Many practitioners may have heard about how lucrative major gambling operators are, and everyone believes that "being the house" always wins.

While everyone is envious of the revenue of each gambling platform, those who try to enter the industry without careful consideration and in-depth research might first want to read this article by PASA.

Globally, the online gambling industry is expanding at an astonishing rate, especially in countries with a strong sports culture such as India and the UK, where sports betting has become a popular form of entertainment for thousands of sports fans.

Many outsiders and even practitioners may not know that most gambling companies, such as the frequently played Bet365 and William Hill from the UK, are privately owned.

Compared to public companies, private companies do not need to publish financial reports regularly, so their actual income levels and profitability are a mystery to the outside world.

This layer of mystery also attracts many rumors, such as certain organizations manipulating matches, knowing the results in advance, and making huge profits by manipulating the odds, etc.

In these rumors, gambling institutions are seen as omnipotent gods, and the players are like lambs to be slaughtered.

However, is this really the case? As PASA holds first-hand information on the gambling industry, it will answer the following questions from a professional perspective.

Is the gambling industry a highly profitable industry, and how much money can gambling institutions make each year?

Can sports betting merchants really profit by manipulating matches?

I. Detailed Analysis of Gambling Institutions' Financial Reports

The good news is that the two largest gambling institutions in North America are public companies that regularly publish financial reports. Therefore, PASA took these two gambling merchants as examples and reviewed one of the institution's financial report transcripts and Q&A records from the past three years, extracting a lot of valuable information.

Draftkings (DKFG) is one of the largest sports gambling institutions in North America.

Its main business is online sports betting for major sports events, including football, NBA, NFL, etc., referred to as osb online sports betting in their financial reports.

The second part of the business is online gaming, also known as iGaming, such as common casino games like baccarat and slot machines.

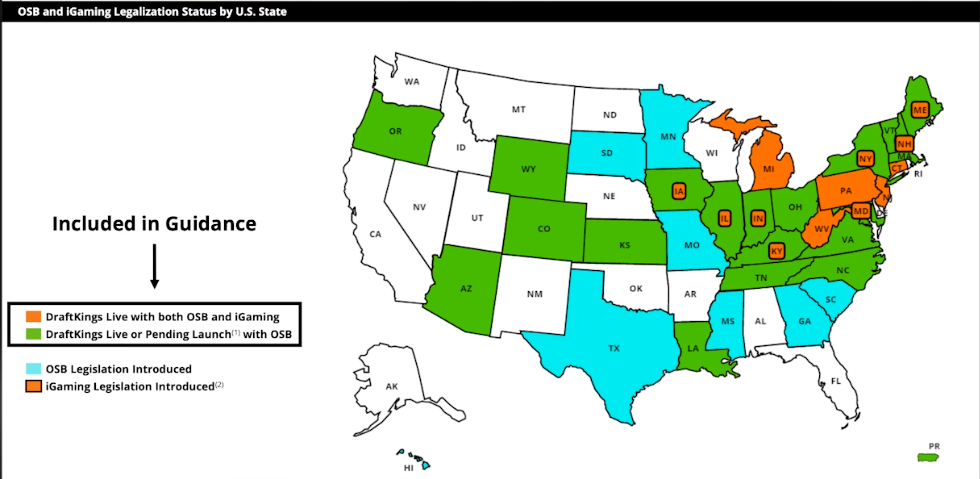

Due to different laws and regulations in various states, sports betting is only legal in some states.

With the recent legislative follow-ups in various states, the general trend in the US market is that sports betting will gradually be legalized nationwide.

