Recently, Mr. Dennis Ngabirano, the acting CEO of the Uganda National Lottery and Gaming Regulatory Board, pointed out, "From the beginning of 2024 to July, Ugandan gamblers have wagered 3.3 trillion shillings (approximately 8.6 billion USD), an increase of 1.2 trillion shillings (approximately 2.9 billion USD) from the 2.1 trillion shillings (approximately 5.7 billion USD) recorded from July to December 2023."

"In recent years, the returns from the gambling industry have been increasingly high. The revenue ratio has risen from 73% in the 2022/23 fiscal year to the current 90.9%, which can be attributed to the tax amendments in the Income Tax Act," he said.

Currently, Uganda's betting is growing rapidly, with the 2023/24 fiscal year's betting almost double that of the 2022/23 fiscal year.

In March this year, due to increased compliance and licensing in Uganda, the turnover and tax contributions of the betting and gaming industry grew rapidly like a runaway horse, leading to a surge of various betting operators into Uganda, with the number of betting and gaming companies increasing to 45 in just half a year.

Currently, gambling and gaming have become the most popular industries in this region, and official forecasts in Uganda show that national tax revenue and the betting market are expected to expand further and may double (100% growth) by the end of the 2023/24 fiscal year compared to the previous fiscal year.

As online gambling heats up in Uganda, the national government is also beginning to worry about the social impact of the industry, currently facing a dilemma where on one hand they are reluctant to give up such high gambling tax revenues, and on the other hand, they are trying to control the rampant development of the gambling industry through legislative amendments.

Thus, this article by PASA will take you to explore the hot gambling land of Uganda and see if there are also opportunities for us to strike it rich.

I. Current Status of Uganda's Gambling Regulations

The gambling industry in Uganda essentially originated with the implementation of the Lottery and Gaming Act in 2016, which established a legal framework for all forms of gambling in the country, including lotteries, sports betting, casinos, and gaming machines.

The established National Lottery and Gaming Regulatory Board (NLGRB) is responsible for licensing, regulating, and supervising gambling activities in Uganda.

Currently, all gambling operators in Uganda must obtain a license from the NLGRB to operate legally.

Although the 2016 Act did not explicitly regulate online gambling, operators providing online services must still obtain a license from the NLGRB. The commission has been working to update regulations to better manage the growing online betting market.

As the Ugandan government's concerns about its social impact deepen, the government is currently discussing new control measures for the industry, aimed at limiting the activities of foreign betting companies.

Uganda's Deputy Minister of Finance, David Bahati, said at an event, "Ugandan youth are caught in a vicious cycle of gambling, betting their meager incomes on the chance of winning big."

"In the coming period, we will no longer issue licenses to any new companies. Licenses of registered companies will not be renewed after they expire."

Of course, Uganda has not yet changed the existing system of the Lottery and Gaming Act.

But as one of the restrictions, the Ugandan government has raised the gambling tax rate from 20% to 30%, and winning bets are subject to a 15% withholding tax, in addition to a 20% tax on the initiator's winning lottery tickets. This amendment took effect on July 1, 2023.

Although this increase was immediately resisted by the Ugandan public, it did not change the Ugandan people's addiction to gambling, and Uganda's betting stakes continue to grow against the trend.

II. The Situation of Ugandan Players: Young Ugandans Who Treat Gambling as a Profession

Initially, Ugandan President Museveni was very encouraging of the emerging gambling industry, encouraging some new gambling companies, believing they generated substantial tax revenue and invested in local football leagues.

But now he is beginning to express his reservations. He said, "What they do is accumulate money from Ugandans and then transport it out of the country."

Meanwhile, as young people are the group that gambles the most, the problem of gambling addiction is becoming increasingly severe locally.

A recent study in Kampala, the capital of Uganda, found that many people involved in gambling do so to make a living, rather than for leisure and entertainment.

The study by the Economic Policy Research Centre (EPRC) shows that about 45% of Ugandan males aged 18 to 30 participate in some form of gambling, while the proportion among all adults is about one quarter.

The study also found that "those who gamble to escape poverty are more likely to become addicted than those who gamble for recreation."

