Performance in 2023

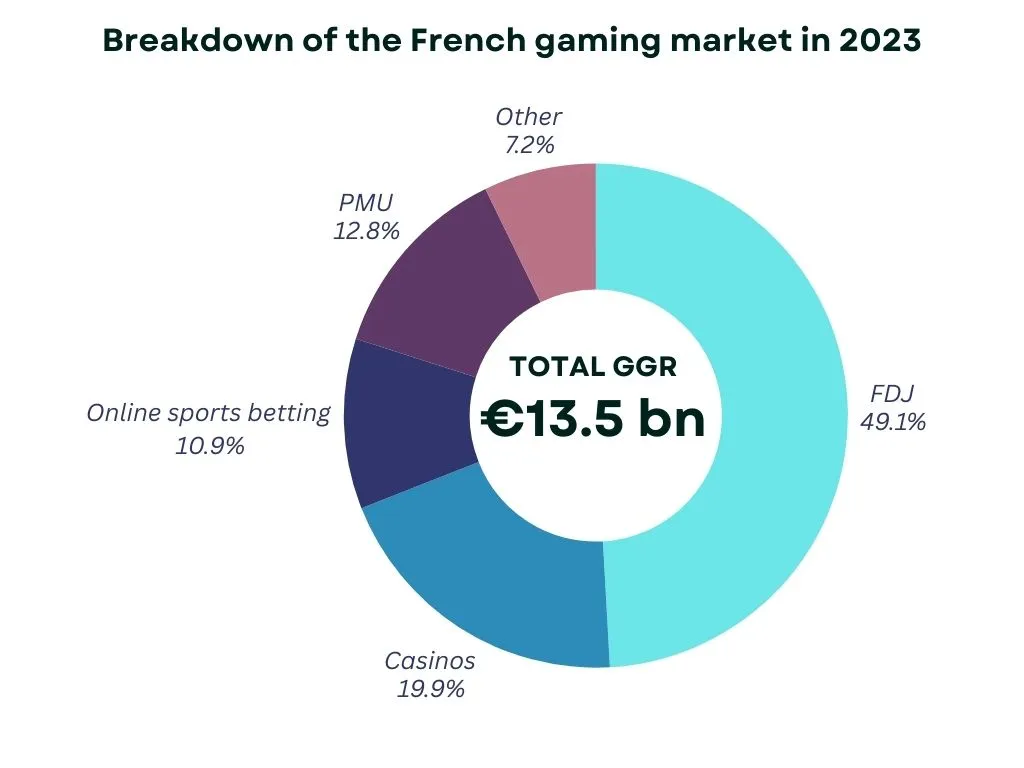

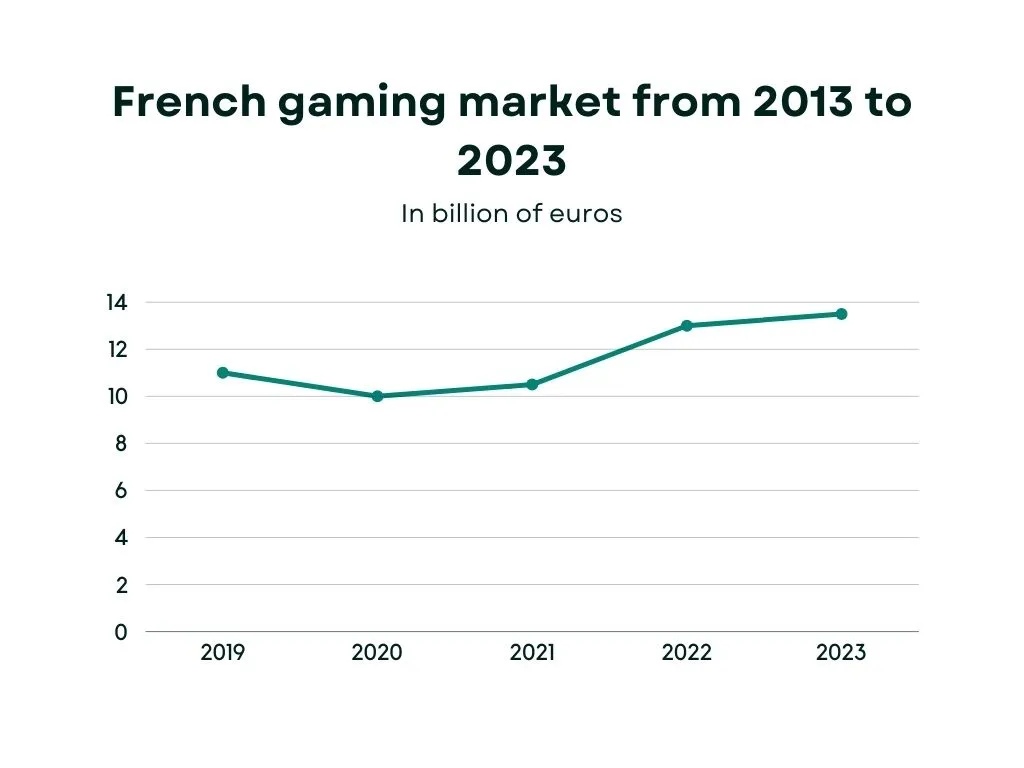

In 2023, the French gambling market reached a historic high, with a total Gross Gaming Revenue (GGR) of 13.4 billion euros, up 4% from 2022. This means an increase of 450 million euros in GGR across all types of games, from online poker to lotteries and sports betting. Notably, 2023 