Preface:

"IP" stands for Intellectual Property, which encompasses various forms of cultural assets. For example, "Star Wars" is an IP owned by Disney, which possesses some of the most famous IPs globally.

IP games are games developed around specific IPs.

In recent years, there has been a trend of IP revival in the gambling industry, especially with slot games. It is believed that more IP gambling games will emerge soon.

In this article, PASA will explore the reasons behind this trend. What can practitioners learn from this?

Brand IP content is not new in the gambling industry, with many game developers focusing on external IPs for a long time.

For instance, NetEnt is one of the most renowned brand content studios in the industry, having released games based on IPs from Columbia Pictures, 20th Century Fox, and Universal Studios over the past decade.

Some of the earliest brand content released includes "Dracula," "Conan," and "Jimi Hendrix," showing that brand IP content is not a novelty in the industry.

In 2021, NetEnt released Gordon Ramsey's "Hell's Kitchen," in 2018 "Jumanji," and in 2016 "Guns N' Roses," indicating that such gambling games have been around for over a decade.

However, the development of this type of IP games has been slow over the past two years (2021-2023), only recently seeing typical developments such as Games Global's collaboration with "WWE" to launch a slot machine, Inspired releasing a "Terminator" slot machine, and Aristocrat launching a "House of the Dragon" slot machine.

These three cases can be called classic examples by PASA this year, mainly because the value of brand IPs is not constant—the success of the released games is related to the cyclical nature of IP value.

The Cyclical Nature of Brand IP Value

The value of brand IPs is cyclical, similar to fashion trends. When hot, they are widely discussed, but when interest wanes, they become less popular.

For example, Disney Marvel's "Avengers: Endgame" was at its peak when it was released in April 2019.

The movie grossed $2.7 billion worldwide, followed by over a dozen mobile games using the Marvel series IP, achieving significant download volumes.

However, with the advent of Covid19, the movie industry suffered a major blow, and the reputation of Marvel's productions declined significantly in the following years, leading to a severe loss of casual fans and a significant reduction in audience numbers.

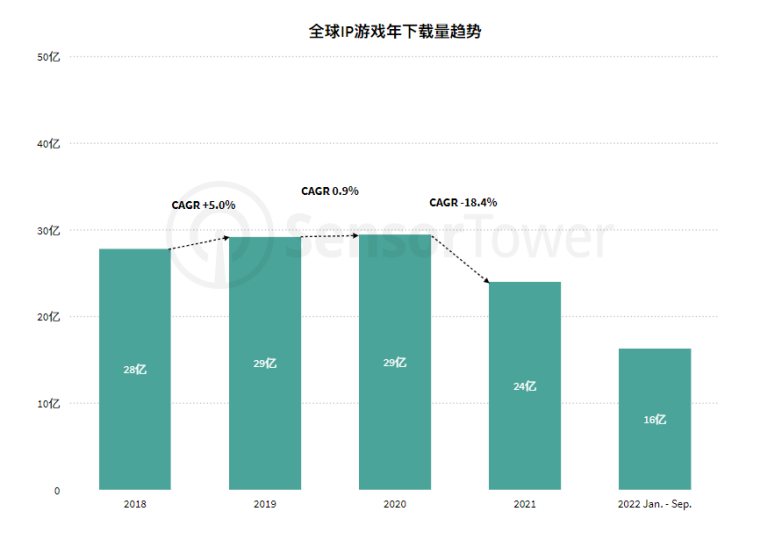

According to SensorTower data, the global mobile IP game market was relatively stable from 2018 to 2020, with annual download volumes nearly reaching 3 billion, undoubtedly contributing significantly to the "Avengers" IP.

Interestingly, as the "Avengers" IP declined, the global IP game download trend began to decline from 2021.

This is what we mean by the cyclical nature of brand IP value.

So, are the three classic IP slot games released this year by Games Global, Inspired, and Aristocrat at the peak of these IPs?

