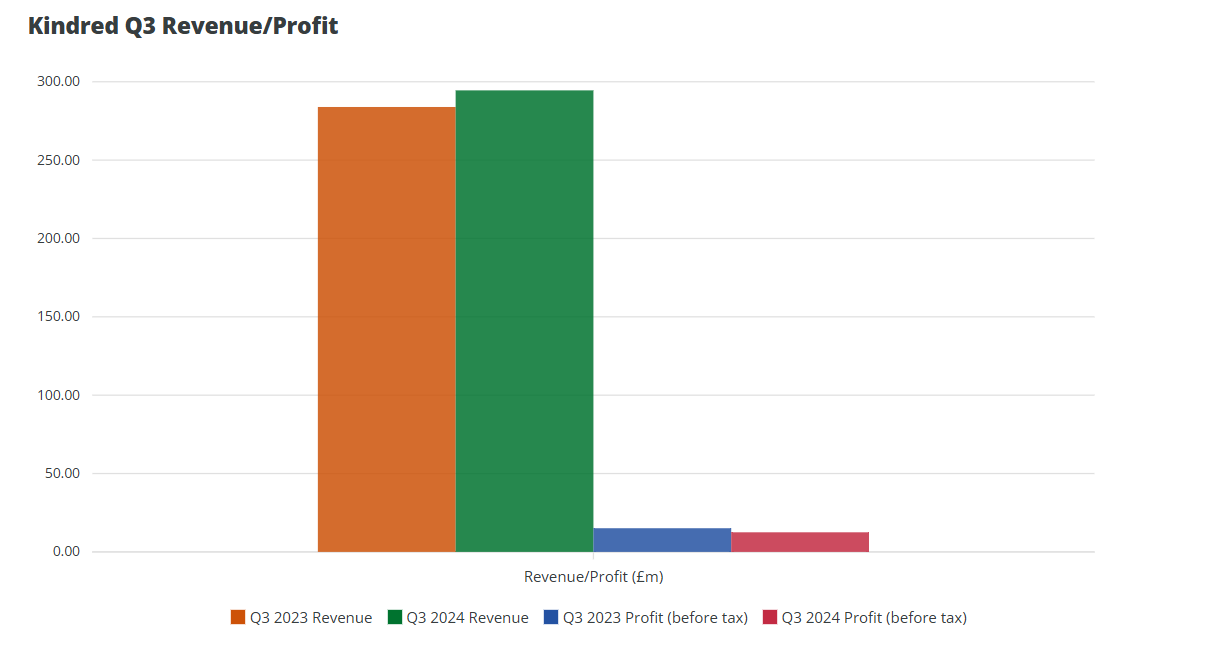

Kindred Group released its financial results for the third quarter of 2024, showing a 4% year-over-year increase in revenue to £295.4 million ($382.2 million), but a 18.8% decrease in gross profit to £12.5 million.

Third Quarter Highlights

The quarterly net profit also decreased by 27% year-over-year to £9.6 million, compared to £12.6 million in the third quarter of 2023. However, Kindred stated that its profit figures were significantly impacted by "substantial" strategic review costs, which were part of its large-scale acquisition by La Française des Jeux (FDJ)—the French operator acquired over 90% of Kindred's shares.

The group's underlying EBITDA saw a significant increase of 49% compared to the third quarter of 2023, reaching £63.4 million in the third quarter of 2024. This significant growth resulted in a 22% underlying EBITDA profit margin—the group's overall EBITDA figure for 2024 has so far reached £196.3 million—33% higher than the same period last year.

In this year's third quarter, Kindred's total bonus income (B2C) also grew by 3%, reaching £283.1 million, with the figure for the year to date reaching £897.9 million. Additionally, in the third quarter of 2024, its number of active customers also experienced a healthy growth of 9%, reaching 1.7 million.

It is worth noting that following the FDJ transaction, as part of the executive restructuring, six members of the Kindred Board resigned, including the chairman.

CEO's Message

Kindred CEO Nils Andén commented on the company's latest financial results, saying: "As we enter the second half of 2024, the positive momentum achieved in the first half continues, with major markets maintaining strong performance."

He continued: "Our strategic focus on growth in locally licensed markets will continue to generate long-term, sustainable revenue.

"Total bonus income in locally licensed markets grew by 4% compared to the same period last year (7% excluding North America). France maintained strong momentum, further boosted by the European Championship and local Olympics. Besides France, we also saw very positive results in the Netherlands, Romania, and Denmark during this period."

Year to Date

As for the full-year data so far, revenue has again increased by 4%, reaching £929.8 million. Additionally, despite the costs accumulated due to the acquisition of FDJ, the company's pre-tax profit so far this year is 31% higher than at the end of the third quarter last year. The full-year net profit to date has also reached £85.5 million, a 25.9% increase year-over-year.

FDJ's Takeover

Following the release of the financial results for the second quarter and first half of 2024 in July, the third quarter was primarily dominated by the FDJ acquisition case—the company moved the offer deadline from the end of September to October 2. Since then, FDJ has completed the tender offer earlier this month—acquiring about 90.66% of Kindred Group's shares. Yesterday, FDJ also announced a public offer to the holders of Kindred Group's Swedish Depository Receipts (SDR), offering 130 Swedish kronor in cash for their SDRs. Following this, the Kindred Board has now applied to delist its SDR from the Nasdaq Stockholm Exchange.

Looking Forward

As part of the third quarter statement, Andén also reflected on the acquisition, stating: "With FDJ's public offering now completed, as we enter the next exciting phase in Kindred's history, I would like to take this opportunity to thank Kindred's past and present investors. Our twenty years as a Nasdaq Stockholm-listed company are about to end.

"Together, we have made significant contributions to building a competitive, digital, and sustainable online gambling industry. Finally, I would like to take this opportunity to thank the global Kindred team for their unwavering resilience and dedication. One chapter ends, another begins."