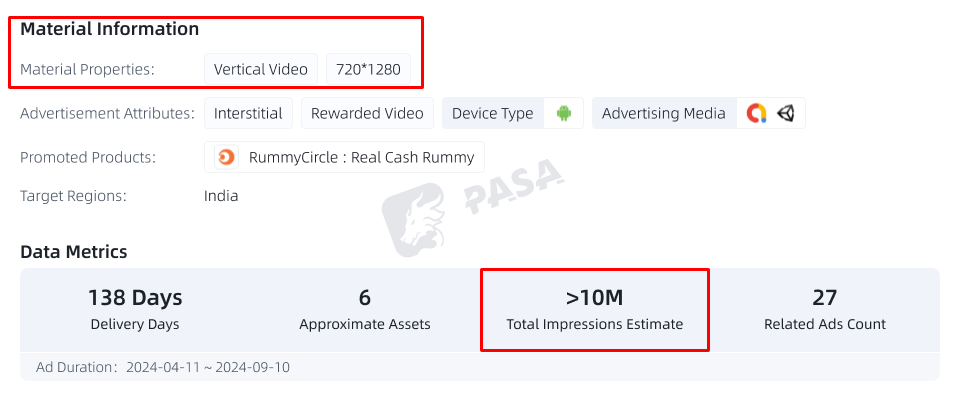

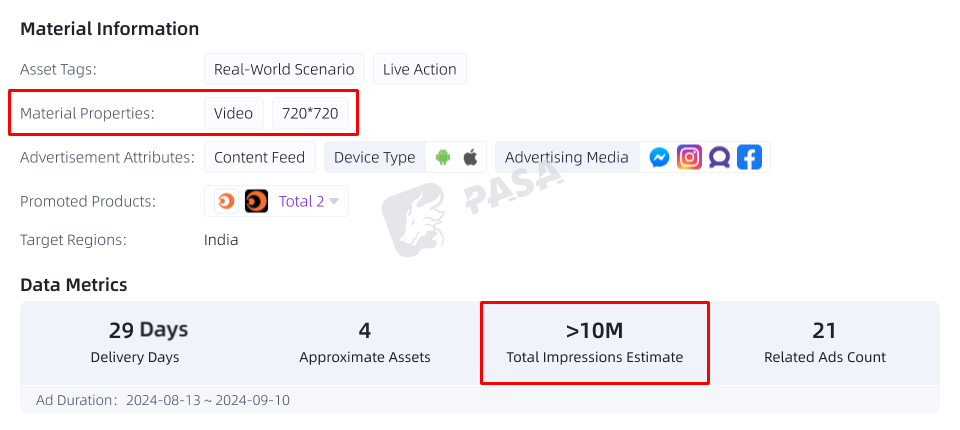

1. Placement side and resolution

According to the "2024 Indian Mobile Game Market Report", India has the world's second-largest internet user group and will soon surpass China to become the first, with over 80% of players playing games through mobile devices, so a mobile-first placement strategy is crucial.

In the past articles, it was mentioned that Android devices occupy more than 95% of the Indian mobile device market, so developing Android games and collecting user targeting data for Android will be a shortcut for game merchants.

Of course, if you have the capability to be compatible with both systems, that would be even better. For example, India's number one Rummy game "RUMMY CIRCLE", which is dual-channel compatible, thus perfectly accommodating almost all Indian players.

2. Types of advertising materials

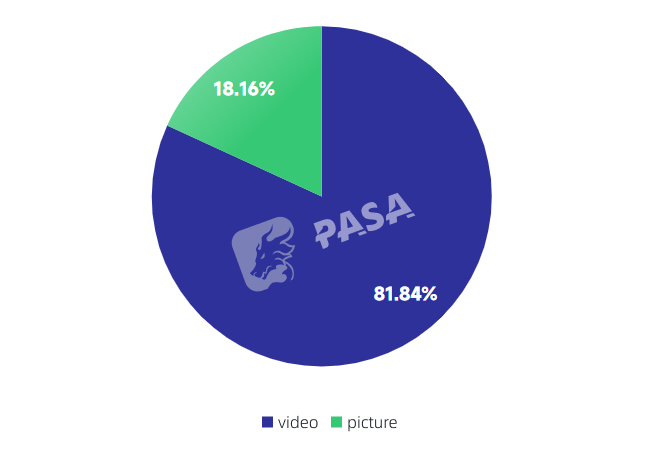

According to SocialPeta's data, nearly 82% of ads for Indian card mobile games are delivered through videos, while 18% of ads are delivered through images.

Since the configuration of Indian users' devices is generally not high, it is necessary to avoid overly fancy video materials when making video ads.

Running not smoothly is likely to affect the ad's completion rate, thereby affecting the player's conversion rate. In the 2022 ad data, the 600*600 resolution is the most commonly used, with more than 68% of ad materials on the market using this resolution.

In image ad materials, a 1:1 ratio is the best, accounting for 80% of the ad materials on the market.

