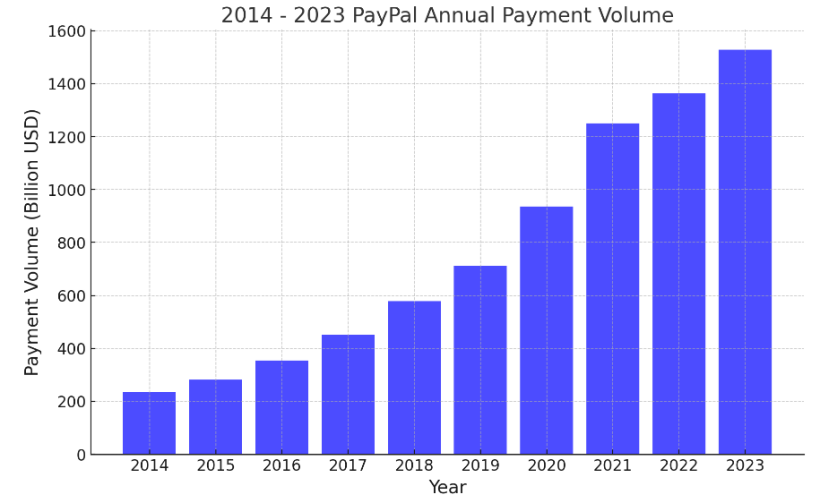

PayPal is the undisputed leader in the global online payment industry, with 435 million users worldwide and annual transactions exceeding 1.5 trillion US dollars.

This digital payment giant has completely transformed the way people and businesses manage their finances, providing a seamless, secure, and trustworthy platform for millions of transactions daily.

Whether it's making small purchases from local stores or making large-scale cross-border payments, PayPal's coverage and reliability make it the preferred choice for consumers and merchants alike.

The reason PayPal maintains an unparalleled leadership position in the fintech sector is its continuous ability to maintain user trust and satisfaction, which is crucial for many online gambling operators.

Typically, when players encounter a new online casino platform, they approach with caution, unsure of the platform's reliability.

If the platform can incorporate elements that inspire their trust, the likelihood of users staying and betting on the platform significantly increases.

At this point, PayPal, as an authoritative payment intermediary, is exactly what can enhance user trust in the platform.

Moreover, as the world continues to shift towards online digital payments, traditional debit and credit card payments will gradually be phased out.

Therefore, a gambling site that accepts PayPal deposits and withdrawals will open unexpected doors to wealth.

Unlocking 435 Million Potential Customers

PayPal is the preferred payment method for many gambling players, especially sports betting enthusiasts, because it is fast, reliable, convenient, and safe. However, it is not widely accepted by online gambling operators.

In fact, as a payment merchant, PayPal can also bring traffic to gambling platforms just like many well-known game providers.

PayPal's authority stems from 25 years of accumulation, starting in 1998 under the name Cofinity, this payment giant has grown into a powerful bilateral network, providing payment services to individuals and companies in over 200 countries and regions worldwide.

There are 36 million merchants worldwide using PayPal, and in the fourth quarter of 2023 alone, PayPal processed 6.8 billion commercial payment transactions.

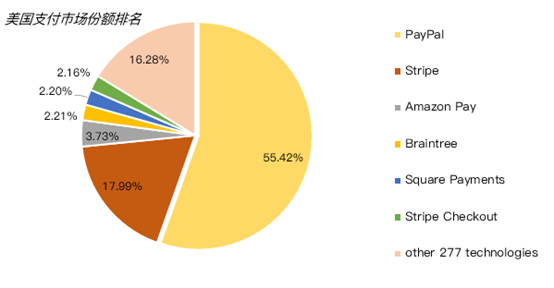

PayPal holds 45% of the global online payment market share, nearly half.

PayPal has established a good brand reputation by providing users with round-the-clock fraud monitoring, financial encryption, and purchase protection.

According to a joint research report by PYMNTS and FIS, 60% of consumers trust PayPal more than banks to store payment credentials.

This is enough to demonstrate PayPal's authoritative position in the minds of consumers.

Why does PayPal bring traffic to gambling platforms in reverse? Do consumers really pay for the platform because of this trust?

The answer is yes, according to an internal corporate data from PayPal, businesses using PayPal have a 25% higher conversion rate than those that do not. Large businesses using PayPal have a 33% higher checkout completion rate than traditional payment methods.

Moreover, PayPal also encourages users to spend more due to trust, with consumers paying through PayPal spending 12% more than those using other payment methods.

PayPal acts like a key, allowing gambling platforms to unlock a broader user base while gaining additional user bets.

Additionally, PayPal has also expanded online payment solutions through digital products such as Venmo, Xoom, Paidy, Honey, and Zettle, aimed at emerging trends in peer-to-peer payments, mobile payments, and more.

The socially-oriented payment product Venmo is very popular among young, mobile, and social crowds, providing PayPal's partners with access to a younger market.

We often find that gambling companies that stand out in the market tend to list PayPal as an acceptable payment method.

