In the article "In-depth Analysis of Brazilian Users—How Operators Can Attract All Brazilian Players in One Step" by PASA, it was explained how we can target popular games for localized deployment in Brazil for Brazilian players.

In this article, we will directly focus on the most popular project in Brazil right now—the real money games, and thoroughly study the various characteristics of real money games, discussing their market advantages, traffic sources, target audience, payment methods, and suggestions for promoting real money games in Brazil.

This article is full of practical information, and PASA can be said to be leading everyone by the hand on how to layout the Brazilian real money game market.

Brazilian Gambling Market Size and Status

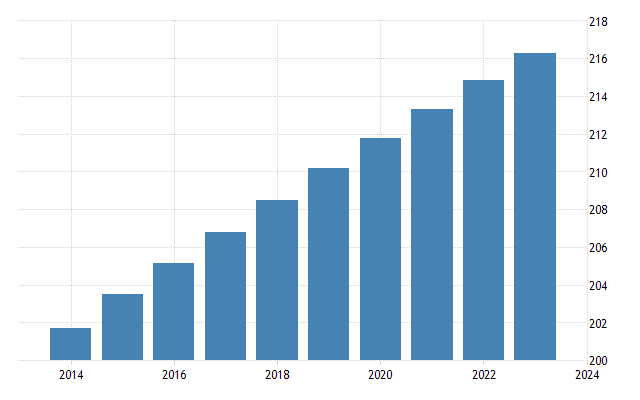

As the largest country in Latin America with the most population, Brazil reached a population of 213 million in 2023. The Brazilian gambling market is referred to as a sleeping giant that is about to awaken and is one of the fastest-growing countries in gambling development in recent years.

With this population size, promoting a gambling game can lead to a market of astronomical scale.

According to market data, the size of the Brazilian online gambling market in 2023 is 1.5 billion US dollars, expected to grow to 3.2 billion US dollars by 2027.

However, since the Brazilian online gambling market is not yet fully open, it is estimated that the size of the illegal gambling market in Brazil is between 6 billion and 8 billion US dollars per year.

Moreover, since 2023, the frequency of time spent by Brazilian male users on online gambling has increased by 45% compared to 2022, and the gambling market has added 20% new female users, who are counted as first-time users.

What investors look forward to the most is the legalization of online casinos in Brazil.

The Law No. 13,756 passed in 2018 paved the way for domestic and international operators to conduct business in Brazil. This law stipulates that both online and offline gambling are legal.

Although the law has been passed, the specific regulatory framework (including the issuance of licenses, tax rates, and legal enforcement) is being gradually formulated and implemented.

The regulation of online casinos in Brazil is expected to be finally introduced in 2024, allowing the legalization of iGaming activities, and many gambling operators and game merchants are currently in the process of applying for relevant licenses.

With the promotion of the 5G network in Brazil in recent years, the coverage of the 5G network in major Brazilian cities is now very high.

The popularization of the 5G network allows Brazilian users to have a better experience in online gambling, which can further drive their interest. Additionally, due to the implementation of the 5G network, mobile payments in Brazil are now very widely adopted.

PIX, as a very convenient online mobile payment channel, can also provide a good experience for mobile gambling game users in terms of deposits and withdrawals. This super convenient experience benefits both online gambling operators and users.

Based on all these favorable conditions, the Brazilian online gambling market has begun to grow explosively!

Unveiling Brazilian Real Money Games, Evaluating Popular Competitors

The explosion of real money games in the Brazilian market started in 2022, which can also be seen from the growth data of the Brazilian gambling market from 2022 to 2023, which was explosive.

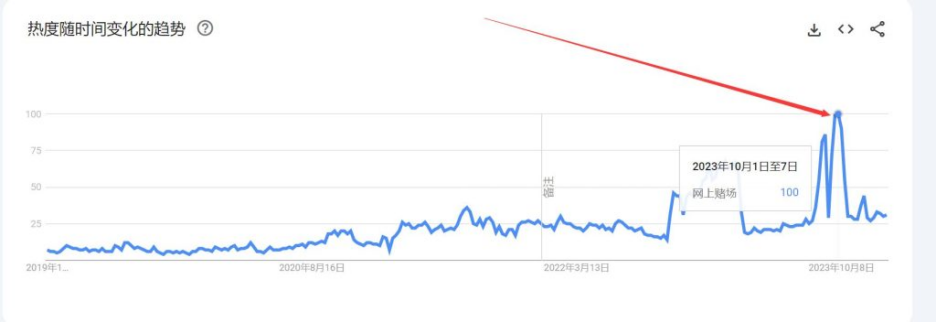

At that time, many game merchants began testing real money games in Brazil, and some clues can be seen from the Google Trends chart.