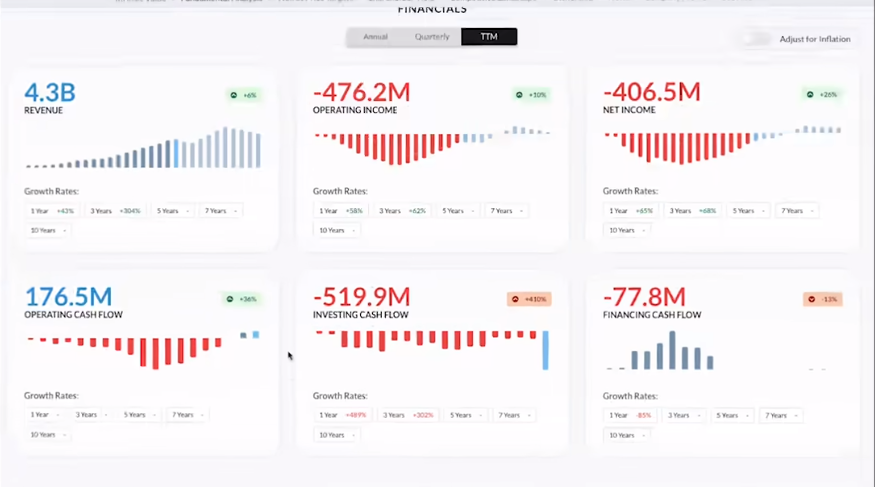

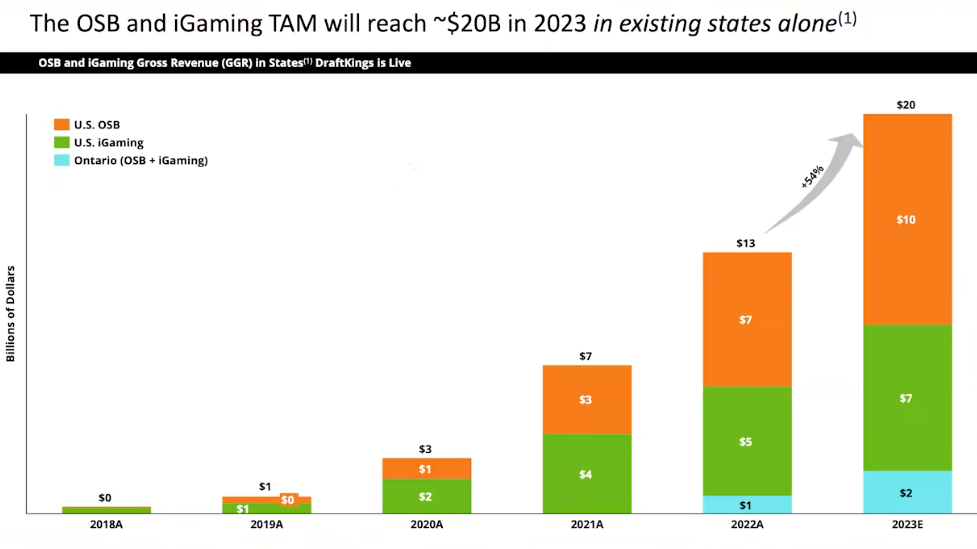

Currently, in 2023, the net revenue of the US gambling market has reached $20 billion.

In all existing legal states, Draftkings' average market share is 35%, and as local policies gradually relax, the company's revenue level is also rapidly growing.