The collaboration between Games Global and WWE seems quite natural. The sports industry has already established connections with gambling through sports betting, and moreover, Games Global has also collaborated with another fighting organization, UFC (which belongs to the same parent company as WWE), to release a series of games.

WWE indeed had a hot year in 2024, according to the 2024 ranking of sports events with the highest number of live spectators in the US:

1. WWE WrestleMania 40 Night Two— Audience: 72,755

2. Kansas City Athletics vs. Miami International— Audience: 72,610

3. WWE WrestleMania 40 Night One — Audience: 72,543

4. New England Revolution vs. Miami International—Audience: 65,612

5. NFL 58th Super Bowl Final— Audience: 61,629

WWE programs ranked first and third.

Therefore, when Games Global announced it had signed an agreement with WWE to produce three themed online slot games, with "WWE Bonus Rumble: Gold Blitz" launched in August, this release can be said to be a very successful strategic launch by Games Global.

Inspired adapted Arnold Schwarzenegger's classic movie "Terminator" and released the online slot game "Terminator."

Although this movie was a classic released forty years ago, this IP was heated up this year, 2024, with the release of a "Terminator: Zero" Netflix series and the announcement of "Terminator 7: World's End."

Finally, Aristocrat's release of "House of the Dragon" was in collaboration with George R.R. Martin's "A Song of Ice and Fire" IP. The company had previously released games including "Game of Thrones: Winter is Coming" and "Game of Thrones: King's Landing."

"Game of Thrones" can be said to be one of the hottest adapted TV series in recent years, and the production of "House of the Dragon" in the past two years has once again deepened this IP's impression in the audience's mind.

This year's "House of the Dragon 2" series, although not as well-received as "House of the Dragon 1," did not differ much in terms of popularity.

These three games, all in collaboration with classic IPs and launched at the peak of these IPs' popularity, are indeed when the brand IP value is at its highest.

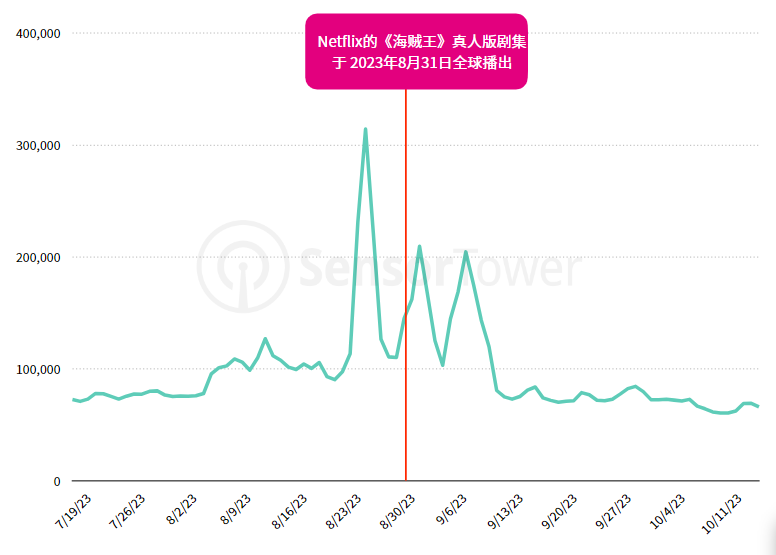

This is also evident from SensorTower data: the week before the "One Piece" series premiered, the download volume of the adapted mobile game for this IP surged significantly.

On August 26, 2023, the download volume of "One Piece" IP games in Vietnam increased by 450% compared to the previous day, and in Indonesia, there was a 200% significant increase.

Therefore, the IP slot games launched by Games Global, Inspired, and Aristocrat this year can be said to be the most typical IP collaboration cases.

Specific IPs Attract Specific Players

After understanding the relationship between IP value and game release timing, it's time to select the appropriate IP.