Speaking of the Google Trends tool, we will have a special issue next on how to flexibly use Google Trends to find business opportunities, how to judge market conditions, volume, timing of project searches, countries, languages, etc.

Let's first look at the data situation of Brazilian online gambling in the past five years.

The popularity of online gambling in Brazil, a sudden peak at the end of 2022, was an important time node when game merchants first entered the Brazilian market, around September 2022.

Then there was a peak in January 2023, which was an important time point when PG Soft games began to become popular in Brazil.

October 2023 is a peak, a peak of online gambling, which coincides with the time when Brazil opened online gambling licenses, and many game operators flocked in.

Since ten years ago, the real money game team has been developing various online games, with popular companies including PG Soft and PPSlots.

In the Brazilian market, PG Soft's games are the most chosen by players. PG Soft, short for Pocket Games Soft, is a mobile game development company established in 2015 in Valletta, Malta.

What are PG Soft's real money games like in Brazil?

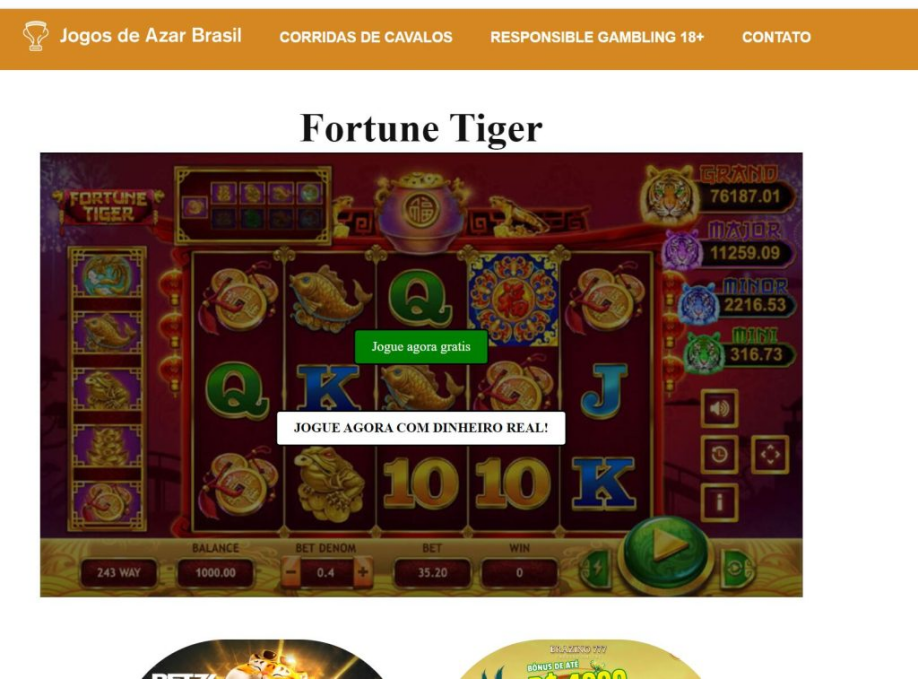

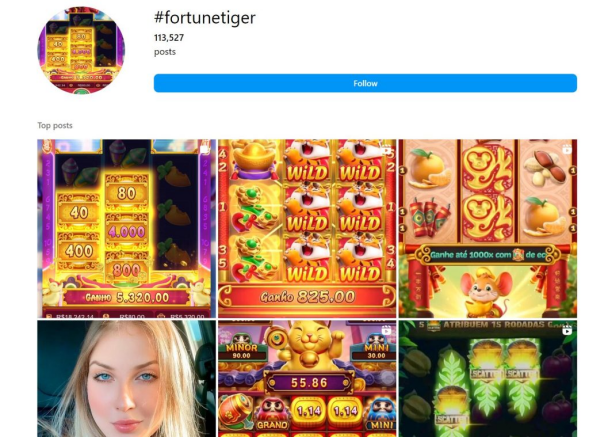

For example, this game Fortune Tiger is the hottest real money slot game in Brazil.