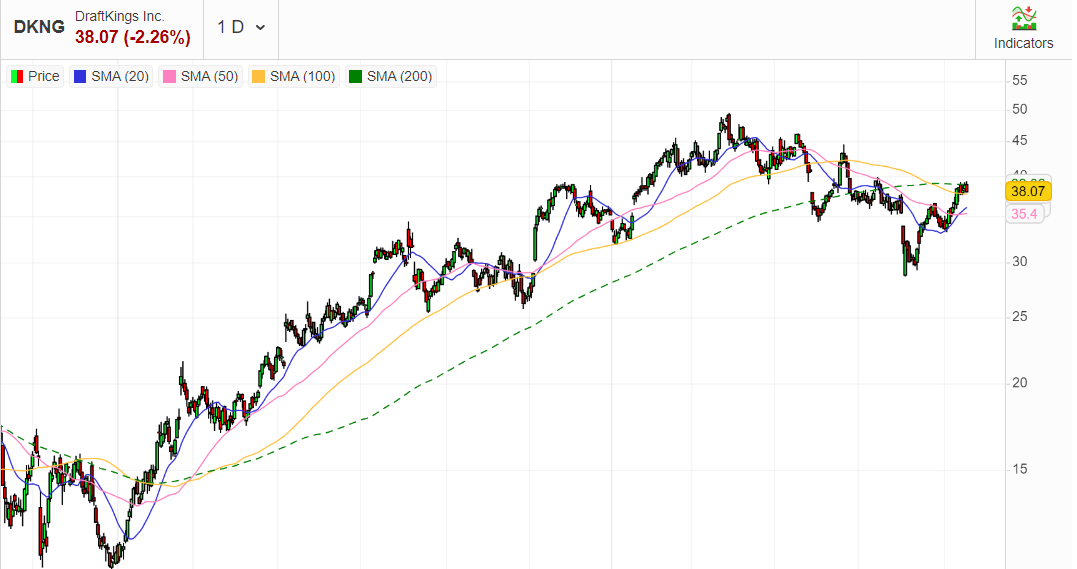

The stock price trend also reflects the company's fundamentals, currently maintaining near historical highs.

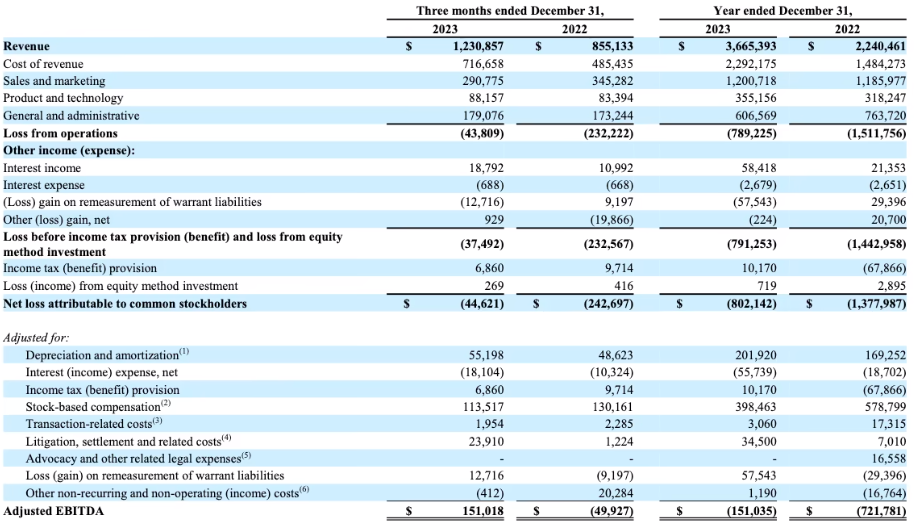

Through the financial report, we can see that in the fiscal year 2023, Draftkings' annual revenue reached $3.6 billion, a 63% increase from $2.2 billion in 2022.

It is worth noting that this $3.6 billion revenue is the net income after deducting total payouts from total wagers.

Draftkings' actual wagers, the total amount of bets received from players, were actually over $30 billion in 2023.

According to accounting standards, the revenue in the gambling company's financial report is GGR (Gross Gaming Revenue), which is the net income after deducting total payouts from total wagers, so the Revenue data in the financial report does not reflect the issue we are truly concerned about—the profit margin of the institution's gambling operations.

This profit margin refers to the percentage of money left after payouts, as a percentage of the total betting volume.

This indicator is academically called Structual Hold, and its calculation formula is easy to understand. For example, if Draftkings receives a total bet of $20 billion in one year and the total payout is $15 billion, the payout here is the money returned to the bettors who guessed the match results correctly, then its net income GGR, is $20 billion minus $15 billion, equaling $5 billion.

And its Structual Hold, or profit margin, is $5 billion divided by $20 billion, equaling 25%.

For example, if I, as a gambling operator, receive a betting amount of $100 million, but return a payout of $95 million, even though I earn $5 million, it does not mean I am making a lot of money.

But the same $5 million profit, assuming I only received $10 million in bets, then my profit margin is 50%, proving I am extremely profitable.

Structual Hold is the indicator that truly reflects the profitability of gambling institutions and is the core indicator of gambling institutions, so this indicator is not directly disclosed in the financial report.

Although we mentioned in past articles that the payout rates for various types of gambling, such as sports betting being around 90%, lottery being around 50%, etc., Structual Hold, as a company with mixed operations, better reflects its overall profitability.

Thus, PASA reviewed all of Draftkings' financial reports and Q&A sessions and finally found some relevant information.