Of course, this data will change with India's consumer electronics cycle. As India's phone replacement wave changes, more Indian users' phones can accommodate higher-resolution materials, and high-definition materials can then improve player retention and conversion.

According to current data, the 720*720 resolution has become more common, and there are already many well-performing 720*1280 resolution video ads on the market, which are very popular with users.

For example, a video ad for "RUMMY CIRCLE" with 10 million exposures uses a 720*1280 resolution.

Of course, the 720*720 resolution ad for "RUMMY CIRCLE" can also achieve 10 million exposures.

Because "RUMMY CIRCLE", as the industry-leading game, has its unique opportunity to experiment, based on its advantage of 70 million players, it can produce higher-quality video ads to attract more segmented players.

PASA, after reviewing most of the market's outstanding video ad works, actually found that more game merchants still focus around 600-720 resolution, and as a new game, making ads of this resolution can adapt to more and larger Indian down-market users, and its cost-effectiveness will be higher.

And for image ads, the requirements for phone configuration are relatively low, and the use of various materials is more important.

Therefore, next, we need to focus on analyzing the impact of materials on ad performance.

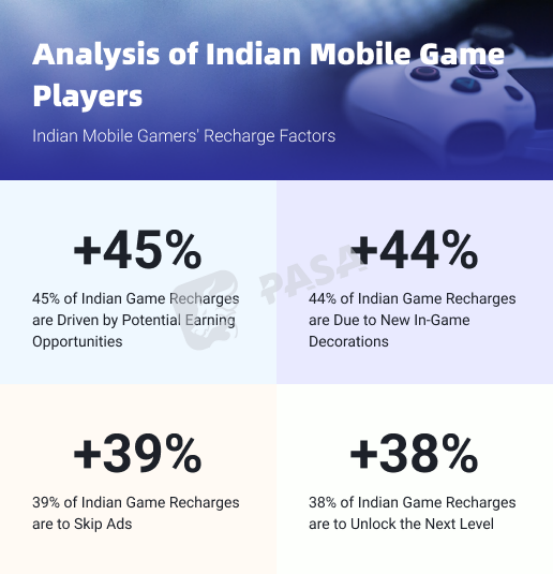

First, we need to be clear that unlike brand ads, the purpose of our game ads is to get users into the game and achieve recharges.

Data speaks, according to the "2024 Indian Mobile Game Market Report", the highest proportion of Indian mobile game players recharge because the game has the potential to make money.

Therefore, highlighting the game's prize benefits and directly displaying game rewards and real income in the materials can stimulate users' desire to download.

Ad titles often directly use winning prizes, awards, etc.

For example, this video ad for "RUMMY CIRCLE" called "Play Rummy Online and Win Big Prizes" with a 720*1280 resolution, continuously repeats the scenes of players winning large amounts of income.

In a good ad, continuous brainwashing elements can deepen the impression in the audience's mind, and the direct display of income is a direct hit to the target user's heart.

Even if the player does not download the game immediately after watching it, these images have been deeply remembered, which can also improve the success rate of the next ad.

We see in other video materials of "RUMMY CIRCLE", there are many cases of directly displaying income, such as the following material directly withdrawing 150,000 Indian rupees.

Of course, in addition to game rewards and real income, the game's first recharge reward is also a good ad material, this type of ad has a very intuitive help in pulling new users.

In addition to the most important display of rewards and income, high-quality plots are also key to whether an ad can stand out.

Some Rummy game ads will use live-action plots, focusing on the actor's character portrait, to highlight their facial emotions—such as excitement, excitement, etc., to reach users through the character's excited expression.

For example, the ad data ranked fourth "Rummytime", its ads mostly use character dialogue plots, using live-action narration to highlight the game's advantages.

And the scene will often use everyday life scenes, to show the game's playability anytime, anywhere, while showing the game's social attributes—that is, it can be played and shared with friends and family.

And social attributes are also a point that Indian users pay the most attention to, which we will talk about later in conjunction with the delivery channels.

Of course, showing social attributes can also use the method of interspersing game videos, after all, creative ad materials are not immutable.

As for the budget and cost control of Facebook placements, PASA will use a dry article as a summary, and everyone can pay attention to it later.

3. Placement platforms and timing differences

After preparing the ad materials, it's time to start placing.

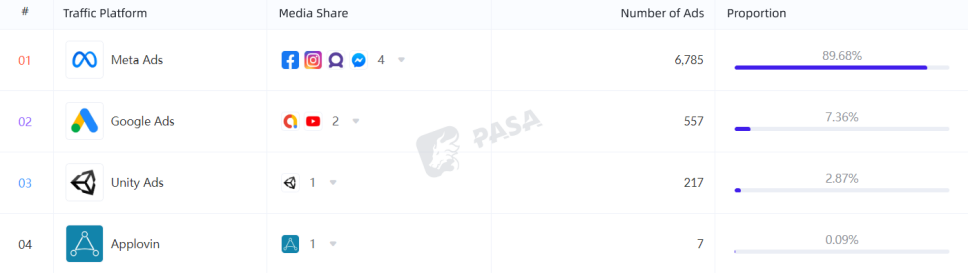

Still data speaks, currently, the games with excellent placement effects are mostly based on Facebook and Instagram, which corroborates the socialized ad materials mentioned above.

