PASA mentioned in the article "Lightning Strike! Entering the market is like a suicide mission for gambling operators? Why Serie A sponsorship is the 'blank' choice for operators" that due to the "Dignity Decree," many sports betting operators are unable to launch major market campaigns in Italy.

However, recently, for new gambling operators wanting to enter the Italian market, there has been a change in regulation.

Italy has recently completed a new online gambling licensing framework, which has entered the final legislative process through the Customs and Monopolies Agency (ADM) and will introduce a new online gambling franchise framework.

This framework is currently under review by the European Commission, with the review phase ending on October 18, 2024.

The Italian government will initiate a tender process for new remote gambling licenses, expected to start at the end of December 2024 or early January 2025.

According to the new regulations, the Ministry of Economy and Finance (MEF) charges a fee of 7 million euros (approximately $7.7 million) for each online gambling license, valid for nine years.

The fee of 7 million euros is 35 times that of the 200,000 euros franchise fee in 2018.

The Ministry of Finance recognizes the significant increase in fees as an appropriate measure for a market dominated by gambling companies such as SNAI (Playtech), Flutter Entertainment, Lottomatica, and Entain.

Italy is trying to address several major issues in the gambling market, such as market monopolies and gambling addiction, through "gambling restructuring."

The technical regulations of the Monopolies Agency (ADM) ensure that licenses are limited to "one operator, one website," and ADM requires operators to "activate an application for each product category: such as betting, online casinos, poker, and bingo games."

The regulation prohibits "subsidiary online sites" and "agent sites," and allows for separate applications for various types of games such as betting, casino games, poker, and bingo games.

In layman's terms, this means that some of Italy's past monopoly operators could cover many gambling projects with just one franchise license, even placing some unlicensed projects on sub-sites of their gambling websites.

Under the new gambling license framework, gambling operators need to operate specific products separately, and each license can only operate one brand. This also provides new entrants with a fresh opportunity to enter the Italian market by developing specific gambling games and effectively circumventing the "Dignity Decree."

Next, PASA will delve deeper into the Italian online gambling market, analyzing how businesses can join the market competition under the new regulations.

Current State of the Italian Online Gambling Market

The gambling industry in Italy has been around for centuries, dating back to the Roman Empire when the precursor to the modern game of backgammon, Ludus Duodecim Scriptorum, was popular among Roman legionnaires.

The first casino in Italy, "Ridotto," opened in 1638 (386 years ago) in Venice. It was government-sanctioned to control citizens' gambling activities.

In 1774, with the closure of "Ridotto," gambling clubs became increasingly popular. These clubs were called "casinos," a word that originates from Italian.

Baccarat originated in Italy in the 15th century, and bingo also has its roots in Italy. In the 1530s, Italians played a game called "Lo Giuoco del Lotto D'Italia," similar to bingo.

The liberalization of the Italian online gambling market began in 2006 when the European Commission investigated the case after receiving complaints in 2003 and initiated infringement proceedings against Italy.

The reason for such actions was that Italian gambling legislation was very strict (as mentioned in the article "Lightning Strike! Entering the market is like a suicide mission for gambling operators? Why Serie A sponsorship is the 'blank' choice for operators"), even prohibiting legal European gambling operators from offering online services in Italy.

The 2007 "Financial Law" was a milestone in Italian gambling regulation.

After the European Commission initiated infringement proceedings against Italy, the Italian authorities notified the Commission of the revisions made to the gambling law in 2009.

Since the new law took effect in March 2010, foreign gambling operators have been able to launch online real money games.

Since then, gambling operators only need to obtain an Italian gambling license to operate locally, including licenses for skill games, tournaments and single-player poker games, cash poker games, casino games, fixed odds and total betting on sports, horse racing and other events, bingo games, etc.

The "Comunitaria" decree (February 2011) was a major breakthrough for the Italian gambling industry. One of its most notable aspects was the new tax system based on profits rather than turnover. Except for video lottery games, all newly legalized games were subject to a uniform tax rate of 20%. Operators organizing sports and horse racing betting, lotteries, and skill games still had to pay 3% of the total tournament buy-in fees sold.

