In the past four years, significant changes have occurred in the gambling industry in Bulgaria. Four years ago, the company owned by Vasil Bozhkov, which was the largest gambling company at the time, was suspended. Since then, the online gambling market has opened up, and currently, there are 22 companies holding gambling licenses, an increase of 16 since 2020.

This year, new local and international players are entering the Bulgarian market. For example, bet365 is collaborating with EGT Digital to introduce products from suppliers such as Amusnet, Playson, CT Interactive, Wazdan, and 7777 Gaming to Bulgarian players.

Gaming Business Valued at 561 Million Euros

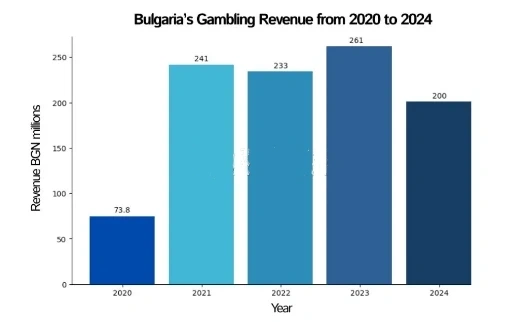

According to Kapital, the value of the online gambling industry in Bulgaria is 1.1 billion Bulgarian Lev (561 million euros). This valuation is based on taxes paid from gambling activities over the past year, reflecting the gambling revenue minus the prizes paid to players. Last year, the industry's growth slowed to just under 12%.

Industry representatives state that online casinos hold the largest share, accounting for two-thirds, while sports betting accounts for 30-35%. According to industry spokespeople, at least 1 million people in Bulgaria gamble online, and although the expected audience is predominantly male, about 40% of the bets are placed by women.

Market Leadership Changes

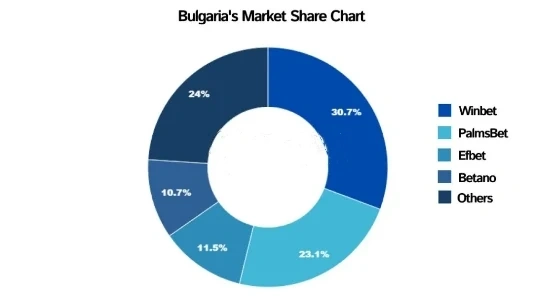

According to local media reports, in 2023, there was a change in the rankings of top leaders in the Bulgarian gambling market. In the casino sector, Winbet, in collaboration with Walter Papazki, surpassed the Naydenov brothers, Boyan and Tsvetomir, owners of Efbet, who fell to second place.

The top five also include Palmsbet, publicly traded by Telematic Interactive Bulgaria and associated with Milo Borisov, and Top Bet, operating under the 8888.bg brand. Notably, a year ago, Top Bet underwent an ownership change, with 60% of its shares acquired by Dencho Ganev, father of Dimitar and Milen Ganev, who were partners in Vasil Bozhkov's lottery business, with Vasil Bozhkov being the unofficial market monopolist.

Current Ranking of Bulgaria's Most Visited Gambling Websites:

Growth Forecast for Online Gambling in Bulgaria

By 2024, the revenue from the online gambling market in Bulgaria is expected to reach 136.6 million euros. The annual growth rate is projected at 5.42%, with the market size expected to reach 168.7 million euros by 2028. The online sports betting market is expected to reach 60.81 million euros by 2024.

This year, the average annual revenue per online gambling user in Bulgaria is expected to reach 411 euros. According to Statista, the user penetration rate is projected at 4.9% by 2024, with the number of online gambling market users expected to reach 377,300 by 2028.

Advertising Opportunities in Online Gambling

In April 2024, the Bulgarian Parliament passed amendments to the Gambling Act, which will come into effect on May 18, 2024. These changes impose strict restrictions on gambling advertising, especially on websites. For more details, please refer to the SiGMA News article "Reforms in Bulgarian Gambling Legislation".

According to the National Revenue Agency (NRA), the ban on gambling advertising only applies to online media. The NRA's stance is that social networks do not fall under electronic media, hence the ban does not apply to them.

Furthermore, the NRA notes that online media can post content links from licensed gambling operators on platforms like YouTube, provided the links themselves are not gambling advertisements and inform users that they will be redirected to social media profiles containing gambling-related content.