Half a month ago, Evoke announced the acquisition of Winner.ro operated by New Gambling Solutions (NGS), by injecting its own Romanian business and offering a cash consideration of 10 million euros (11.1 million USD), obtaining 51% of the shares in the merged business.

This marks another new regional expansion for Evoke (formerly known as 888 holdings) after laying out markets in many countries in South America and Africa.

The news of spending over ten million euros to enter the Romanian market immediately caught the attention of PASA.

For Evoke, entering new markets through mergers and acquisitions is nothing new, but what deserves our attention is the high success rate of Evoke.

This means that the Romanian market must have some exceptional advantages, while also having details that are largely overlooked by many external gambling operators.

Therefore, PASA tries to analyze the case of Evoke's acquisition of Winner.ro, and thereby uncover the appealing aspects of the Romanian market, providing relevant advice to industry operators.

Overview of the Romanian Gambling Market

The gambling industry in Romania has a long history, dating back to the early 20th century. Historically, the country has enacted various laws to regulate and control the industry, especially after the modernization of the gambling industry and its entry into the digital realm.

The gambling industry in Romania began to emerge and flourish in the early 20th century. The Romanian National Lottery (“Loteria Română”) was established in 1906, making it one of the oldest state-run lotteries in Europe.

For nearly the entire 20th century, gambling in Romania mainly took place in physical locations such as casinos and betting stations, most of which were operated by government or state-supported entities.

Following the Soviet invasion of Romania in 1944 and the subsequent joint rule, during the Communist regime (1947-1989), gambling activities were heavily suppressed, and various forms of gambling were banned.

Despite this, underground illegal gambling activities continued to thrive in Romania, where gambling was extremely popular among the locals.

After the fall of communism in 1989, Romania's gambling industry began a significant liberalization. In the 1990s, the gambling industry was re-legalized, including casinos, sports betting, and lotteries.

The first legal physical casino reopened in the 1990s, and gambling once again flourished as a popular form of entertainment to this day.

Looking back at the entire history of gambling in Romania, gambling activities have been deeply ingrained in the locals' "genes," laying a crucial foundation for the development of modern online gambling in the country.

In 2009, the Romanian government officially issued Government Ordinance No. 77/2009, introducing the first comprehensive legal framework for gambling. This law aimed to regulate the gambling industry and grant legal licenses to gambling operators.

Subsequently, in 2015, Romania officially legalized online gambling by updating Government Ordinance No. 77/2009. The government also established the National Gambling Office (ONJN), responsible for overseeing the licensing and regulation of operators in the country.

The new regulations require both domestic and foreign online gambling operators to pay 20% of their total gambling revenue in taxes and comply with various responsible gambling measures.

In Romania, player protection and responsible gambling are heavily promoted. ONJN requires operators to take measures to protect players, such as self-exclusion programs, deposit limits, and advertising restrictions—where players need to pay a tax on winnings based on the amount won. Winnings exceeding 66,750 Romanian lei are taxed at 40%.

Thus, Romania has become one of the most well-regulated and active gambling markets globally.

Why Did Evoke Choose to Acquire Winner?

Given that the Romanian market offers such a well-developed environment for growth, it is only logical for Evoke to enter this market.

Currently, the Romanian regulatory authority has issued about 475 Class 2 licenses to gambling industry suppliers (game providers, platform providers, affiliates, payment processors, auditors, certification bodies, physical machine suppliers, etc.) since 2016.

One factor contributing to this significant increase goes back to the 2020 European Football Championship.

During the event, participation in online gambling increased by 90%, nearly doubling, which directly accelerated the operators' efforts to obtain licenses from the Romanian government.

Among the 475 Class 2 licenses issued by ONJN, 140 to 150 were granted to software/game providers, with about 25 issued in 2023 alone.

Based on these results, it is evident that the Romanian market will continue to grow rapidly, and the trend is quite stable, as evidenced by these numbers.