According to "RUMMY CIRCLE"'s data, whether it's Android or IOS, Facebook's ad placements account for more than 80%, and the remaining 20% mainly revolve around Google and other platforms.

The results are already very clear, social media and socialized games are indeed a big pain point for Indian users, making targeted placements around these two points can encompass a large part of Indian players.

Perhaps there will also be a small number of game merchants taking a different path, putting more ad investment on Google's placements to attract missed Indian long-tail users.

But focusing on "non-mainstream" placement methods is not suitable for most game merchants, this part of the long-tail users cannot carry too many game merchants.

In addition, choosing the right placement time is also something we need to pay attention to.

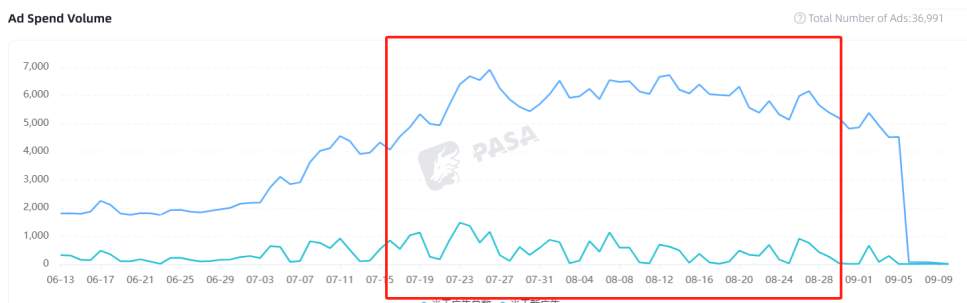

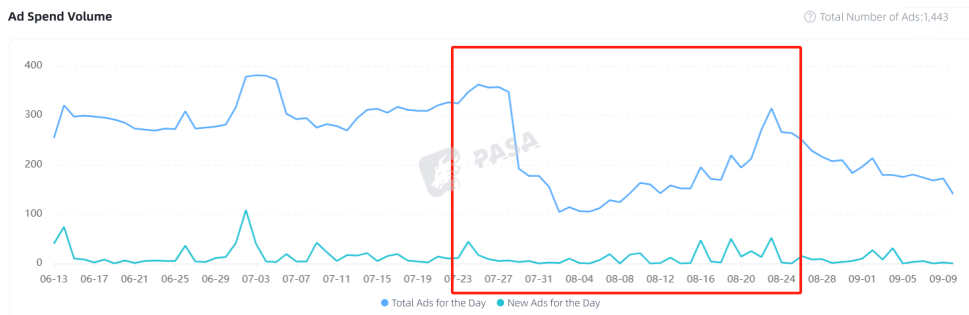

Still taking "RUMMY CIRCLE"'s placement data as an example, we find that its Android and IOS game placements will be staggered.

That is to say, whether the same type of ad can attract more users at the same time depends on the number of ads at the current time.

The more ads there are, the more likely it is that the users will be more divided, "RUMMY CIRCLE" itself has two games that respond in this way, not to mention different merchants' games.

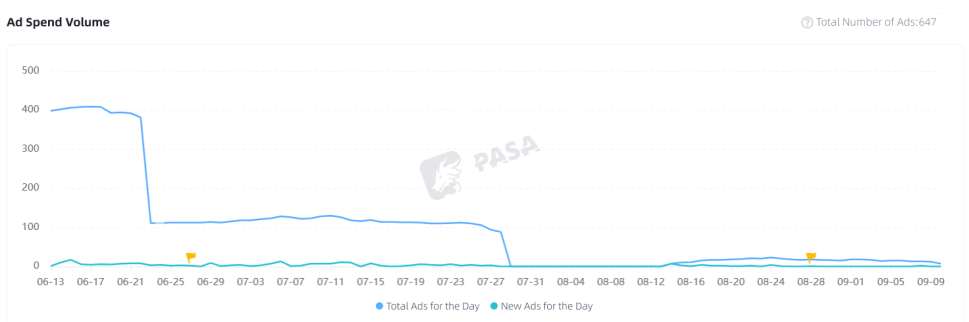

For example, the game "Rummytime" mentioned above, when "RUMMY CIRCLE" starts large-scale ad placements, it stops its placements.

By differentiating the placement timing, it maximizes its ad effectiveness.

4. Achieving localization

Finally, we need to mention the issue of localization.

Although most game users in India can use English and Hindi, due to India having 10 major ethnic groups and several minor ethnic groups, the language is very complex, with 29 languages having more than one million users.

Therefore, if you can carry out corresponding language localization through specific regional placements, you will have a great opportunity to carve out your own market.

For example, "जंगली रमी : रम्मी कैश गेम" translated as Junglee Rummy, its video ads basically use Hindi, and its ad materials are more grounded, closer to the lives of ordinary Indians.

From its use of 360*640 resolution, it can be seen that its target market should be ordinary Indians in the down-market.