According to the EPRC, sports betting is overwhelmingly a male activity, with less than 4% of female respondents indicating they had participated in sports betting.

The report also estimates that gamblers spend about 12% of their income on gambling activities each month.

Researchers say, "The desire to make quick money through gambling drives young people into gambling, and some even see gambling as a means of making a living, as an alternative to engaging in jobs that require a lot of time, mental, and physical effort."

So how large is this group? PASA, in conjunction with Uganda's population and internet user data, performs a reverse calculation.

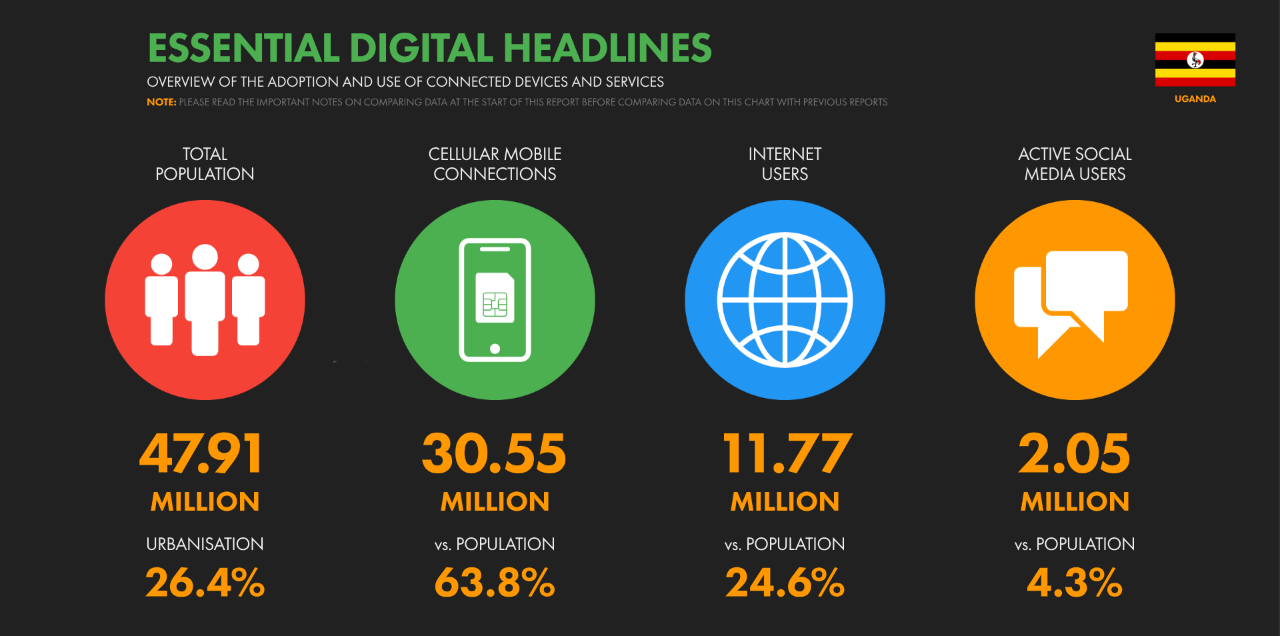

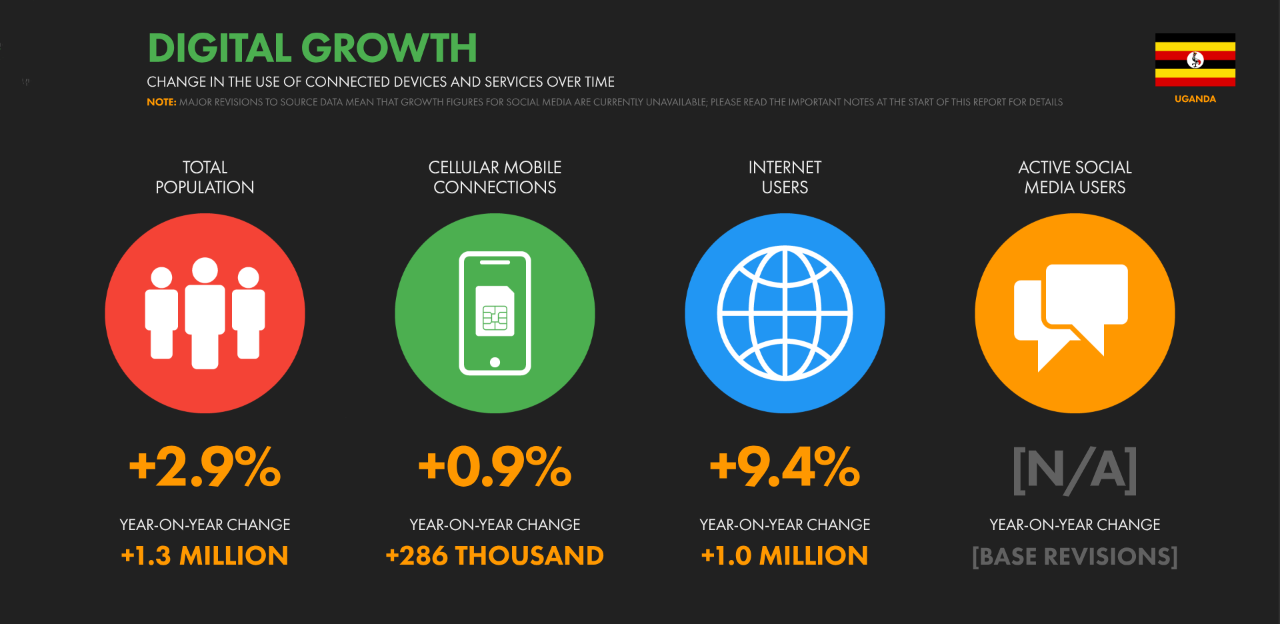

All data is sourced from DATAREPORTAL, with Uganda's current total population approximately 48 million, still growing at an annual rate of 3%. The gender ratio is 50.5% male and 49.5% female.

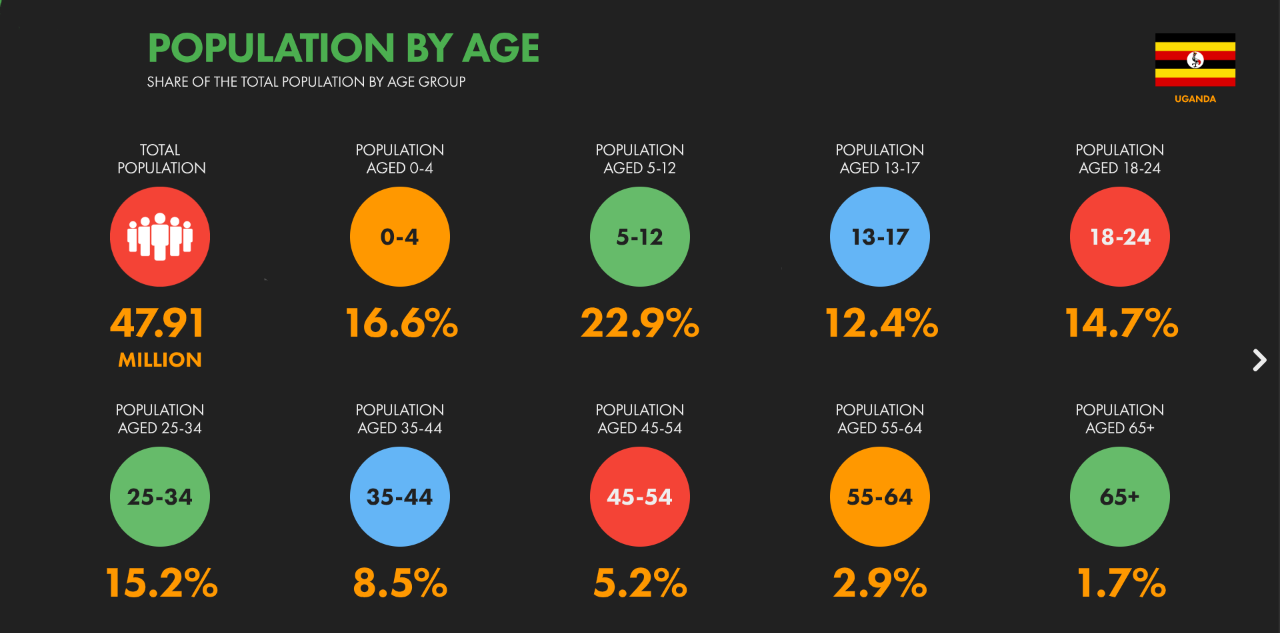

The age ratio in Uganda is extremely young, with over 90% of the population under 45 years old.

