Veikkaus released its first half of 2024 financial results on September 2, which were overall quite pessimistic, marking the biggest decline in the company's history.

This Finnish gambling operator achieved actual sales revenue (including total gambling revenue and other business activities turnover) totaling 483.8 million euros (approximately 535.4 million US dollars), a decrease of 6.8% year-on-year;

The total gambling revenue from physical sales outlets decreased by 21%, and operating profit fell by 20.4% to 252.3 million euros, which is almost 50 million euros less than from January to June last year.

In past PASA articles analyzing the Finnish gambling market (Thirty billion euros in gambling revenue unnoticed? Finland's zero-competition gambling market is about to fully open!), it has been explained that Veikkaus is a state-owned monopoly gambling operator in the Finnish market.

This is due to past Finnish gambling regulations, where gambling revenues are mainly managed by the Finnish government and used for social welfare and public service projects.

As such, corresponding gambling revenues cannot be reinvested in the development of the gambling industry, which suppresses related commercial activities and thus fails to bring the economic momentum that it could.

Therefore, the new Finnish government has decided to reform the gambling industry in 2027: changing from the current monopoly system to a licensing system, opening up possibilities for external operators to enter the Finnish market, with related legislation already on the agenda and in progress.

But in the first half of 2024, with at least two more years until the Finnish gambling market is fully open, Veikkaus is already facing significant challenges—gambling total revenue down 21%, net profit down 20.4%. This is highly unusual.

Therefore, this PASA article will take us to Finland to see why the aurora is gradually fading from Veikkaus and what insights this can bring to us practitioners.

Diving into Veikkaus' financial report, uncovering two major reasons for its performance decline

Veikkaus Group mainly consists of two companies, including Veikkaus Oy and Fennica Gaming Oy.

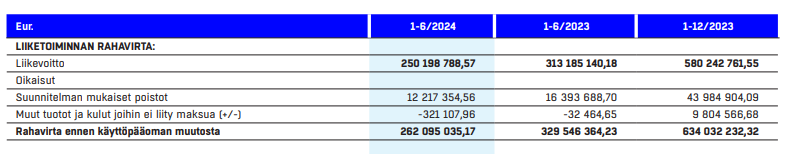

Veikkaus Group's actual operating income from January to June was 483.8 million euros (compared to January to June 2023, it was -6.8%).

Veikkaus Group's operating profit was 246.9 million euros (year-on-year -20.4%).

Among them, Veikkaus Oy's operating profit from January to June 2024 was 250.2 million US dollars (year-on-year -20.1%).

That is to say, the decline in revenue and profit of Veikkaus Group mainly stems from the impact of Veikkaus Oy.

The decline in revenue and profit went where, this is what we need to focus on.

First, excluding the less influential factors, such as the Finnish government's national lottery tax levied from gambling business profits increased from 5% last year to 7%, and returned to 12% in this fiscal year after the pandemic.

The company paid 31.7 million euros in lottery taxes during the review period, an increase of 1.8 million euros from 25.9 million euros in the same period last year.

This has less impact on the company's revenue, so it is not the main reason for the decline in Veikkaus' performance.

Moreover, since last year, identity verification requirements have been introduced in all gambling games in Finland.

The purpose of identification is to prevent adverse gambling factors, promote age restriction monitoring, and establish a safer gambling environment overall.

The company and external parties mostly attribute the performance decline to this regulatory measure—blaming it for causing customer gameplay disruptions and consumption declines. After the introduction of identity verification requirements, some customers were unwilling to continue playing. Identity verification and mandatory customer game management tools (such as loss limits) also reduced the amount of gambling by customers.

But in fact, this action just follows similar identity verification requirements implemented for coupon games like Lotto and Eurojackpot at the beginning of 2023.

The system had already been implemented in most game categories in 2022, and at the beginning of 2024, it was only expanded to scratch cards, causing scratch card revenue to drop by 44%, but scratch cards actually only account for a small part of the company's GGR.

The greater impact part had already been implemented in 2022 and 2023, although it also put some pressure on Veikkaus' performance at the time, but the decline was not as high as this year.

That is to say, the above points hotly debated in the industry are actually not the biggest reasons for the serious decline in Veikkaus' performance.

The most important and fundamental reasons, PASA will mention next:

One. Retail market facing severe shrinkage

From January to June 2024, the total Finnish gambling market is estimated to be about 790 million euros. The market share compared to January to June 2023, the overall market is still close to last year's level, with an overall market growth of 5.3%, while the online gambling sector grew by 17.6%.