II. Reverse Engineering Gambling Institutions' Profit Margins, What Lessons Can We Learn?

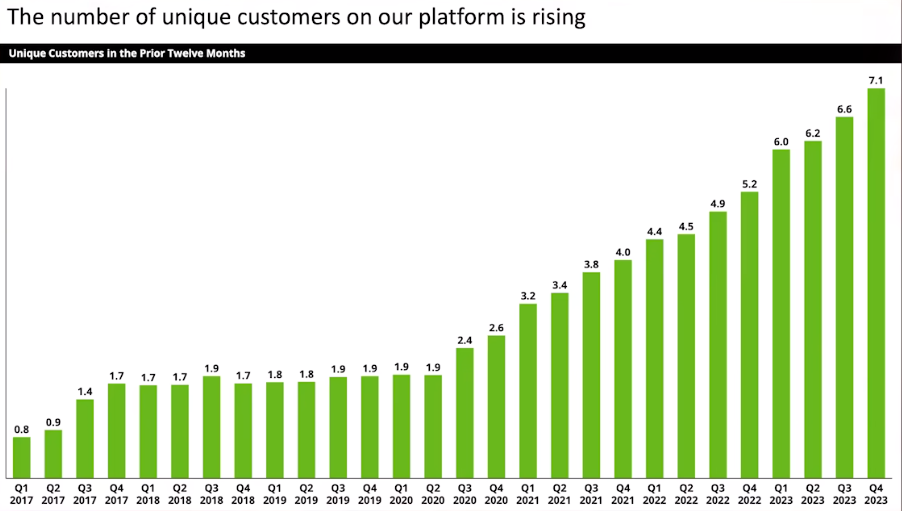

As mentioned earlier, the $3.6 billion that Draftkings earned, which is contributed by the US market players, is steadily increasing as gambling is gradually legalized in each state. According to data, the number of US players betting on the Draftkings platform reached 7.1 million.

Based on its market share of 35%, the total number of US players should be at least 20 million, and this is only when less than half of the states in the US have legalized online gambling.

As online gambling is trending towards nationwide legalization, by 2030, the number of US players is expected to grow to around 100 million.

According to data from the fourth quarter of 2023, the platform's monthly active players reached 3.5 million, with an average monthly betting contribution of $116 per person.

It is evident that the betting amount of US players is very large, and it is estimated that by 2030, the total betting amount in the US will reach $120 billion.

However, Draftkings mentioned in a Q&A session that they are not having an easy time.

"Our match results in March and April did not meet expectations, resulting in a revenue reduction of $60 million and $42 million in those two months."

Institutions indeed lose money in some matches, and there are quite a few such matches.

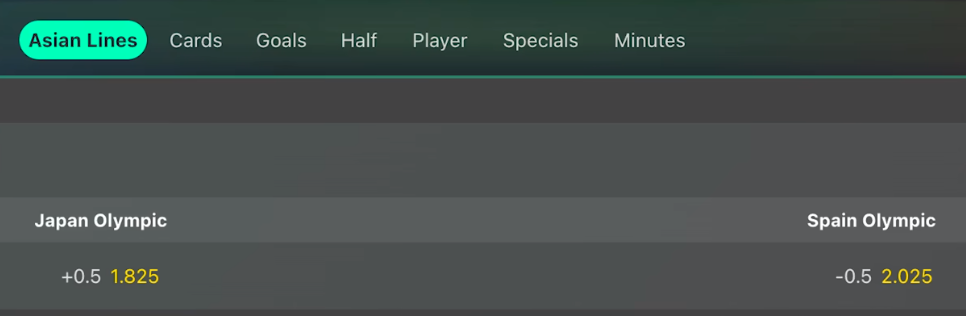

Take the recent Olympic men's soccer match between Japan's national team and Spain's national team as an example. The odds market pricing for this match was Spain giving half a goal at high water. Suppose the betting amount for both sides is equal at $1 million, then consider the different outcomes and the institution's corresponding profit margin.

The institution's total revenue before payout for this match is $2 million.

Scenario one, if Japan wins, then their total payout is 100*1.825 equals 182.5 million, and the net income is $2 million minus 182.5 million equals 17.5 million, and the profit margin for this match is 17.5/200 equals 8.75%.

But in scenario two, if Spain wins, the total payout is 100*2.025 equals 202.5 million, and the institution's net income for this match is a negative value of 200 minus 202.5 equals negative 25 thousand.