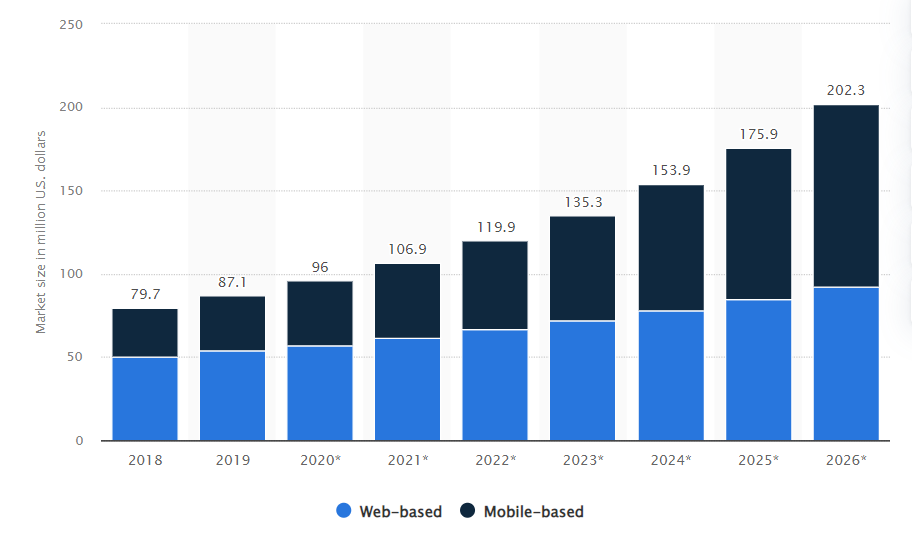

According to Evoke's forecast, the new business formed after the acquisition of Winner is expected to become the fourth largest group in Romania, with a market share of 7%, and according to Statista, the net revenue of the Romanian market is 1.3 billion euros, expected to grow at a compound annual growth rate of 13% from 2023 to 2026.

Thus, Evoke expects the 11 million euros invested this year to return a revenue of 77 million euros, seven times the investment.

Now, let's return to the main topic, the reasons Evoke chose Winner.

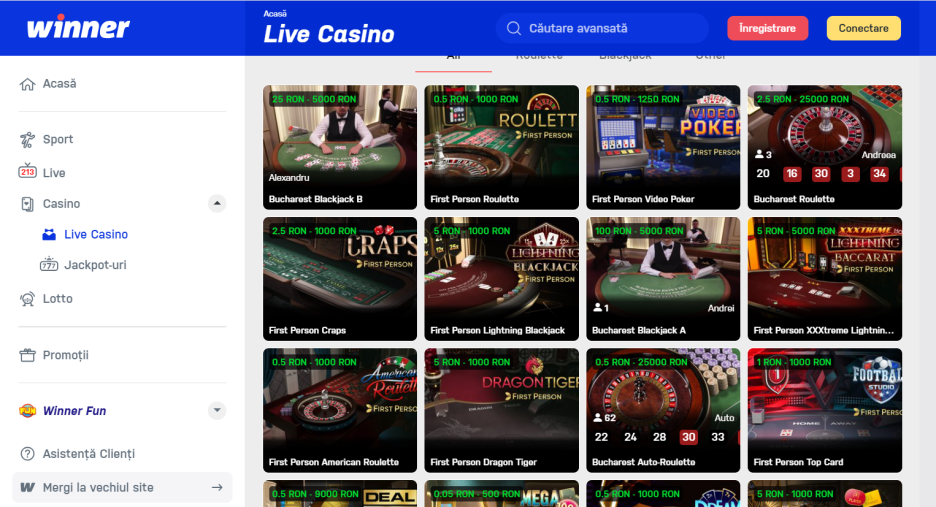

Winner is one of the domains under NGS, and besides Winner, the latter also owns 14 other domains, such as Seven, Lady Casino, and Mr Play, but not all website users are comparable to Winner.

Winner has over 20,000 retail deposit points, making it a highly localized product platform in Romania, thus its online users in Romania are highly concentrated.

Secondly, unlike the UK, Italy, Spain, and Denmark, which already have very mature markets, only a few operators among the 475 Class 2 licenses issued in Romania are operators, with the majority being suppliers (game providers, platform providers, affiliates, payment processors, auditors, certification bodies, physical machine suppliers, etc.).

Therefore, Evoke and NGS are among these two, and Winner already has a strong leadership team. Coupled with Evoke already having about 500 employees in Romania, this acquisition is a strong union of two major operators.

At the same time, coupled with Romania's huge growth potential, it is a very wise move for Evoke to use Winner to seize the gold rush in Romania.

What Makes Winner Attractive to a Large Number of Romanian Users?

Since Evoke's acquisition of Winner was based on the latter's high localization and large player base, what advantages does Winner have that allow it to occupy a portion of the Romanian gambling market share?

It is because the services of the Winner platform deeply resonate with the pain points of Romanian players.

If Brazilian players are mainly composed of "thrill-seekers," then Romania is composed of classic slot enthusiasts and bonus buyers.

According to the player analysis report by Slot trump, the top 20 most popular games in Romania can be divided into two categories: classic-themed games without bonus features (online digital versions of physical slot machines) and games with purchase features.