As of now, in Italy, gambling, betting, and lotteries are all legal, but Italy regulates various forms of gambling, including casinos, sports betting, lotteries, and online gambling.

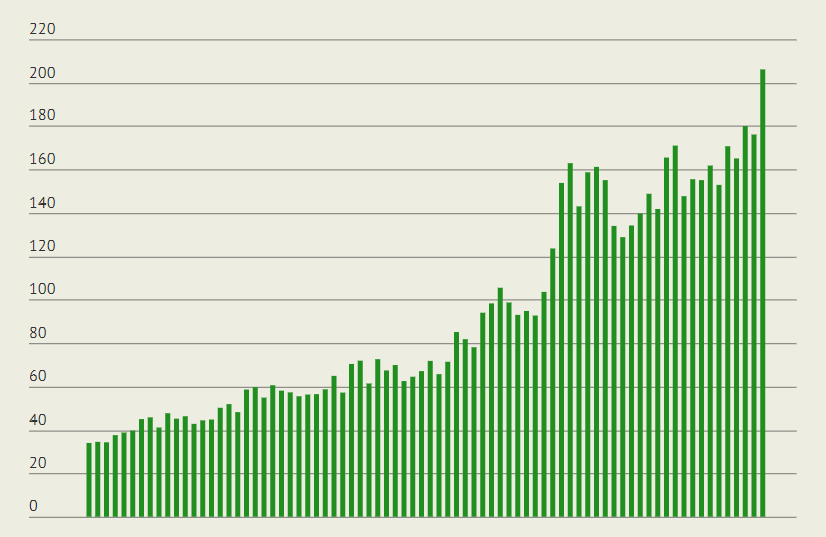

In 2022, the total betting amount in the Italian gambling market reached a peak, exceeding 136 billion euros, an increase of about 23% from the pre-COVID-19 pandemic year of 2019.

According to data from Statista, the Italian online gambling industry is expected to generate 2.9 billion euros in revenue in 2024, with online gambling becoming a strong growth sector in the gambling field.

The Italian online gambling industry is expected to grow at an annual rate of 5.52% from 2024 to 2029, with the market expected to reach 3.78 billion euros by the end of the forecast period. This growth includes only the online casino segment, which is expected to generate 1.54 billion euros in revenue in 2024.

Additionally, the number of Italian users is expected to increase to 4.3 million by 2029, with a user penetration rate of 6% expected in 2024.

These statistics highlight the urgent attention of Italian players to online gambling platforms.

In summary, the strict regulation of the past made it very difficult for many gambling operators to enter the Italian market.

But with a nearly 3 billion euro online gambling revenue market, with the Italian government's attempt to carry out "gambling restructuring" reforms and promote a new gambling license framework, it has provided a good opportunity for new gambling operators and game developers.

So, what we need to do next is to find the perfect entry point into the Italian market and make a strong push.

Two Golden Tracks in the Italian Market, Where Are Their Focus Points?

Football dominates the Italian sports betting market, with bettors wagering approximately 13 billion euros on football matches in 2022, about four times the amount bet on tennis.

That year, the Serie A league had the highest football betting amount, followed by the 2022 FIFA World Cup and the UEFA Champions League.