Whether a brand IP is useful for our gambling game development depends on the audience it connects with.

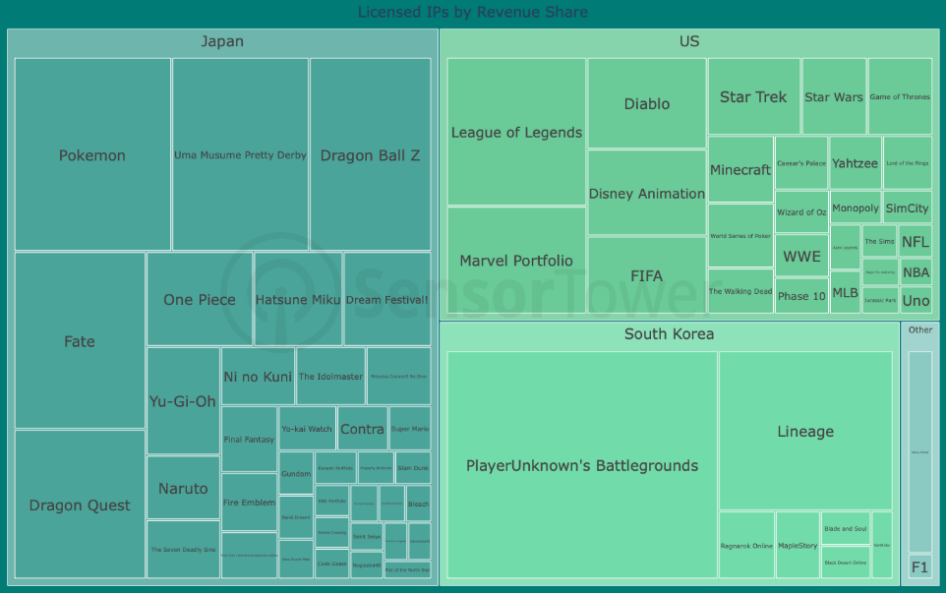

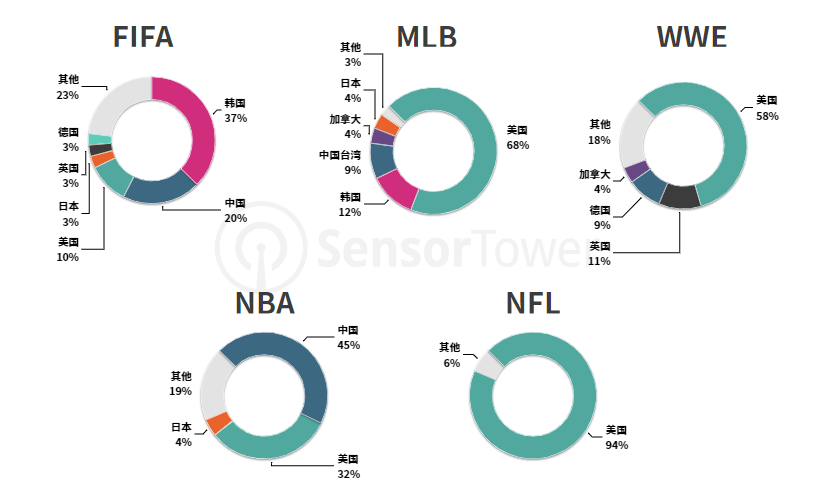

First, we differentiate by region. According to SensorTower data, we can see from the following chart that users from different regions have different preferences for different IPs.

For example, audiences in Japan and Korea prefer anime and second-dimensional IPs, while American audiences lean towards classic movies and sports IPs.

So once we have identified the target market, we can choose the corresponding IP based on the preferences of users in that region.

For instance, the NFL is predominantly favored by American audiences.

If we aim to enter the American user market, we can reach an IP collaboration with the NFL before the season starts and launch the gambling game at the start of the season, at which time the empowerment of the IP will undoubtedly push this game to a climax.