Players need to match three symbols to win, just like a slot machine. Three identical characters in a row can win a cash prize, and there are multiple combinations of three characters, with prizes of different values.

Because the gameplay is simple, and the image of the tiger is very popular among Brazilians, coupled with the high-return jackpot mechanism, it fits the user profile of Brazilian users very well.

The winning rate of Fortune Tiger is very high, and a round only takes a short time. A higher winning rate can increase user stickiness. If a user likes to play this game, he will spend time on the platform every day.

And as various bloggers promote this game and make demo videos, the user base of Fortune Tiger continues to expand, and these factors together create this explosive product.

In past articles, PASA has already analyzed the user profile of Brazilian players. In addition to real money slot games, Brazilian users like high-volatility gambling games, so designing Brazilian real money games in this direction is the best choice.

So the most important step we need to consider next is how to drive traffic to the project and how to increase the conversion rate. We will focus on discussing this next.

How Brazilian Real Money Games Acquire Traffic

Before discussing traffic-driving solutions, we need to first clearly research and analyze the target audience groups, so that the project's traffic driving can be more precise and purposeful.

This point has also been analyzed by PASA in the past, and here it is discussed comprehensively again.

Age: The age group of Brazilian online real money games, the 20-40 age range accounts for 60%, and the 40-60 age range accounts for 25%.

Gender: In terms of gender ratio, in traditional advertising concepts, we generally subconsciously think that the male audience should be the majority, because men are naturally more inclined to gamble.

However, the result in Brazil is exactly the opposite. In Brazil, 57% of those who like to play slot machines are women, and there are more female players than male players.

This point is very important. If it is not clear, it is easy to make mistakes in traffic driving. Therefore, some teams previously found bloggers with large breasts and a large number of fans, but the results were very poor because they got the target audience group wrong.

On the other hand, many mommy bloggers and beauty bloggers with a large female following have very good conversion rates.

Region: There are regional differences among players in different states of Brazil. São Paulo is the state with the most concentrated real money game players, accounting for nearly a quarter (24%) of the player base. Rio de Janeiro follows closely, with 14% of players coming from that state.

Rio Grande do Sul, Bahia, Ceará, Paraná, Minas Gerais, Pernambuco, Goiás, and the Federal District each contribute about 5-7% of the player population.

This data result is consistent with the previous data on the distribution of 5G mobile communications in Brazil. Metropolitan areas, communication infrastructure, and regional economic development all have an impact on game preferences.

There are many solutions for deploying real money games, and each solution has a big difference in conversion rates and final profit results.

Moreover, each country will have differences, such as the past articles PASA wrote about India, where social media deployment in India had much better effects than information flow deployment.

Here, PASA will comment on the traffic-driving solutions that everyone has used in the Brazilian market and reveal some niche channels.