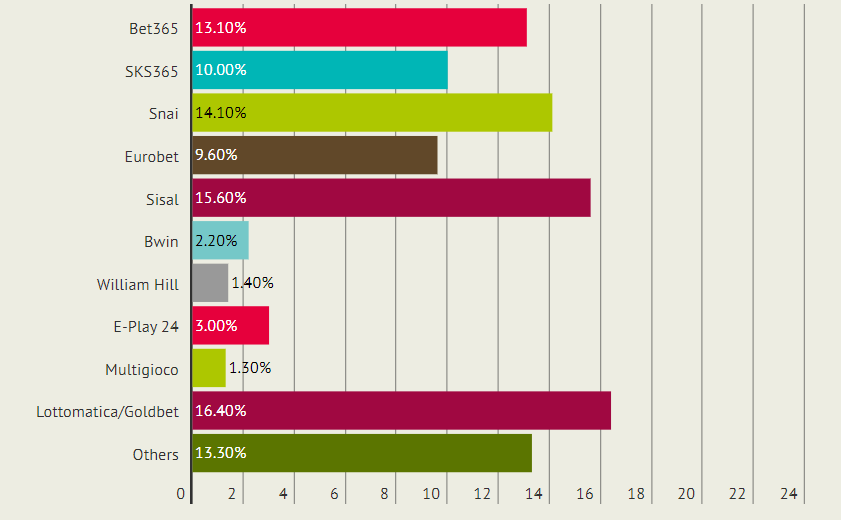

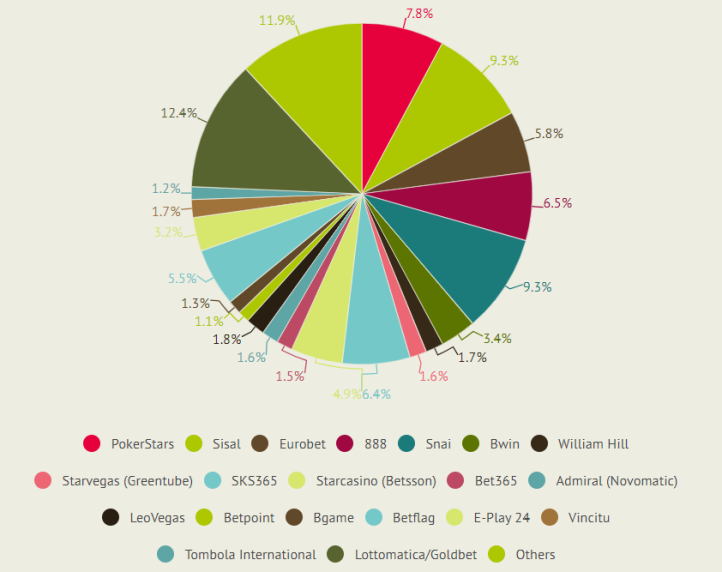

In the online sports betting field, Lottomatica was the sports betting operator with the largest market share in Italy as of December 2023, leading Sisal, Snai, and Bet365.

A significant trend in the Italian market is the popularity of sports betting, especially football.

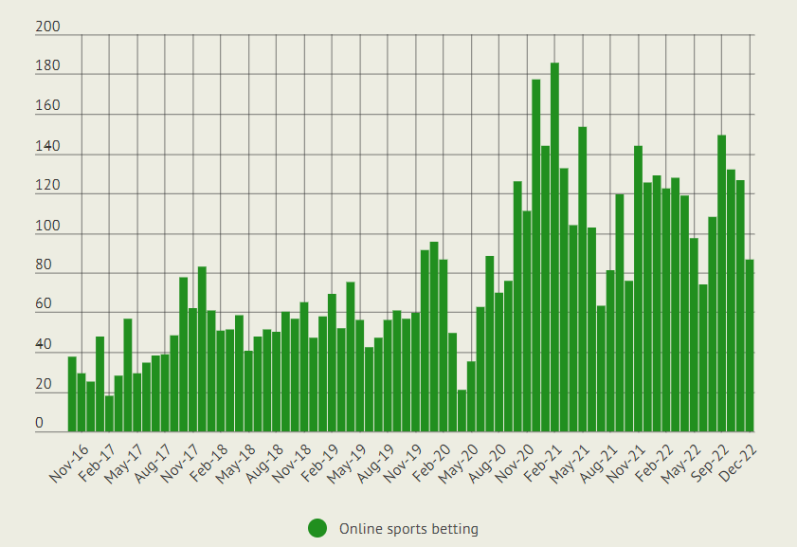

However, after 2022, the revenue from online sports betting in Italy slightly declined, with both retail sports betting and online sports reflecting this downward trend.