PayPal can essentially replace traditional debit cards, credit cards, direct bank transfers, prepaid cards, or e-wallets like Skrill or Neteller.

Using PayPal allows for instant deposits without the need to enter card details on a web form.

Beyond payment trust, many bettors also value the speed and convenience of PayPal deposits. When it comes to withdrawals, PayPal is also one of the fastest available methods.

Below, PASA lists several gambling sites that use PayPal:

BetMGM is one of the best PayPal gambling sites globally. BetMGM sports betting is co-owned by MGM Resorts International and Entain.

DraftKings is known for its generous bonuses, exciting sports betting matches, and smooth mobile application. PayPal is also one of the many convenient deposit methods offered by DraftKings sports betting.

Caesars Entertainment, after acquiring William Hill for $4 billion in 2021, operates one of the largest online sports betting sites in the US. All customers have migrated to the Caesars Entertainment sports betting app, which also accepts PayPal bets and offers huge bonuses.

FanDuel Sportsbook is owned by Flutter Entertainment, the world's largest online gambling company, and the site also accepts PayPal bets.

In addition to these, there are many more gambling sites that accept PayPal payments, but it is not difficult to conclude that gambling sites that support PayPal payments are basically well-known authoritative sites in the industry, and it can also be said that authoritative gambling sites generally support PayPal payments.

Both can be said to complement each other, making PayPal a safe, reliable, and convenient choice for anyone depositing and withdrawing on sports betting sites.

PayPal's excellent security record and loyal customer base, which are precisely the gambling users who visit our gambling site, can undoubtedly leave a loyal user on the platform.

Follow PayPal's Steps to Unlock New Markets

With this perspective, as gambling operators, can we also think in reverse—if we can leverage the dividends of PayPal's development, can we open up a larger user market?

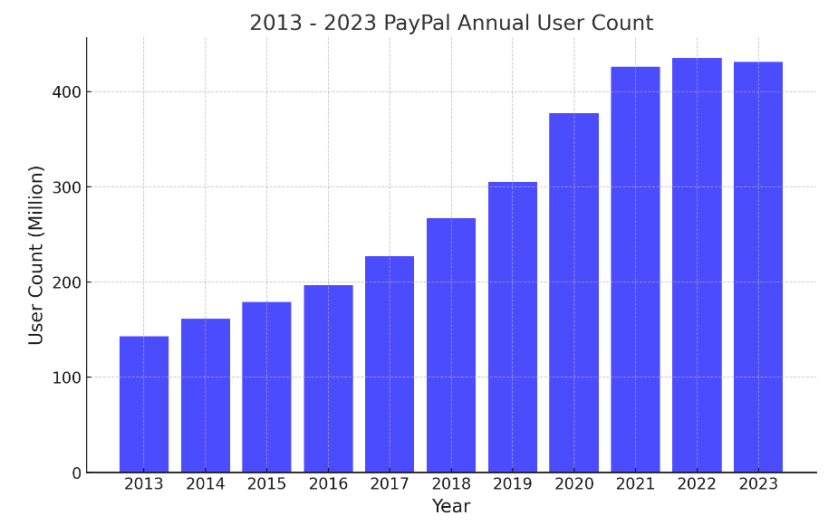

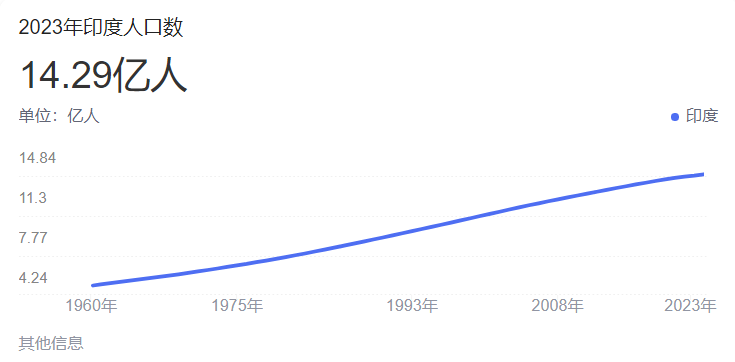

PayPal has over 435 million active users worldwide, with an average annual growth rate of about 13%.

Currently, PayPal's largest user markets are in the US and Europe, with the US alone having over 30 million users, accounting for more than 55% of the market share.

However, for a new gambling operator, entering the relatively competitive gambling markets of the US and Europe is quite challenging.

On the other hand, PayPal's Asian market is also growing, especially in India. In 2023, about 72,000 Indian websites integrated PayPal, accounting for about 29% of websites that have integrated payment solutions.

Compared to the 1.06 million integrated websites in the US, the growth potential is self-evident.

India's population and the penetration rate of the internet are currently experiencing explosive growth, with the population number already reaching the highest in the world.

Although PayPal's mobile payment service was only launched at the end of 2017, it has rapidly expanded and is now widely adopted among Indian netizens and high-income consumers.