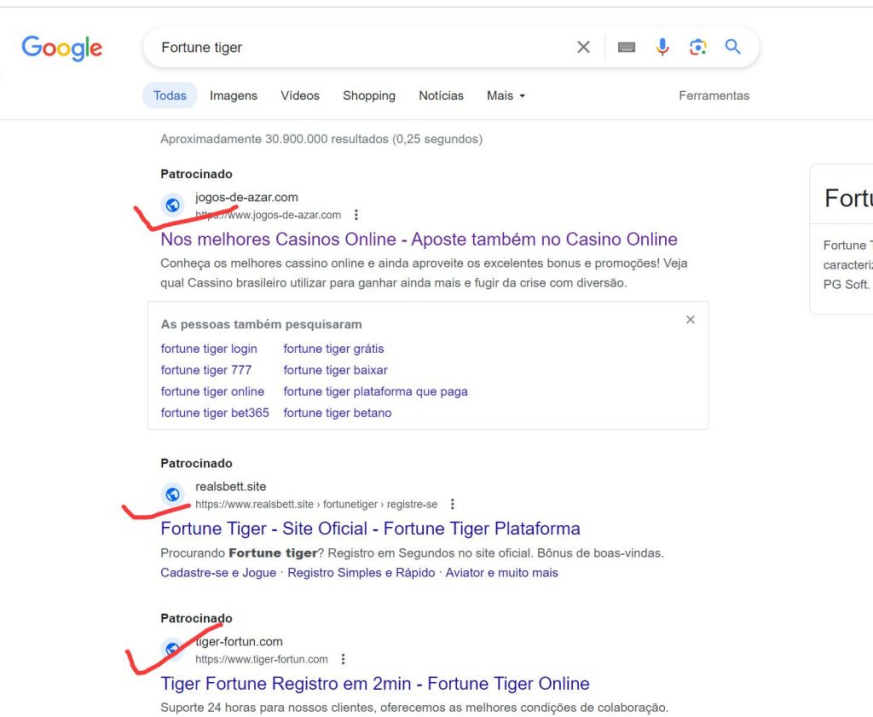

Google Paid Traffic

Google traffic is quite difficult, but it is very precise traffic. It is keyword search advertising. Users search for keywords in Google, and Google displays our ads. The traffic comes from users clicking on the ads.

This type of traffic is users who are looking for platforms to play games by searching for keywords in Google, so the conversion rate is relatively high.

However, the review time for Google ad accounts is long, and it is especially difficult for new accounts to get started. Additionally, Google ads also require some small tricks and some creative ideas.

Common advertising cases, such as investing in the hottest game in PG Soft, Fortune Tiger.

The tricks they use include having a landing page that is an intermediate transfer page, not the final game platform, in order to evade Google's review.

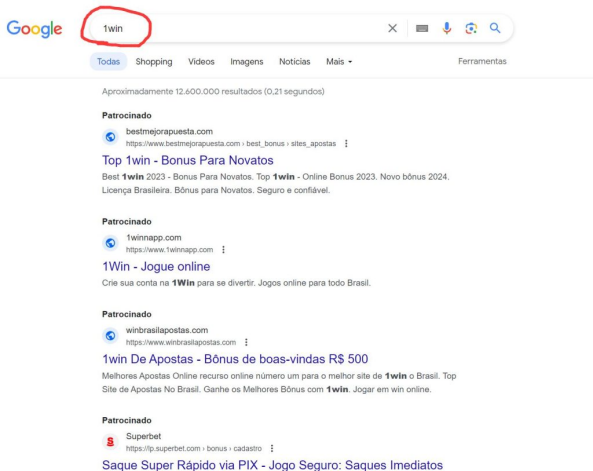

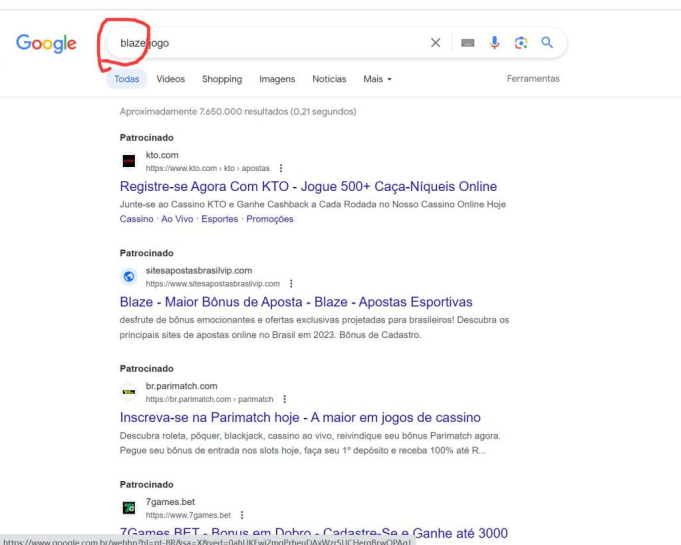

Fortune Tiger Brazilian Google search results screenshot

Intermediate page - Final landing page

Additionally, many landing pages lead to a display page of various major gambling platforms. These traffic investments are to earn the new user rewards from these platforms. Think about it, if the new user rewards can be earned back through traffic investment, you can imagine how low the traffic cost in Brazil is.

Here, PASA reveals a trick on how to harvest traffic at a very low price.