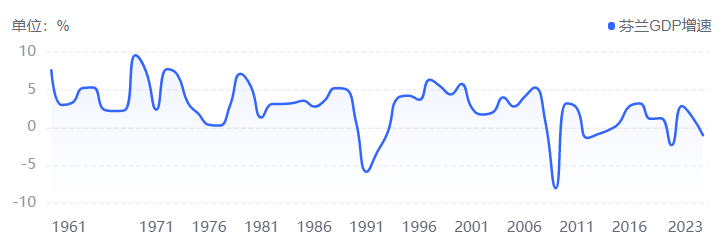

The overall Finnish gambling market did not achieve significant growth, due to the overall economic situation in Finland and the decline in consumer purchasing power, Finland's GDP growth rate for the full year 2023 was -1.04%.

We have mentioned before that the Finnish gambling industry is highly linked to the government, and the country's low GDP also leads to the delay in the release of many games. Business expenses and personnel costs also increase with the overall cost level.

Meanwhile, from January to June 2024, the size of Finland's online gambling market was about 600 million, and the ratio of the retail gambling market to the online gambling market was about 1:3; with the growth of the online gambling market, the overall size of the Finnish gambling market remains unchanged, the rapid growth of the online gambling market (+17.6%) will further suppress the retail gambling market, and the market size gap will continue to widen.

Conversely, from January to June, 60.5% of Veikkaus Oy's gaming profits came from digital channels, 39.5% from physical channels.

Although the share of digital channels increased by 6.6% year-on-year, compared to the market size ratio, Veikkaus Oy's share of physical profits is obviously too large.

According to the market size ratio, Veikkaus Oy needs to achieve at least 25% of physical channel profits, plus 75% of digital channel profits, to mitigate the severe consequences brought by the decline in retail channels.

Fortunately, Veikkaus Oy has also realized this point, and since the end of last year, Veikkaus has gradually closed 19 gaming halls and the Tampere casino.

The gambling profits generated by the online casino have been at a good level since the beginning of the year, benefiting from good game development, especially the new games produced by Veikkaus' own game studio Kulta-Jaska Lapin Kesä and Huutokauppa have been very successful.

As such, Veikkaus' user base has not declined, the company currently has 2,535,000 registered customers, with the number of registered customers at the beginning of the year increasing by about 15,000.

Two. Gambling regulations advancement, external operators intensifying competition

According to estimates by Gambling Capital, of Finland's 790 million gambling market, about 310 million euros are generated by gambling services other than Veikkaus.

The scale of online gambling services outside of Veikkaus increased by nearly 15%. In the review period from January to June, Veikkaus' share of the entire Finnish digital gambling market was about 49%, down 2% from last year.

In addition to the retail market being compressed in size for various reasons, Veikkaus' share of the online gambling market is also facing external competition.

Currently, Veikkaus is competing with unlicensed foreign gambling companies operating in Finland for the Finnish market, mainly due to the restrictive nature of current legislation and the regulatory authority's failure to address unregulated gambling products.

We mentioned that Finland will fully open the gambling market in 2027, and the consultation period for the new gambling law draft ended in August.

According to the draft, the gambling system will be introduced in phases, gambling implementation licenses can be applied for from the beginning of 2026, and licensed gambling activities can start from the beginning of 2027. Veikkaus Oy will end its monopoly activities by the end of 2026.

Therefore, Veikkaus is facing two major competitions: 1. Overseas operators before the license is implemented. 2. New market participants after the license is issued.

But Veikkaus is not just sitting back and waiting for doom, the company is also preparing for the transformation of the gambling system, Veikkaus has specifically made investments to enhance its competitiveness in digital channels.

Veikkaus' other business, Fennica Gaming Oy, began operations at the end of January 2022.

The company's business is the development, sale, and leasing of gambling games and related services, and the company's turnover from January to June compared to the same period last year has almost doubled.

In its first two and a half years of operation, Fennica Gaming has consolidated its position in the digital online lottery market through the launch of new markets and new games. The company currently operates in three different continents, providing online lottery delivery to Virginia, the United States, and France.

At the same time, the company also delivers slot machine games to Sweden through IGT's game system, thereby gaining new markets.

Although Fennica Gaming Oy's turnover was still low at the beginning of 2024, it is expected to bring new cash flow to the group.

Conclusion

In summary, the fundamental reasons for Veikkaus' significant performance decline are the two points mentioned above, one, the company's business leans more towards physical retail business, unable to withstand the impact of the decline in the size of the physical gambling market. Two, the online gambling business is impacted by external gambling operators, further eroding market share.

But Veikkaus has also made countermeasures—vigorously developing its existing online gambling business, and expanding to new markets abroad to cope with all local competition crises.

Whether Veikkaus can achieve a phoenix-like rebirth through targeted measures, we can only wait and see, at least PASA believes that Veikkaus' two decisions are very correct.

We believe that in the near future, even if the Finnish gambling market is fully open all year round, Veikkaus will still be an indispensable force in the local gambling market.

We look forward to discussing more unique insights about the Finnish market and enterprises with our readers, and we sincerely invite you to follow the global iGaming leader outbound information platform PASA for more first-hand industry information.

Welcome to subscribe to the official PASA channel: https://t.me/PASAIGHYJL