The main reason for this, as mentioned in the article "Lightning Strike! Entering the market is like a suicide mission for gambling operators? Why Serie A sponsorship is the 'blank' choice for operators," is the strict restrictions on gambling advertising by the "Dignity Decree" and the corruption and decline of the Serie A league.

However, as sports betting revenue declines, it is worth noting that the performance of live casinos and slot games has gone in the opposite direction, with these two projects not only not decreasing but accelerating in growth.

The reason is not difficult to understand. As a traditional gambling country, Italy has many casino projects that actually originated in Italy, so Italian players have an inherent attraction to traditional casino games, such as blackjack, roulette, and slot machines.

Also, due to the catalysis of Covid-19 in 2022, the emergence of real-time live dealer games directly changed the gaming habits of Italian players, enriching the online casino experience through video streaming and interaction with real dealers.

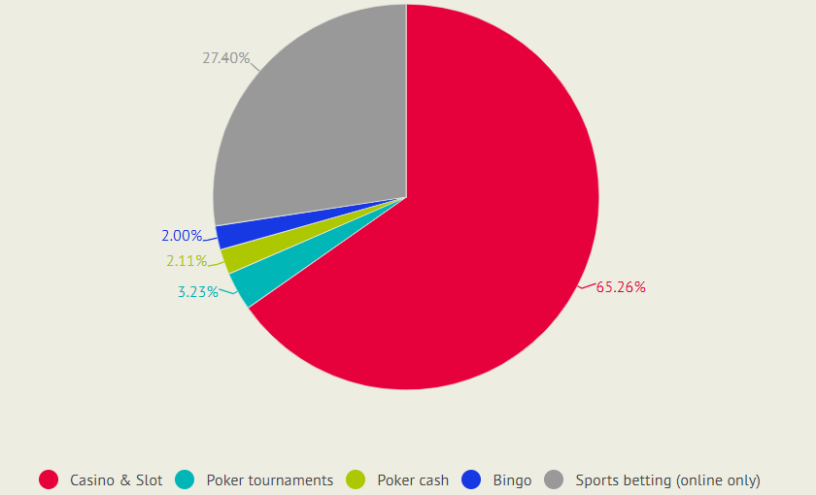

From the market share perspective, casinos and slot machines dominate, with the largest market share increase, while the online sports betting market share has decreased by nearly one-third, with both sectors showing a zero-sum situation.

Live casinos and slot machines hold 65.26% of the market share, while online sports betting has dropped to 27.40% of the market share.

At the same time, among local operators, Lottomatica/Goldbet maintains the leading position in the online casino industry with a 12.4% market share.

Lottomatica is also a gambling enterprise established in 2021 under International Game Technology, able to occupy such a large market share in such a short period of time, largely because it chose the right track.

That is to say, through the latest gambling license framework, we can theoretically enter the Italian online gambling market by designing a skill-based real-time poker cash game or an innovative slot game.

Of course, these are all based on theoretical expectations from data. In the actual operation process, we still need to figure out how to apply for and obtain an Italian gambling license and bypass the "Dignity Decree" to launch our games.

PASA will gradually share these key points with you in the future.

Conclusion

In conclusion, the nearly 3 billion euros in online gambling revenue in Italy seems not small, but it is not easy to swallow due to the strict regulation of the "Dignity Decree," which has cultivated consumer trust and attracted well-regulated international gambling operators. The Italian online gambling market can expand quickly and stably.

As Italians increasingly opt for online gambling, this change in consumer behavior is supported by various betting options. Once gaming platforms can meet their preferences, they will become the most loyal users.

We look forward to discussing more unique insights about the Italian online gambling market with our readers and sincerely invite you to follow the global iGaming leader's outbound information platform PASA for more industry information.

Welcome to subscribe to the official PASA channel: https://t.me/PASAIGHYJL