Besides, the popularity of an IP also varies by age.

For example, the "Terminator" IP mentioned earlier is not actually favored by young people.

But Inspired aims to capture the pre-1980s born population, targeting a potential content vacuum for this user group, which the company sees as a relatively untapped market opportunity.

Of course, this makes sense to some extent. We all know that millennials or Generation Z are currently the largest customer group in online casinos, and the older generation may not be willing to switch to online casinos, but if there is a game targeting them with an IP they are familiar with and love, they might be willing to make a change.

Because customer loyalty to a brand can likely overcome any cross-platform barriers, just as the author happens to be a loyal football fan, if a platform or game developer launches a fantasy sports game in collaboration with FIFA, I would definitely play without hesitation.

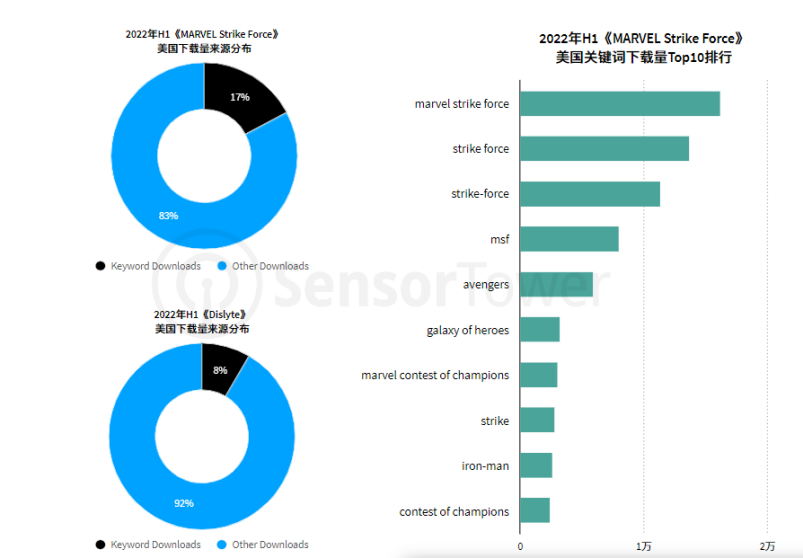

Moreover, according to SensorTower data, IP games can achieve natural downloads through keyword searches, meaning IP games can even bring their own traffic.

For example, "Dislyte" and "MARVEL Strike Force" were among the top team games in the US market in 2022, ranking first and fourth in downloads in the first half of 2022, respectively.

But "MARVEL Strike Force" achieved a higher proportion of natural downloads through keyword searches, accounting for 17%, and the absolute value was higher than "Dislyte," clearly showing that IP games are more likely to achieve natural downloads through keywords.

The keyword download ranking also shows that having a game name containing IP-related content will help gain search exposure, thereby increasing the likelihood of user conversion.

Conclusion

In conclusion, IP collaboration is a good strategy for any industry, not just the gambling industry.

Using content familiar to players makes the product more reliable, immediately connecting players with the new product.

But when choosing a collaboration IP, remember two key points: 1. Pay attention to the IP's popularity cycle, and the game's collaboration should be launched when the IP is at its peak or even exploding. 2. Pay attention to the IP's audience, corresponding to the entered market, and collaborate with an IP that is popular in that market.

As long as these two points are met, the empowerment of the IP is like a cornucopia, bringing a continuous stream of wealth to our games.

With extensive research on how Generation Z and millennials' preferences for IP brands evolve, we can look forward to seeing more corresponding brand products released in the future. Therefore, new game developers can also seize this opportunity to secure a popular IP, which can save a lot of detours.

We look forward to discussing more unique insights about IP games with our readers and invite you to follow the global iGaming leader's outbound information platform PASA for more firsthand industry information.

Welcome to subscribe to the official PASA channel: https://t.me/PASAIGHYJL