Q3 2024

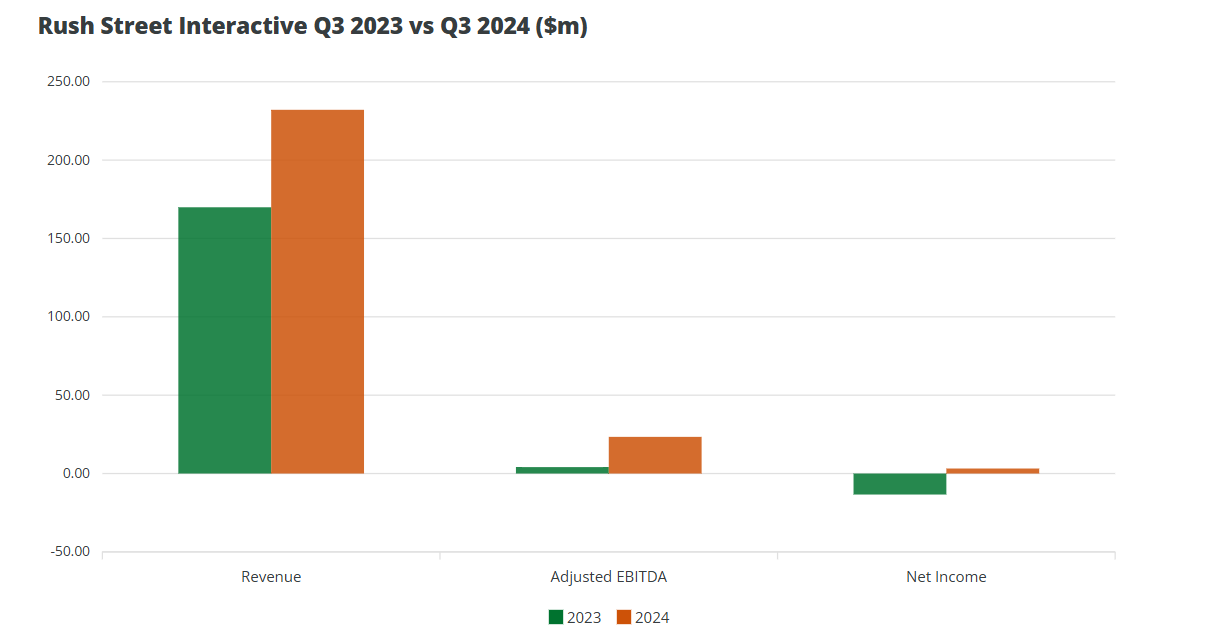

In the third quarter, RSI's revenue increased by 37% year-over-year to $232.1 million, with adjusted EBITDA growing by 470.7% to $23.4 million.

Looking at net income, Q3 2024 saw a net income of $3.2 million, compared to a net loss of $13.4 million in Q3 2023.

These figures were driven by an increase in the number of monthly active users, with a 28% increase in the US and Canada to approximately 168,000 people, and a 122% increase in Latin America to about 329,000 people.

This means that the average revenue per user in the US and Canada rose by 4% to $388, while in Latin America, it actually fell by 9.3% to $39.

The company's board also approved a buyback of up to $50 million of RSI Class A common stock.

Guidance

Based on these results, RSI now expects full-year revenue to be between $900 million and $920 million, with the midpoint increasing by $30 million compared to previous forecasts. If revenue reaches the midpoint of $910 million, it would represent a 32% growth compared to the total revenue of 2023.

For adjusted EBITDA, RSI expects the full-year figure to be between $82 million and $86 million, $16 million higher than the midpoint. The midpoint of $84 million would be 924.4% higher than the adjusted EBITDA of 2023.

RSI's stock price remained relatively stable, with a slight increase during the reporting period.

Worth noting: RSI's adjusted EBITDA rose by 1683.3% in the second quarter.

Comments

RSI CEO Richard Schwartz stated, "We are pleased to report another excellent quarterly performance, setting new quarterly records in both revenue and adjusted EBITDA. Our third-quarter revenue grew by 37% year-over-year, and adjusted EBITDA increased more than fivefold compared to the same period last year. These record-breaking performances highlight the effectiveness of our strategic initiatives and execution capabilities. We continue to focus on innovation to attract and retain high-value participants, which drives significant growth and profitability."

"Our strategy has brought broad growth and success across all our regions and products. We have accelerated player growth for another quarter, gaining more players with higher marketing efficiency while increasing player value. The combination of these factors lays a solid foundation for our continued strong performance."

"In addition to these strong performances, we are excited to announce the authorization to buy back up to $50 million in stock. This move reflects our confidence in the future of the company and our commitment to enhancing shareholder value. Our cash generation capabilities and strong balance sheet provide us with the flexibility to make this strategic investment. We remain on a clear path to becoming a leader in online gaming in the Americas and are committed to delivering outstanding value to our customers and shareholders."