With the push of the digital era, Indians are gradually accepting mobile payments. According to a recent internet survey, 56% of adult internet users in India use their mobile phones to access bank accounts and/or shop at retail stores, with digital payment apps leading this trend.

What is particularly surprising is the popularity of PayPal in India. Among them, 39% of adult surveyed netizens stated that they use PayPal's payment app.

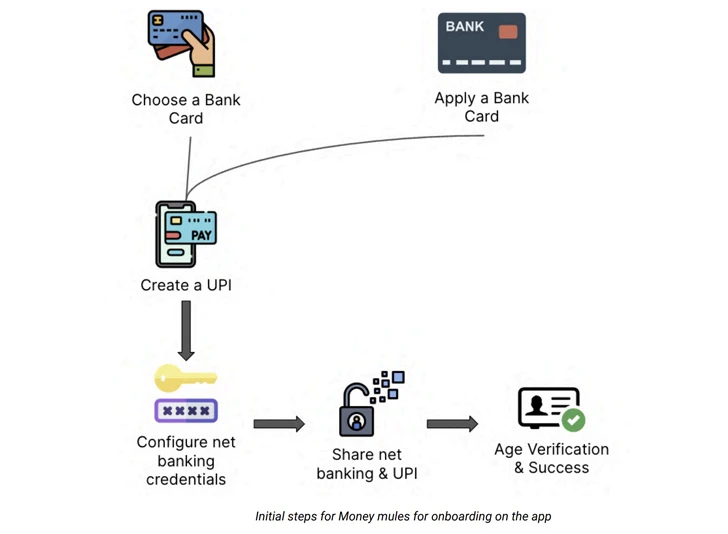

The uniqueness of online payments in India lies in the fact that non-banking institutions need to access real-time payment infrastructure established by banks, UPI, for peer-to-peer payments.

The Unified Payment Interface (UPI) is an instant payment system developed by the National Payments Corporation of India, which integrates previously required transfer information such as bank account numbers into a single string ID, eliminating the need to enter cumbersome details.

This UPI ID can be a person's name, ID number, mobile number, email, or any string. This makes transfers between individuals no longer require entering bank account details, just the ID.

In simple terms, it establishes a virtual ID account, allowing banks and mobile payment merchants to make instant transfers between two accounts on the mobile platform.

Since its launch in 2016, UPI has been continuously expanding its popularity in India.

Therefore, account-to-account transactions dominate mobile payments in India, bypassing card network tracks and eliminating the hassle of recharging e-wallets. UPI transactions are growing faster than card payments.

UPI also makes non-banking institutions the main drivers of mobile payments, as the country's credit card acceptance infrastructure is not widespread. The UPI system makes banks an important part of the digital payment mechanism.

In plain terms, despite the imperfect network infrastructure in India, online payments cannot completely bypass banks, but PayPal can also adapt to the Indian market, focusing on credit card payments, helping consumers bind debit and/or credit cards for faster payments during online shopping.

PayPal recently launched a "one-click" payment feature in India, also reducing the identity verification steps during the checkout process.

Demographic data shows that PayPal stands out among the top five mobile payment apps in India. PayPal's 18-29 age group has the lowest proportion, while users over 40 have the highest proportion.

PayPal has the wealthiest customer base in India, as its income distribution is skewed towards the high end. Although the peak trend of PayPal users matches the peak trend of all respondents, it has another peak between 700,000 and 1,000,000 rupees, which the other four brands did not observe.

Android is the favorite smartphone operating system of mobile payment users in India, with most users preferring to keep their phones for one to two years.

In most platforms, the social media usage of the top five mobile payment systems entering the Indian market is quite consistent, while PayPal has the highest participation in purchasing entertainment and paid mobile apps.

By 2024, more than 300 million active users are expected to use India's payment UPI, and the scale of online payments in India is expected to exceed 1 trillion US dollars by 2024.

This is the user base laid down by the Indian government for payment merchants like PayPal, and it is also an important market potential that gambling operators need to see.

Conclusion

A reliable online gambling site inevitably has an impeccable reputation and advanced customer service, offering customers a wide range of payment method choices at the payment end.

If you want the platform to quickly gain user trust, then PayPal is undoubtedly the best choice at the payment end.

PayPal has accumulated authority over many years, while providing a high level of security, meaning customers can rest assured that their personal and financial information is safe.

PayPal's deposits and withdrawals are also instant, so customers can start playing their favorite games immediately after depositing. Although withdrawals usually take 1-2 business days to process, this is much faster than most other withdrawal methods.

For online gambling platforms, integrating PayPal is beneficial without harm. Considering that PayPal's user base in developed markets is nearing saturation, if the platform can catch the fast train of PayPal's growth in developing markets like India, it will be much easier for the platform to capture market share.

We look forward to discussing more unique insights on how gambling platforms can choose payment merchants with our readers and invite you to follow the global iGaming leader outbound information platform PASA for more firsthand industry information.

Welcome to subscribe to the official PASA channel: https://t.me/PASAIGHYJL