SJM Holdings is the oldest casino company in Macau.

Its status in the Macau gambling industry is akin to that of SBM's Monte Carlo Casino in Monaco, dominating the regional market; their performance essentially represents the rise and fall of the local gambling industry.

Since its stock price peaked in 2014, SJM Holdings' stock price has fallen by 90%.

In fact, the company's stock price largely reflects its operational status and investors' outlook on its future.

So, what exactly are the issues SJM Holdings is facing in its operations, and what challenges does the physical casino industry face? These are the main topics of discussion in this PASA article.

Can SJM Casinos Regain Their Former Glory?

SJM Holdings was founded by the late Macau business magnate Stanley Ho, who passed away in 2020 at the age of 98.

From a young age, Stanley Ho witnessed his wealthy Hong Kong father lose everything due to stock investment errors and the Japanese invasion of his hometown Hong Kong in 1941.

Stanley Ho then fled to nearby Macau, a small Portuguese colony occupied for nearly five centuries.

At that time, Macau was a remote backwater where refugees, spies, pirates, and prospectors settled.

Amidst the chaos, Stanley Ho made a fortune through "smuggling trade," first with mainland China and later with North Korea, which was under UN sanctions.

Later, using family connections, he convinced Hong Kong tycoon Henry Fok to fund his plan to turn Macau into a gambler's paradise.

In 1961, Stanley Ho obtained an exclusive license to operate casinos in Macau.

It is said that the casinos were initially used as tools for money laundering and circumventing currency controls, and although governments are now increasingly strict on casino money laundering, this investment made Stanley Ho one of the wealthiest people in Asia at the time.

Stanley Ho's family relationships were complex, having at least 16 children with four wives. In the early 2010s, Stanley Ho's second and third wives teamed up against the current fourth wife in a public battle over director positions and family control rights.

As all this unfolded, Stanley Ho was seriously ill, appearing in a wheelchair on television, issuing contradictory statements about his intentions, further intensifying the inheritance battle.

Upon his death in 2020, his daughter Pansy Ho and his initial supporter Henry Fok's family foundation took control of the core family holding company.

The privately-owned Macau Tourism and Entertainment Co., Ltd. is the controlling shareholder of the Hong Kong-listed SJM Holdings, which owns its gaming subsidiary, Sociedade de Jogos de Macau (SJM).

On the day the family feud was announced to have ended, the stock price rose against the trend by 11%, reaching HK$8.

However, SJM's stock price eventually fell to today's HK$2.50, as the inheritance dispute was just a catalyst for the stock price drop; in fact, SJM's casino performance had already begun to decline.

Macau has operated under a special gambling regime for twenty years, seemingly doing very well.

But as part of complex political negotiations involving Hong Kong's legal status as a Chinese Special Administrative Region, the Ho family relinquished their casino monopoly in 2002. Instead, new licenses were granted to three operators—SJM, American gaming enterprise Steve Wynn's Wynn Resorts, and Hong Kong's Galaxy Entertainment Group.

Soon after, more casino operators were allowed into the Macau market, and the casino construction boom briefly made Macau the world's fastest-growing economy, with annual GDP growth rates reaching as high as 25%.

From 2000, Macau rapidly caught up with Las Vegas, and by 2006, Macau's gambling revenue officially surpassed that of Las Vegas. By 2013, Macau's gaming revenue had grown to four times that of Las Vegas.

However, this revenue growth came to an abrupt halt that year.

A significant turning point was China's crackdown on corruption. In 2013, Macau's gambling industry generated $45 billion in revenue, which was expected to reach $77 billion by 2017. However, by 2023, the revenue was only $22 billion.

The Macau gambling industry, including SJM, has not fully recovered from China's anti-corruption campaign, and Macau's casino operators' stock prices have not rebounded, with the Macau gambling companies in a bear market for a decade.

Additionally, the subsequent Covid-19 pandemic continued to severely impact the Macau gambling industry.

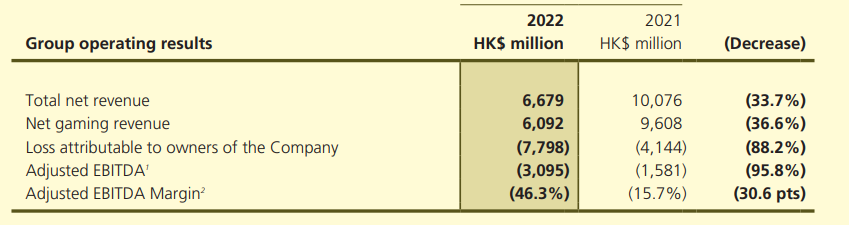

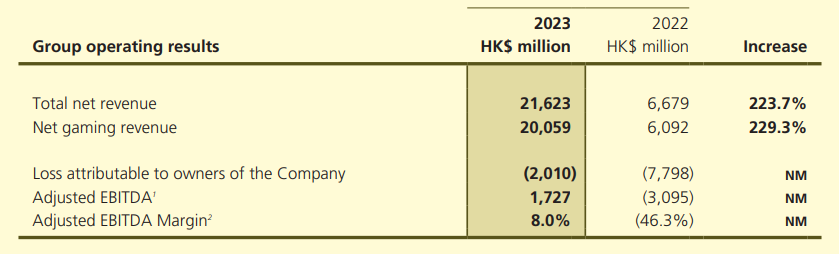

Since the pandemic, SJM Holdings has also been in continuous losses, with the company announcing a net loss of HK$20.098 billion for the year ending December 31, 2023, compared to a loss of HK$77.984 billion for the same period in 2022.

