PointsBet announced the financial results for the first quarter of the fiscal year 2025, covering the period up to September 30, 2024.

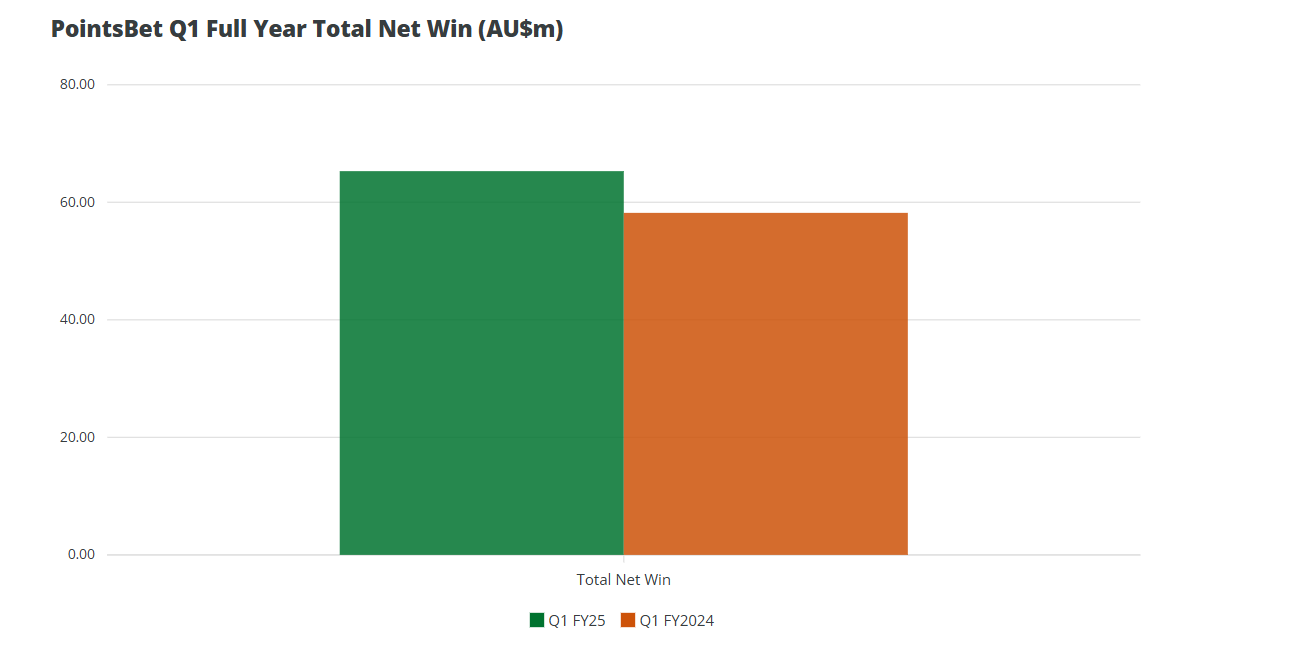

The company reported that its total net profit grew by 12% year-over-year, reaching AUD 65.3 million (USD 42.8 million), primarily due to revenue growth in its key markets, Australia and Canada.

Due to PointsBet maintaining cost efficiency throughout its operations, the gross profit increased by 15%, surpassing the growth in net winnings.

Performance in Australia and Canada

In Australia, PointsBet's net profit was AUD 56.6 million, up 7% year-over-year. The slight increase in gross profit margin to 13.2% was due to consumer preferences shifting towards higher-margin products.

This improvement, along with reduced "generous" spending (awards given to non-genuine customers), helped enhance PointsBet's profitability.

The company also saw a 5% increase in active cash customers in Australia, reflecting ongoing engagement in this core market.

In Canada, PointsBet reported a total net profit of AUD 8.7 million, a significant increase of 62%. Thanks to higher turnover and improved promotional spending efficiency, net winnings from sports betting surged by 77%.

In-play betting accounted for 76% of the total sports betting turnover in Canada, playing a key role in this growth, indicating strong demand from Canadian customers for live betting options.

Enhanced Operational Efficiency and Cost Management

PointsBet's focus on cost management continued to yield positive results. In the first quarter of fiscal year 2025, the company's total cash outflow from operating activities was AUD 2.7 million, a reduction from previous quarters, as PointsBet focused on cost-effective growth.

Marketing expenses reached AUD 16.5 million, reflecting the start of peak recruitment periods in Australia and Canada. However, the strategic use of promotional spending, especially targeting genuine customers, helped improve the net win rate for sports betting to 9.7%.

Furthermore, PointsBet invested AUD 5.6 million in capitalized software development to support ongoing improvements to its technology platform. Despite this investment, PointsBet still expects to achieve cash flow breakeven by the end of fiscal year 2025, with management reiterating this goal.

Growth in Multi-Betting and In-Play Betting Products

PointsBet's multi-betting products also saw significant growth, particularly in Australia. The company reported that turnover for multi-betting and Same Game Multi (SGM) products increased by 24%, with total betting volume up by 44%.

Participation was especially high during the AFL and NRL finals in Australia, with SGM active customers accounting for over 80% of all active customers during these events. This trend continued into the NFL and NBA seasons.

In Canada, in-play betting accounted for 76% of total turnover, growing by 68%. This growth reflects the market's general preference for real-time betting experiences, with PointsBet capitalizing on this trend through its proprietary in-play betting technology.

Cash Position and Future Outlook

As of the end of September, PointsBet reported cash and cash equivalents of AUD 33.6 million, including AUD 16.9 million in player cash accounts. The company's cash outflow from investing activities was AUD 5.6 million, primarily due to software development expenses.

PointsBet also maintained a cautious financing approach, with almost no change in credit arrangements and no new borrowing this quarter.

Looking ahead, PointsBet has issued guidance for fiscal year 2025, expecting total revenue to be between AUD 280 million and AUD 290 million.

The company aims to maintain a gross margin of over 50% and absorb regulatory changes such as the increase in consumption tax in Victoria without impacting overall profitability.

PointsBet also plans to continue strategic investments in marketing and product development to strengthen its market position in Australia and Canada.

Past Developments and Strategic Shifts

In early 2024, PointsBet sold its US operations to Fanatics Betting and Gaming for AUD 225 million. This divestiture allowed PointsBet to focus resources on its core markets, particularly Australia and Canada, which the company believes have the greatest growth potential.

Additionally, in fiscal year 2024, PointsBet implemented significant cost-saving measures, reducing marketing expenses by 21% and achieving a 17% increase in net revenue.