was the first year since 2019 that all sectors of the French gambling industry saw growth.

Casino Growth

Casino Growth

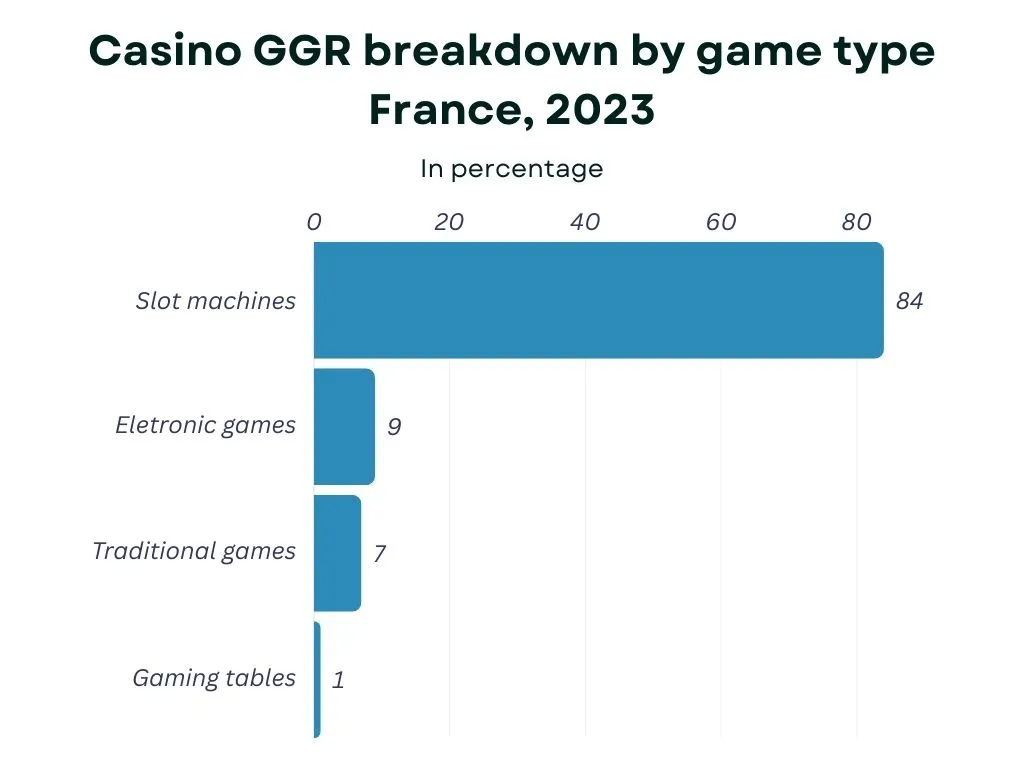

Casinos remain the most important driving force for growth in the French gambling industry. The revenue of France's 203 casinos and 7 gambling clubs climbed to 2.81 billion euros, an increase of 8.4% from the previous year.