For example, you can invest in keyword ads for major gambling platforms. The price is very low, and many well-known platforms do not know how to invest in their own keywords, or they have not yet entered the Brazilian market. Because when users search for their keywords in Google, their official websites are not displayed.

We take 1win and Blaze as examples, and show you screenshots.

Additionally, for Google traffic, some operators spend a lot of advertising money to promote apps, which requires a lot of investment to find people to list on Google Play and the Apple Store, which is not cost-effective.

Facebook Traffic

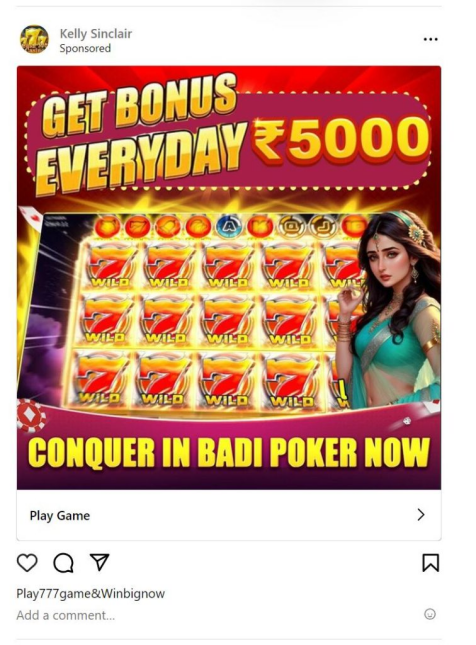

Facebook and Google are two completely different concepts. Google focuses on precise traffic, while Facebook's advertising system is a display ad, relying on Facebook's advertising algorithm and its vast user data analysis to push ads to interested audiences.

The core of Facebook's advertising is the advertising material. The platform identifies your material, matches it to the corresponding users through AI algorithms, and pushes ads to them.

There are two cores here, the first core is to test various advertising materials until the user push is relatively precise, and the second is that the content needs to stimulate the user's impulse, because he sees the ad not because he actively searches for it, unlike Google, so your ad content also needs to be able to stimulate the player.

Facebook traffic can also be deployed mainly on Instagram.

However, according to 2023 data, the data for Facebook traffic in Brazil is about 10 US dollars per depositing user, which is the industry average. Therefore, Facebook traffic is not necessarily a very good deployment channel in Brazil.

Influencer Marketing

Influencer marketing is a very fast traffic growth solution, and it is also the mainstream solution currently used by most Brazilian real money game merchants.

Finding influencers to promote has an obvious advantage: you can find a large number of exposure channels, and you can have as much traffic as you want, provided that you are willing to pay enough fees.