As you can see, assuming equal betting amounts on both sides, if Spain wins, the institution will lose 25 thousand, and such match results are also known as player-favorable matches.

From a low-tech perspective, assuming we do not know who will win or lose before the match, how can a gambling platform ensure a stable income from this match?

It is not difficult to imagine that as long as the payout amounts on both sides are roughly equal, note that this is about equal total payout amounts, not equal betting amounts, it can ensure that the platform earns a risk-free income of 5% of the total betting amount.

Their means of balancing the total payout amounts on both sides is to adjust the market odds pricing, which is the changes in the odds and water levels that players see during the match.

Take this match as an example, when Japan's total betting amount is 1.1 times that of Spain's total betting amount, no matter what the outcome of the match, the platform can obtain a stable income of 5% of the total flow. In actual operations, due to the institution's huge advantage in AI analysis and prediction models, their average profit margin will be higher than 5%, which is also confirmed in their financial report meetings.

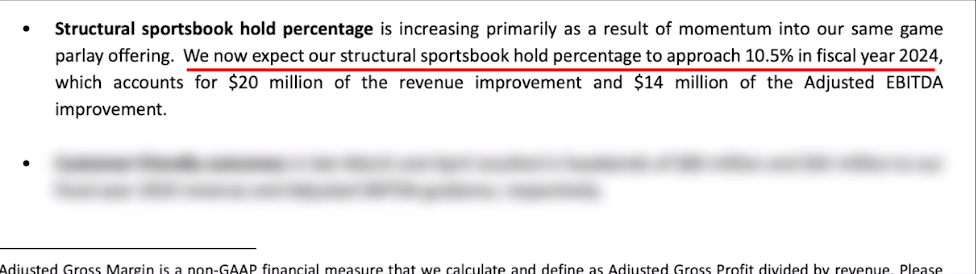

Draftkings expects their profit margin to reach 10.5% in the fiscal year 2024, which corresponds to the payout rates mentioned in our past articles, with sports betting payout rates generally around 90%, and the money institutions can earn is the remaining 10%.

Many people may be surprised that institutions can only earn a hard-earned 10% of the total betting flow.

Therefore, in reality, the situation of institutions manipulating matches only exists in most people's imaginations.

To earn more money, gambling institutions need to optimize Structual Hold.

Methods Draftkings also mentioned in the financial report, in sports betting gameplay, first, develop new gameplay, such as corner kicks, size balls, red and yellow cards, and other rolling combination bets, the more complex the gameplay, the higher the profit margin for institutions.

Second, strengthen risk control and real-time match trading pricing optimization, which is based on more accurate predictive models of real-time match trends, also mentioned in our previous articles as AI models.

In addition, to increase the overall company's profit margin, it is to develop games with lower payout rates, which is the iGaming business aspect. This point was discussed by PASA in this article "The Giant of the Lottery World: Unveiling The Lottery Corporation's Annual Revenue of Over $4 Billion and User Base Exceeding 4.75 Million", for those interested in faster ways to get rich, you can also take a look.

Conclusion

PASA has unveiled the mysterious veil of gambling institutions, showcasing their real income and profit levels through financial data.

In reality, institutions earn just 10% of the total betting flow, and gambling institutions fear match-fixing more than players, so they invest heavily in their risk control departments every year. Sports betting merchants not only need to provide players with fair and just betting opportunities but also play an important role in regulating the market within the entire industry.

Therefore, we hope this article can provide some insights to practitioners.

Gambling merchants are not really just lying down and making money. Modern gambling operators face not only traditional market challenges but also need to continuously optimize their business models to maintain market competitiveness in order to earn a share of this huge market as digital transformation, changes in user behavior, and compliance requirements increase.

If you blindly believe in some hearsay and rashly enter this industry, you might end up losing everything.

If you need more professional advice and opinions on the gambling industry, feel free to contact PASA, and we will continue to provide valuable insights for all practitioners.

We also look forward to discussing more unique insights about gambling institutions with our readers and sincerely invite you to follow the global iGaming leader's overseas information platform PASA to get more firsthand information about the get-rich-quick industry.

Welcome to subscribe to the official PASA channel: https://t.me/PASAIGHYJL