PASA mentioned earlier, based on Romania's long gambling history, those attracted by classic themes and physical games, when they turn to online games, will still choose the games they are familiar with.

For example, these players particularly like content with classic themes like Lucky 7, and the game mechanics also adopt the same classic features, which are more likely to retain players.

On the other hand, those attracted by bonus purchase features, their bets in some popular games are higher than the average, up to 16.5 times the average bet.

For example, Sweet Bonanza and Gates of Olympus among the top 20 games in Romania reflect this effect, ranking 3rd and 11th in session numbers, but 12th and 16th in total bet amounts, with much higher average bets.

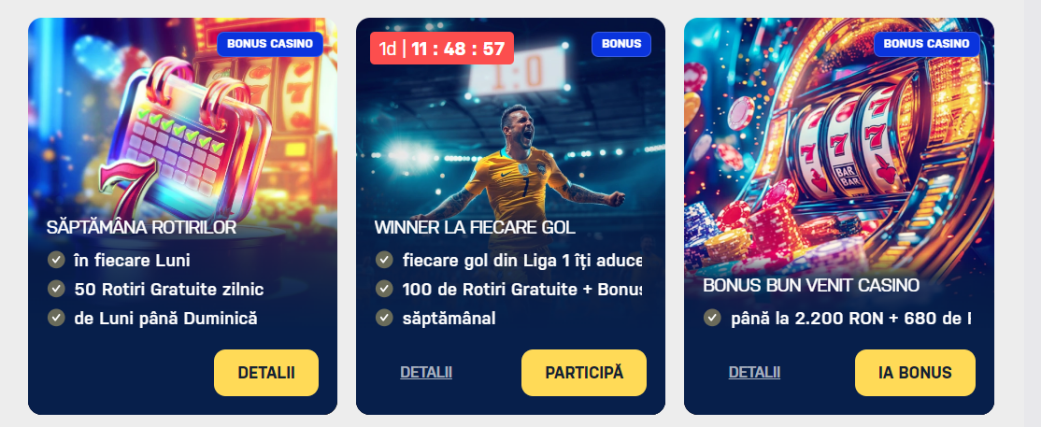

Winner largely combines these two aspects, forming games with top retention features. The purchase feature enhances player engagement by offering more rewarding game modes.

It mimics classic content and can create and add any form of configurable jackpot to any game of their choice. This is the ideal way to increase local player engagement, especially for traditional players who can customize products to mimic local traditional gaming hall jackpots.

Winner recreates the look and feel of physical casino games while being able to offer personal jackpots to classic slot players, providing additional big prizes on top of their favorite games. Which Romanian player wouldn't be attracted?

Many Romanian online casino players are very fond of classic games, but the appeal of these classic games goes far beyond what was seen in the past.

As long as the capabilities of online digital technology are utilized, combining innovative gamification and retention features, and presenting them according to player preferences, then player retention rates and player revenue will undergo a dramatic change.

And this is precisely the most correct strategic decision made by the Winner platform.

In addition, for classic slot enthusiasts, presentation is also crucial, as they are more accustomed to single-type games with limited features.

How to customize content according to player types and match these personalizations to the content they want to see and play. Only in this way can they be gradually guided from their favorite old content to newer content.

At the same time, identifying player preferences for game types and guiding players to find similar content they might like, then ensuring that the content they are likely to play in the most prominent positions is highlighted, and achieving this requires the power of AI—"How to Utilize AI and ML Tools", PASA has also published related articles in the past.

In summary, based on the above platform operations, Winner has attracted a large number of local Romanian players and has been favored by Evoke to merge with it, with both major operators waiting for the rising sun of the Romanian industry.

Conclusion

As the Romanian gambling market continues to mature and grow, it has become one of the most attractive gambling markets in Europe.

By 2026, the market size in Romania will grow to 1.9 billion euros, which will also prove whether Evoke's strategic planning was correct.

It is believed that more and more gambling operators will pay attention to this market, which is old but still has a lot of room for online gambling.

Moreover, player demands will change with the growth of a new generation of "gamblers," and it is not surprising that the future will shift towards more innovative, entertaining, and high-volatility game types.

Therefore, future challenges still exist, and gambling operators will have more opportunities to participate in them. PASA will continue to track Romania, this "old casino," bringing more useful industry experience and dry goods to everyone!

We look forward to discussing more unique insights about IP games with our readers and sincerely invite you to follow the global iGaming leader's overseas information platform PASA for more firsthand industry information.

Welcome to subscribe to the official PASA channel: https://t.me/PASAIGHYJL