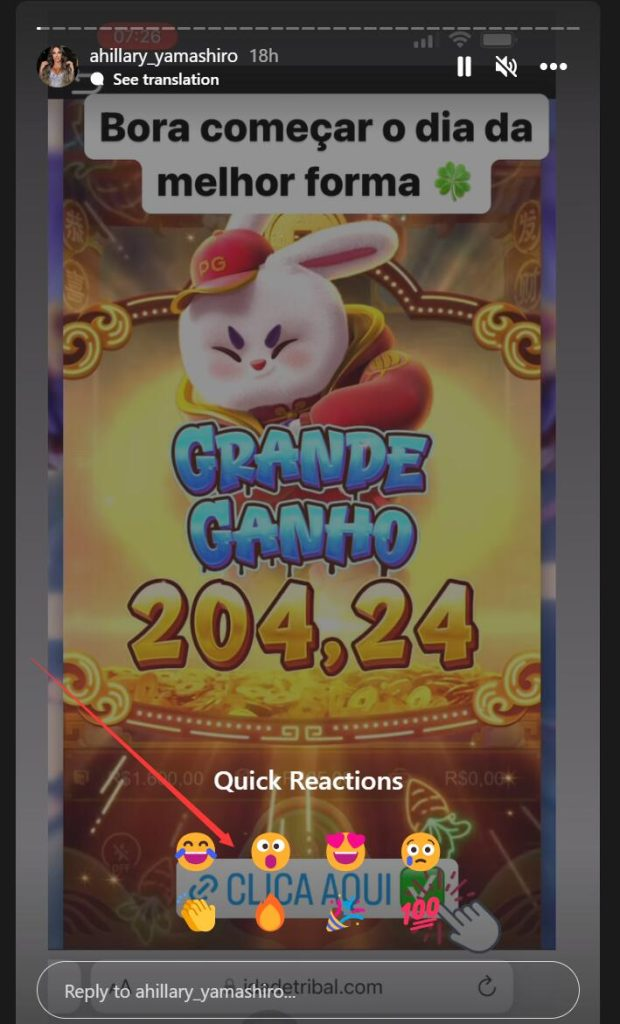

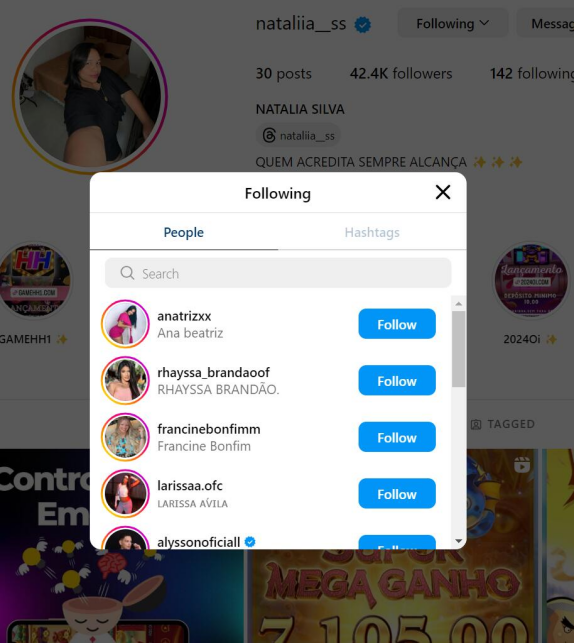

The Instagram influencer promotion plan is undoubtedly the top-ranked among all plans. Instagram is the second most popular social platform in Brazil, and its large user base also means that there are more influencers on this platform.

One very important reason why Instagram can bring such good results is that the Story section has a very large number of visits, and each Story video can bring a link, which is very convenient for users to click directly, thus bringing very good conversion rates.

High-traffic influencers can bring millions of views with just one Story post, which is an astonishing number. If the influencer you find has a good conversion rate, then the registration and deposit data will not deceive you.

How to find these local influencers?

The traditional solution is to first find excellent influencers through keyword searches, then filter out the ones you think are good and send them private messages. The second is to follow the vine, through known influencers, open their following list.

Influencers generally have a circle. If you can cooperate with one of them and achieve good results, then asking him to recommend his influencer friends is likely to also achieve good results.

Of course, while cooperating, it is also necessary to be cautious about fraud. There are good and bad influencers in Brazil, but once you encounter a scammer influencer, the investment funds will be wasted.

Therefore, anti-fraud measures are also essential. Generally, small influencers can let them post first, and then you pay. For big influencers, you can take measures such as finding someone to verify and paying in installments.

Youtube

As a long video application, Youtube has many fan user groups that mainly focus on learning skills. There are influencers you can cooperate with, such as slot game sharing influencers or other game evaluation-related influencers.

There are also many hidden gem influencers on Youtube, and you need to test different solutions. Moreover, Youtube videos are stored on the page for a longer time and can have clickable links directly.

When there are more keyword settings on Youtube, as the views increase, it can also appear on the Google search page, attracting more traffic.

However, Youtube does not have private messages, so when looking for influencers, you need to contact them through the contact information in the description, email, or social software such as WhatsApp, Telegram, Instagram. If there is no contact information in his description, you can also try to comment on his latest released video.

Tiktok, Kwai

Tiktok and Kwai are the overseas versions of Douyin and Kuaishou. They are currently the hottest short video platforms abroad, with a large number of user groups and very high user stickiness and APP usage time.

But there is one different point: the link can only be hung on the homepage description, not directly on the video description. The video description does not allow you to click on the link.

Because of this issue, although these two platforms seem to have a large user base, compared to Instagram and Youtube, the conversion rate is still much lower.

Conclusion

Having discussed this, we have also roughly understood the strategies for the Brazilian market. The