Pennsylvania Entertainment Company announced its financial results for the third quarter of 2024. Total revenue was $1.64 billion, a 1.2% increase year-over-year, with adjusted EBITDA at $193.5 million, down 35.2%, and adjusted EBITDAR at $348.4 million, down 21.7%.

Despite the declines in EBITDA and EBITDAR, the net loss significantly narrowed from $725.1 million to $37.5 million. Penn also reported a positive operating income of $67.5 million for the quarter, compared to a loss of $786.4 million last year, primarily due to last year's loss from the sale of Barstool, which resulted in operating expenses of $923.2 million. Another notable factor was the change in income tax expense, which was $2.8 million this quarter, compared to -$161.7 million last year.

This quarter's operating expenses were $1.57 billion, compared to $2.41 billion in the same period last year.

Revenue by Division

Of the $1.64 billion in revenue at the University of Pennsylvania, $1.29 billion (78.6%) came from the gaming business. This reflects a growth of 2.9% in this sector. It must be noted that the operating expenses for this sector also increased—the only sector to do so. Gaming operating expenses rose from $709 million to $826.1 million, an increase of 16.5%.

Revenue from food, beverages, hotels, and other sources was $351.2 million, slightly down from $367.3 million in the same period last year. Expenditures decreased by over $15 million to $244.4 million. General and administrative expenses dropped to $392.5 million, while depreciation and amortization costs increased by nearly $3 million to $108.7 million.

Revenue by Region

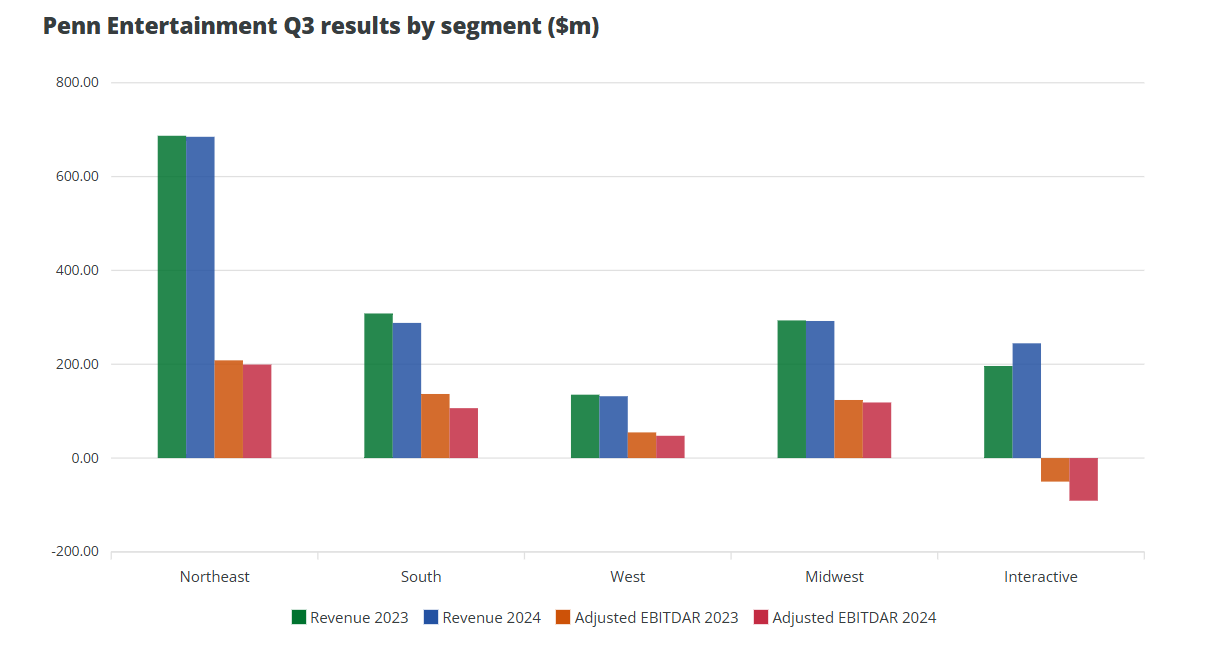

The Northeastern Pennsylvania division was the highest earning sector this quarter, with revenues of $684.8 million. This reflects a slight year-over-year decrease of 0.4%, while adjusted EBITDAR fell by 4.3% to $199.3 million. This division consists of over a dozen properties, including Ameristar East Chicago, Hollywood Casino at Greektown, Hollywood Casino at The Meadows, and Plainridge Park Casino. Pennsylvania attributes this decline to "unfavorable holdings."

