Sportradar announced its financial results for the quarter ending September 30, 2024.

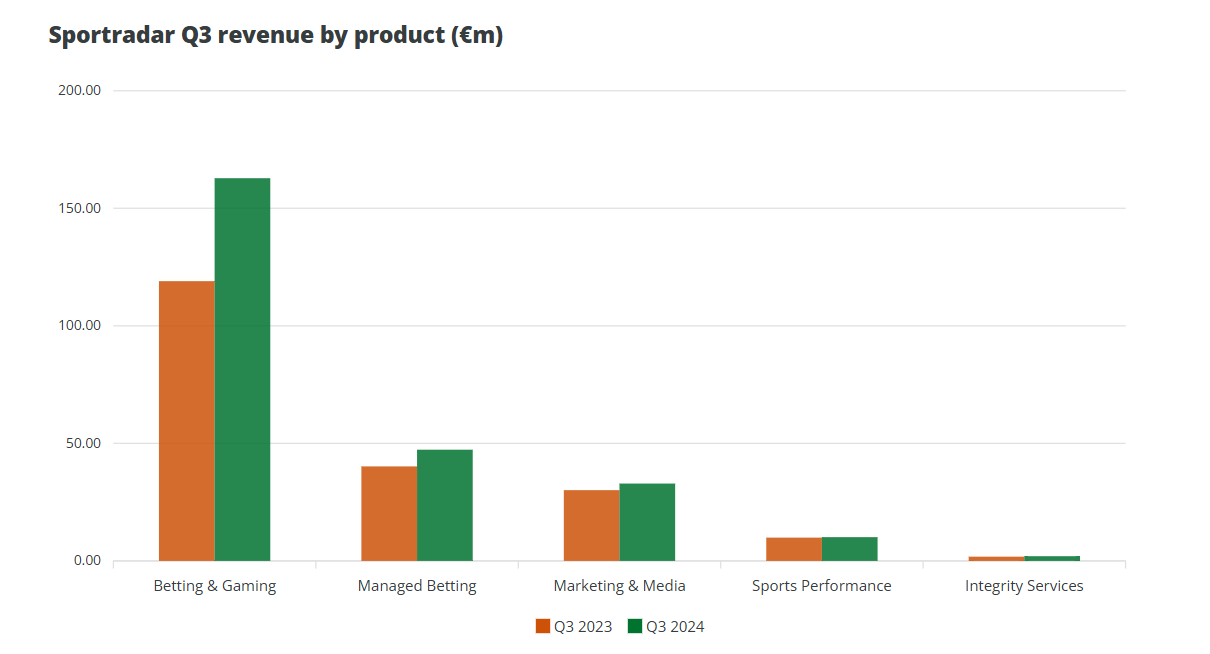

Compared to the same period last year, total revenue for the third quarter increased by 27%, reaching 255 million euros, thanks to a 32% growth in betting technology and solutions, and an 8% increase in sports content, technology, and services.

Revenue in the United States grew by 46% to 51.1 million euros, while revenue from other parts of the world increased by 23% to 204.1 million euros.

This means that the US market accounted for 20% of the company's total revenue in the third quarter.

Profits jumped from 4.1 million euros in the third quarter of 2023 to 37.1 million euros this year, Sportradar explained, attributing this to strong operational performance, a stronger euro against the dollar, and "a one-time loss of 15 million euros last year related to goodwill and intangible asset impairment, which was associated with changes in our business strategy and the impact of equity method investments."

Adjusted EBITDA increased by 30.3% to 65.8 million euros, balancing revenue growth with increases in sports rights costs, investment in product portfolio development, and personnel expenses.

The customer net retention rate also increased sequentially, ultimately reaching 126%.

It is worth noting that this quarter, Sportradar repurchased about 721,000 shares, totaling 8.3 million US dollars. So far this year, the repurchase amount has reached 1.7 million shares, totaling nearly 20 million US dollars.

Sportradar CEO Carsten Koerl stated: "Our competitive advantage in the sports ecosystem, coupled with our growth-oriented strategy, is driving broad exceptional performance. We will continue to deliver more value to our clients and partners, creating shareholder value.

"We are at a critical turning point in driving operational leverage and cash generation, as evidenced by our expanding EBITDA profit margin and strong cash flow last quarter. The substantial cash inflow further strengthens our balance sheet, and we are deploying capital to execute our growth strategy while returning capital to shareholders.

"Furthermore, we continue to show strong momentum in the US, and we expect our growth momentum to further increase with the growth of in-game betting and the start of the NBA and NHL seasons."

Recently, Sportradar announced its expansion into the micro-betting market through a partnership with Tennis Data Innovations.