In fact, in a previous PASA article: Industry Depth: The End of an Era, Offline Casinos Will Eventually Be "Replaced", the situation of Macau casinos has already been analyzed:

The early decline of VIP business in offline casinos has already indicated the future of Macau's gambling industry. The slump in offline casinos is due to the rapid rise of online casinos, with players voting with their feet and leaving offline venues.

Therefore, whether it's anti-corruption efforts, the pandemic, or the inheritance dispute at SJM, these are actually just catalysts for the plummeting stock price of SJM.

Even if the company's operations improve (the 2023 loss is narrower compared to 2022), it cannot mask the decline of the sunset industry of offline gambling.

Thus, PASA has already made this conclusion: SJM casinos will not be able to return to their past glory, as offline casinos will eventually be replaced by online ones.

The Difficult Transition of Offline Casinos

He Youjun, Stanley Ho's youngest son, is clearly aware of the industry's transformation. Although his father's legacy is fading, he is trying hard to salvage it.

Earlier this year, the esports company NIP Group, founded by He Youjun, officially filed for an IPO and was listed on NASDAQ.

Starting with just HK$10, Stanley Ho wrote a legendary story that cannot be replicated, but fortunately, He Youjun is not mediocre. From a young age, he began to show his talent in mathematics. In 2013, at the age of 18, He Youjun was admitted to the Massachusetts Institute of Technology.

In 2016, he graduated early and was admitted to MIT's Master of Finance program, claiming on a variety show that he was the youngest Master of Finance admittee in MIT's history.

These experiences laid the foundation for his keen business sense.

In 2018, during a Premier League match, He Youjun inadvertently discovered that the live chat was "distracted" by discussing an esports match instead of the football game.

He realized that this was what young people liked.

Subsequently, He Youjun established his own esports club, V5, and secured a competition slot from Tencent, the operator of the LPL, which is considered a ticket to the world's most valuable esports league. As a result, He Youjun received RMB 120 million in Series A funding, setting a record for the highest single financing amount in the industry.

He Youjun first turned his attention to the top domestic eStar esports club, whose founder, Sun Liwei, was struggling to break through the ceiling and wanted to scale and industrialize the club. The two hit it off immediately.

Consequently, V5 and eStar agreed to a stock swap merger, forming the NIP Group, with He Youjun serving as Chairman and CEO, and Sun Liwei as President of the Group and Chairman of the Club.

NIP Group quickly became an esports company hosting both the LPL and KPL, two of the top leagues.

As the company stabilized, He Youjun replicated the strategy overseas. Considering the slow development of Chinese esports companies starting from scratch abroad, he felt it was better to directly acquire foreign brands and assets as his core competitive advantage.

In January 2023, NIP Group acquired the Swedish veteran esports club NIP through a stock swap, achieving a shortcut in both domestic and international markets after two acquisitions.

Undoubtedly, He Youjun's vision is indeed sharp, as the esports industry is rapidly developing with the advent of the digital age.

In 2023, the 19th Asian Games were held in Hangzhou, featuring esports as an official competition; this year, IOC President Bach revealed at the Gangwon Winter Youth Olympics that he is considering holding the first Olympic Esports Games by 2025 or at the latest by 2026; Saudi Arabia will also officially host the first Esports Olympics in 2025.

In a favorable environment, NIP Group shows endless potential.

According to NIP Group's prospectus, the Group's net revenue in 2022 was $65.84 million (approximately RMB 470 million), and the full-year net revenue in 2023 was $83.67 million (approximately RMB 600 million).

As for how He Youjun's esports industry can benefit SJM, his answer is to focus on "Esports+."

The prospectus shows that the Esports+ 1.0 stage mainly includes the operation of esports clubs focused on competition results and permanent league slots, which are the main sources of revenue for the traditional esports industry.

Currently, they have entered the Esports+ 2.0 stage, which involves generating revenue through data management, product production, and creative advertising services.

In NIP Group's future vision, there will also be an Esports+ 3.0 stage, which involves providing expanded revenue opportunities in areas such as digital collectibles and intellectual property licensing.

In layman's terms, NIP Group can sell collected esports data, develop esports games through IP cooperation or self-developed IP, and bring advertising business to merchants.

In other words, NIP Group can become a supplier of gambling esports data, a game developer, and a gambling advertiser.

This is precisely the online casino business that Stanley Ho's SJM casinos lacked, and we can say that the dragon slayer has become the dragon.

Although NIP Group's current revenue is not yet sufficient to offset SJM's losses, one cannot help but admire that He Youjun is making real efforts to help his family business transition!

Conclusion

In fact, this PASA article is only to more deeply illustrate one point.

The apparent reason is the plummeting stock price of SJM Holdings, and whether it's investors or industry observers, they only focus on finding internal reasons within the company. They attempt to analyze the impact through policies and pandemic events.

However, they overlook the mainstream trend of the gambling industry: the transition from offline to online, which has become an unavoidable keyword for the gambling industry.

As for the reasons, PASA has already clarified in the article Industry Depth: The End of an Era, Offline Casinos Will Eventually Be "Replaced", which we can simply summarize as the evolution of the era and the choices of young people.

He Youjun, born from a physical casino, has already realized this point. In any case, as industry practitioners, we should have a more sensitive sense of smell and throw ourselves into the development trend of online gambling.

We look forward to discussing more unique insights about online casinos with our readers and sincerely invite you to follow the global iGaming leader's outbound information platform PASA for more firsthand industry information.

Welcome to subscribe to the official PASA channel: https://t.me/PASAIGHYJL