In casinos, slot machines were particularly successful, contributing 157 million euros to the overall growth. Table games, including poker, also saw a 11.5% increase in Gross Gaming Revenue.

Online Poker

Online Poker

The online sector returned to pre-2022 growth levels, with Gross Gaming Revenue (GGR) increasing by 7.2% to 2.3 billion euros. The number of individual players reached 3.6 million, with most sub-sectors, except sports betting, experiencing growth.

The online poker sub-sector performed particularly well, with Gross Gaming Revenue increasing by 14% to 504 million euros. This growth was due to more intensive gaming practices among existing players, as the actual number of online poker players actually decreased by 5.3%.

Sports Betting

Online sports betting also achieved a solid growth of 6.4%, reaching 1.477 billion euros. However, the number of active bettors significantly decreased by 3.9%, marking the first decline since 2019. This decrease can largely be attributed to the absence of major international sports events in 2023, such as the FIFA World Cup or the Olympics.

Pool betting on horse racing had a mixed year. While online horse race betting Gross Gaming Revenue grew by 2%, reflecting bettors' continued migration to online platforms, retail betting (through PMU's 14,000 outlets) saw a smaller growth of 0.9%. The total Gross Gaming Revenue for horse race betting in 2023 was 1.74 billion euros.

Lottery

The lottery remains the most popular form of gambling in France, but only saw a slight increase in 2023. Lottery games (draws and scratch cards) generated a Gross Gaming Revenue of 5.56 billion euros, just a 0.2% increase from the previous year. Despite the small growth, the lottery still accounted for 41.7% of France's total gambling revenue, making it the largest part of the gambling market.

Regulatory Framework and Market Structure

The French gambling market is strictly regulated, with the industry managed by both state monopolies and licensed operators. The French National Gambling Authority (ANJ) is responsible for overseeing gambling activities and ensuring compliance with strict regulations aimed at protecting consumers and limiting the risks of gambling addiction.

Lottery and pool betting on horse racing are exclusively operated by the state-owned Française des Jeux (FDJ) and Pari Mutuel Urbain (PMU), respectively. In contrast, the online market for sports betting, horse racing, and poker is highly competitive, with 16 licensed operators offering sports betting and 7 offering poker by 2023. The online sector currently accounts for 17.5% of the overall market and continues to grow steadily, especially as more players opt for the convenience of betting from home.

Decrease in Players, Increase in Spending

One of the most significant trends in 2023 was the decrease in the number of active online players, from 3.8 million in 2022 to 3.6 million in 2023, a decline of 5.3%. This attrition was particularly noticeable in sports betting, where the number of active bettors decreased. However, despite this decline, the overall spending per player increased, indicating that although there were fewer players, their enthusiasm for gambling activities was higher. In 2023, the average expenditure of French adults on gambling was 249 euros, up from 242 euros in 2022.

Forecast for 2024

Forecast for 2024

Looking ahead to 2024, several factors could impact the future of the French gambling market:

Following the 2024 Paris Summer Olympics and Paralympics, the sports betting market is expected to recover. The return of high-profile sports events could reverse the declining trend in sports betting numbers seen in 2023.

Casinos are likely to continue playing a major role in growth, especially if foot traffic and spending continue to maintain a positive trend.

The shift from brick-and-mortar to online gambling will continue. The increasing market share of online operators indicates that internet gambling will continue to outpace traditional retail outlets, especially in sports and horse race betting.

Statista's 2024 Forecast:

Online gambling GGR: 3.71 billion euros

Growth rate: 4.44%

Online sports betting GGR: 1.72 billion euros

Online gambling market penetration rate: 13.2%