The Southern division includes Ameristar Vicksburg, Boomtown Biloxi, Boomtown Bossier City, and Margaritaville Resort Casino, reporting revenue of $288.1 million. Like the Northeastern division, this revenue fell by 6.5% year-over-year. Adjusted EBITDAR also did not fare much better, falling 22.1% to $106.4 million. The University of Pennsylvania blames this on adverse weather conditions.

The Western region's revenue was $131.8 million, slightly down, but with a more severe decline than the Northeastern region, at 2.4%. Adjusted EBITDAR also fell to $47.5 million, compared to $54.7 million last year. This region's assets include Ameristar Council Bluffs, Argosy Casino Alton, and Hollywood Casino Joliet. The division's revenue also includes Penn's 50% investment in Kansas Entertainment, which owns assets such as Prairie State Gaming and River City Casino.

The Midwestern division of Pennsylvania experienced a fate similar to the other three land-based divisions, with revenue falling 0.4% to $244.6 million, while adjusted EBITDAR fell by over $5 million to $118.5 million.

Penn Interactive

Penn's only division to see year-over-year growth was the Interactive division. Last August, Penn sold 100% of its Barstool stock and renamed its sports betting division to ESPN Bet (acquired the brand in February), subsequently achieving revenue of $244.6 million this quarter, a 24.6% increase year-over-year. However, adjusted EBITDAR fell to -$90.9 million.

Compared to Penn's first quarter performance, the EBITDAR loss significantly increased. While the division's adjusted EBITDAR was -$196 million in the first quarter of 2023 and -$50.2 million in the third quarter of 2023; the third quarter of 2024 saw an adjusted EBITDAR growth to -$90.9 million; although the first quarter's adjusted EBITDAR indicated only a recovery potential of -$5.7 million. Thus, it is challenging to predict when this business will have a positive EBITDAR impact on Penn; considering the overall adjusted EBITDAR fell by 21.7%, this would be very beneficial to the operator's overall finances.

Stock Price Impact

As of the time of writing this article (British Standard Time 14:21), the University of Pennsylvania's pre-market stock price was $19.51, up 1.46% from the closing price of $19.23 on November 6.

Comparison

As of the time of writing this article, although FanDuel and DraftKings have not yet announced their third-quarter results, these results seem consistent with other companies in the field compared to competitor Bally.

Bally's revenue fell 0.4% to $630 million, while adjusted EBITDAR fell 47.9% to $166.3 million. Its net loss also more than doubled to $247.9 million, compared to $61.8 million in the same period last year. However, Bally's North American Interactive division significantly outperformed Penn Interactive in year-over-year growth, with revenue increasing 54.5% to $45.7 million this quarter.

Meanwhile, Caesars Digital reported that its third-quarter adjusted EBITDA was a positive $52 million, compared to $2 million last year. Its revenue growth also surpassed that of Bally's and Penn, with a year-over-year increase of 40.9%.

Comments

Regarding the performance, CEO and President Jay Snowden stated: "The University of Pennsylvania's third-quarter performance is consistent with the preliminary estimates we disclosed at our investor event in Las Vegas last month... The fourth quarter started even stronger, driven by multiple markets including Michigan, Ohio, and St. Louis.

"In the third quarter, our Interactive division benefited from better-than-expected revenue, thanks to our continuously improved product mix and lower promotional expenses. Additionally, on October 30, we launched the account linking between ESPN Bet and ESPN, which is the foundation for creating personalized sports betting experiences across the entire ESPN ecosystem."