We first calculate using the official Ugandan age range of 18-30 years old, although certainly, Ugandan gamblers are not limited to this age range, which we will supplement later.

According to the age ratio, there are 30% of the population aged 18-34, which is 14.4 million people, corresponding to 50.5% male, which is about 8 million males.

According to EPRC data, 45% of these people have participated in gambling, which is at least 3.6 million gambling players.

This is the minimum, as PASA has only counted the male population aged 18-34.

The proportion also includes 4% of the female population, calculated to be about 300,000 women.

For other age groups without data, PASA uses the number of internet users in Uganda for a rough estimate.

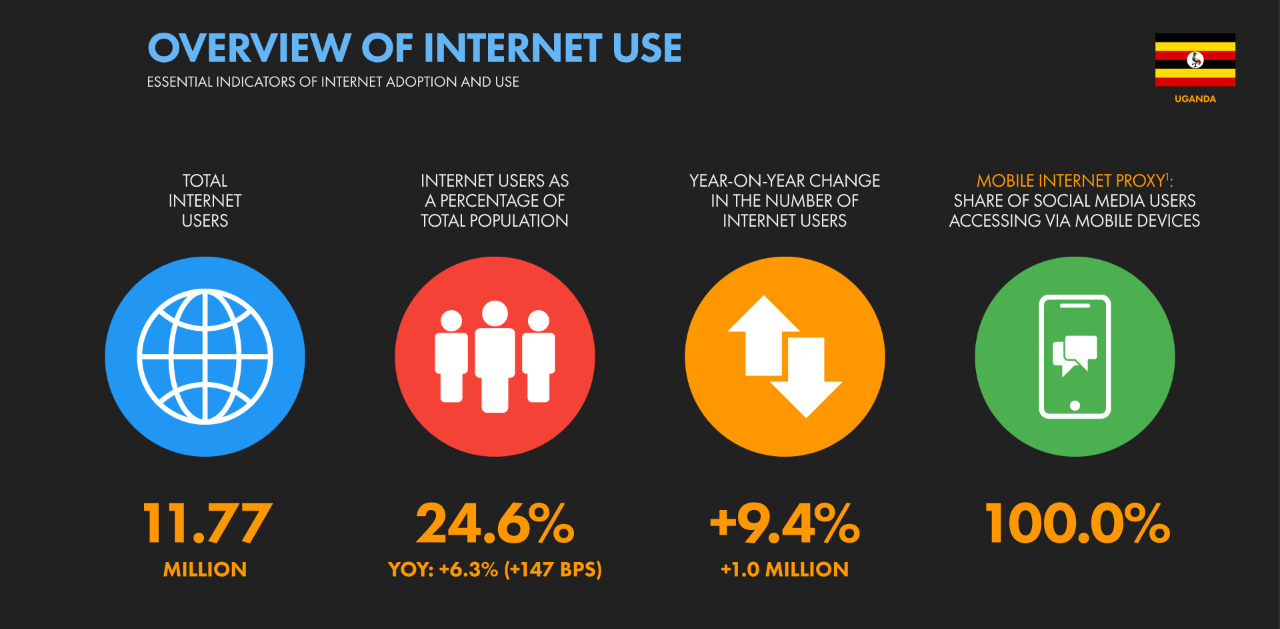

According to data, there are currently 11.8 million internet users in Uganda, growing at a rate of 10% per year.

Based on data from Nigeria, about 71% of internet users play online casino games, and the participation rate of young people in gambling in Africa also reaches 70%, so this data is worth using as a comparative data point.

Assuming this data is similar to Uganda, then we need to calculate the proportion of young internet users in Uganda to reach the final data.

