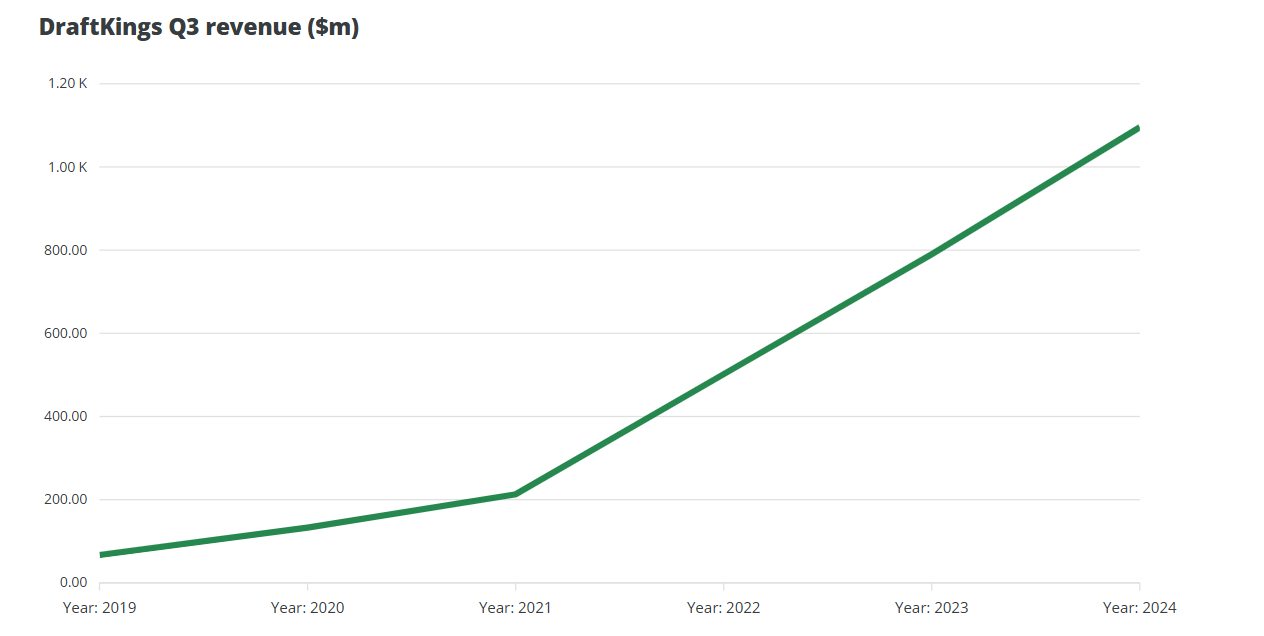

DraftKings released its financial results for the third quarter of 2024. Total revenue reached $1.1 billion, a 39% increase year-over-year, while adjusted EBITDA was a negative $58.5 million—a significant decrease compared to the negative $153.4 million reported in the same period last year. However, net losses slightly increased, from $286.6 million in the third quarter of 2023 to $298.6 million in the third quarter of 2024.

Losses Due to Operational Disruptions

Although revenue increased by over $300 million year-over-year, several factors contributed to the increase in DraftKings' quarterly losses. First, the sports betting company's cost of revenue increased by nearly $200 million, totaling $742.4 million. Overall, expenses were on the rise, with general and administrative expenses up 59.2% to $208.1 million, and product and technology costs up 16.4% to $103.6 million. In contrast, sales and marketing costs were relatively stagnant, increasing by 8.5% to $339.9 million.

Player Data

Looking at DraftKings' player data, monthly unique players (MUP) grew by 55%, averaging 3.6 million players—roughly equivalent to the total population of Connecticut according to the 2023 census. However, it's noteworthy that DraftKings' earlier acquisition of Jackpocket played a significant role in this growth, as MUP growth was only 27% excluding Jackpocket.

Despite the increase in player numbers, the average revenue per MUP decreased by 10% to $103. DraftKings noted that Jackpocket customers, a digital lottery app, spend less compared to traditional DraftKings players; data excluding Jackpocket showed an 8% year-over-year increase in average revenue per MUP.

This Quarter

As of September 30, 2024, DraftKings was operational in 25 states and Washington D.C., covering 49% of the U.S. population. Its iGaming products were launched in five states (with seven states offering legal iGaming). These products were also launched in Ontario.

DraftKings also stated that following the legalization of sports betting in Missouri, the company plans to enter the sports betting market in that state. The company also plans to launch this service in Puerto Rico upon regulatory approval.

2024 Fiscal Year Guidance

DraftKings has adjusted its revenue forecast for the 2024 fiscal year to $4.85 billion - $4.95 billion, lower than the previous $5.05 billion - $5.25 billion, and has adjusted its 2024 fiscal year adjusted EBITDA forecast to $240 million - $280 million, lower than the previous $340 million - $420 million.

DraftKings noted that the impact of "customer-friendly sports event outcomes" at the beginning of the fourth quarter (i.e., the NFL season) was the reason for this decision. This makes sense, as not only has the amount wagered this season increased (according to the American Gaming Association, $35 billion this season compared to $26.7 billion last season), but also, according to DraftKings, the number of winning customers has increased.