We use the population aged 13-54 as the main gambling population, which includes 55% of the Ugandan population, which is more than 24 million people, exceeding the network population of 11.8 million, and since the network population is also concentrated among this age group.

Therefore, we directly use the network population number of 11.8 million multiplied by the participation rate of young people in gambling and the rate of internet users playing gambling games at 70%, which gives us 5.9 million gambling population.

That is to say, outside the age range of 18-34, Uganda still has at least 2 million gamblers not accounted for.

And the total number of gambling players in Uganda is close to 6 million, which is the biggest reason why Uganda's gambling can grow wildly.

As Uganda's population and internet penetration continue to rise, the number of players will only increase.

III. How to Open an Online Casino in Uganda

Despite earlier mentions that the Ugandan government is considering not renewing gambling operating licenses, there are currently no clear indications of which gambling companies operating in Uganda will be affected and when.

Patrick Lubaale, a sports betting official at Galz Betting, pointed out that tens of thousands of people in Uganda rely on the gambling industry for employment.

He said that gambling companies have been advocating responsible gambling.

Lubaale stated, "If the president (Museveni) complains about the negative impact of gambling activities on young people, then we have already been promoting responsible gambling behavior to the public, and people are aware of this — but this should not be a reason to ban gambling activities."

Uganda's Minister of Finance, Matia Kasaija, also called for a moderate approach to the gambling industry.

Currently, the application for an online casino license in Uganda is not strict, as long as it meets the regulatory framework supervised by the Lottery and Gaming Regulatory Board (LGRB).

Then some requirements for the license application proposed to the committee include:

· Company registration certificate

· Investment certificate for foreign applicants

· Proof of actual location

· Most recent annual return of a company with share capital

· Bank account details

· Latest audited books

· License fee

· Corporate Social Responsibility (CSR)

· Security guarantees

· Business plan

· Rules and instructions for games and equipment

· Detailed information on company shareholders, directors, and key employees

· License fee for new applicants

· Company articles of association

The entire licensing process is very streamlined, and you can visit the Ugandan LGRB website to learn more about how to apply for a gambling license to successfully operate gambling in Uganda. Or subscribe to the official PASA channel for relevant information: https://t.me/pasaqqzxzz

License approval does not mean everything is over, as the LGRB will conduct regular inspections to determine whether the institution complies with Uganda's rules and regulations.

Currently, the LGRB conducts regular spot checks throughout Uganda to detect illegal gambling activities.

But the Ugandan market that has been cultivated is unlikely to be contained anymore.

Going forward, even if the LGRB tightens the distribution of licenses in Uganda, I believe more gambling operators will provide services to Ugandan players through offshore websites.

After all, Uganda's population and internet penetration are still rising, and more and more gambling players will appear in Uganda in the future. The widespread adoption of smartphones and the internet will be the key factors for the continued popularity of online gambling in Uganda.

As Western influence continues, the people of Uganda will have more opportunities to access the internet.

And speaking of the future of online gambling in Uganda, the introduction of mobile payments will greatly change the online gambling industry in Uganda. With the increase in payment options such as e-wallets, the banking options for gambling businesses will be significantly improved.

As other African countries embrace emerging technologies, Uganda is doing the same. These technologies are some of the deciding factors for the future success of online gambling in Uganda, and clearly, the government will also be willing to join this trend.

Conclusion

In summary, Uganda can be said to be one of the few player markets in the world. With a relatively low internet penetration rate, it has already nurtured so many online casino players. For gambling operators, this is an endless source of customers.

Currently, Uganda is in an open state for online casinos, and those who want to enter this market can do so through compliant channels.

But the policy is currently in a turbulent period, and like other countries around the world, Uganda's gambling industry is also facing problems. The increasing popularity of online gambling also brings many concerns.

As social problems caused by gambling increase, officials are likely to tighten the distribution of licenses. At that time, we can only seek Ugandan players through offshore websites.

We look forward to discussing more unique insights about the Ugandan gambling market with our readers and invite you to follow the global iGaming leader out-of-country information platform PASA for more industry information on getting rich.

Welcome to subscribe to the official PASA channel: https://t.me/pasaqqzxzz