Looking at DraftKings' stock price reaction to the lowered guidance, as of the time of writing, the pre-market stock price was $36.90, down over $3 from the trading close price of $38.98 on November 7, a decrease of 5.3%. Shareholders seem to have reacted accordingly to the performance, as the adjusted guidance reflects an average revenue decline of 4.9% for 2024.

2025 Fiscal Year Guidance

Looking ahead to the new year, DraftKings has set its 2025 fiscal year revenue forecast at $6.2 billion to $6.6 billion, an average growth of 30.6% compared to the 2024 forecast, slightly lower than the revenue growth rate reported this quarter.

Comments

Regarding performance, Jason Robins, CEO and co-founder of DraftKings, stated: "With the return of the NFL and college football, DraftKings had a strong performance in the third quarter. As major sports events converge on the calendar, we have the ability to continue this momentum while enhancing our top-ranked sports betting app with additional live betting features and exciting new NBA markets. Our focus remains on driving sustainable revenue growth and profitability for 2025 and beyond."

Chief Financial Officer Alan Ellingson added: "In the third quarter, we performed well in terms of core value drivers, effectively attracting customers, reinvesting in promotions, and improving structural sports betting hold rates. Our first published revenue forecast for the 2025 fiscal year represents a year-over-year increase of 31%, and we expect to achieve an adjusted EBITDA of $900 million to $1 billion in 2025."

Comparison

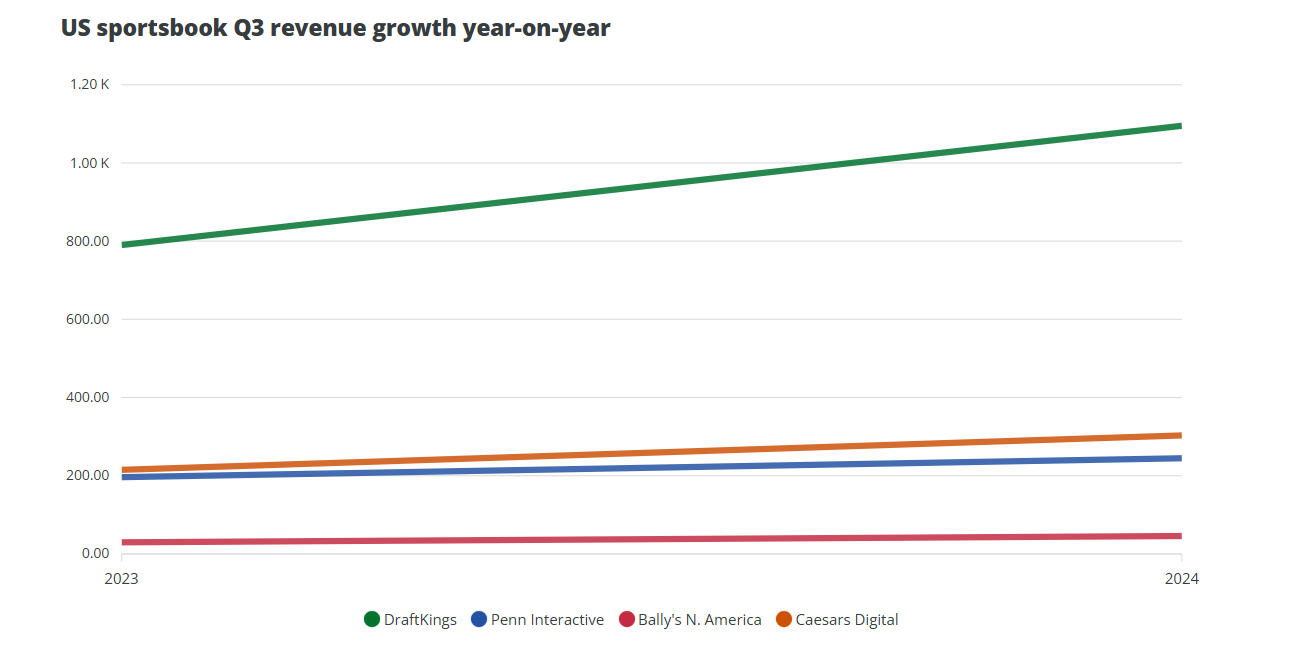

While major competitor FanDuel has not yet published its third-quarter results as of the time of writing, looking at competitors Penn Interactive (ESPN Bet), Bally's North America Interactive, and Caesars Digital, DraftKings' revenue increase but adjusted EBITDA decrease seems to align with industry trends.

Penn Interactive's revenue grew 24.6% year-over-year to $244.6 million, while its adjusted EBITDAR decreased by over $40 million, from -$50.2 million to -$90.9 million.

Bally's North America Interactive division saw a 54.5% increase in revenue to $45.7 million. Nevertheless, its adjusted EBITDAR remained at a loss, totaling -$11 million.

The exception is Caesars Digital, which not only reported positive adjusted EBITDA but also saw an increase in adjusted EBITDA. Revenue grew 40.9%, slightly higher than DraftKings, and adjusted EBITDA reached $52 million, a significant increase compared to the $2 million adjusted EBITDA reported in the same period last year.