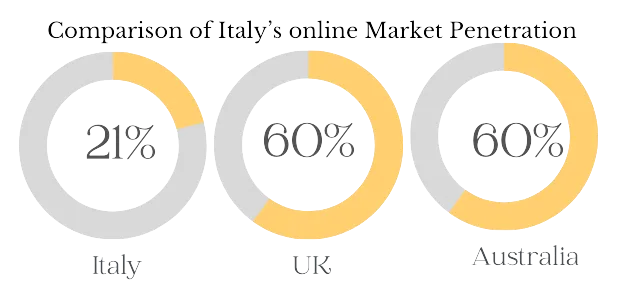

Italy has always been an attractive target for many global gambling companies, and not by coincidence. Italy is the largest regulated gambling market in Europe, with significant digital growth potential. As of 2023, only 21% of Italy's GGR comes from online channels, in stark contrast to mature markets like the UK and Australia, where online penetration exceeds 60%. This highlights key growth opportunities in the Italian market, as the online gambling CAGR is expected to reach about 10% over the next three years. Flutter's strategic entry into this relatively underdeveloped online market through Snai is not only timely but transformative.

Snai holds a 9.9% share of the online market, with an average of 291,000 players per month, making it the third largest online operator in Italy. But its digital influence extends beyond this. Snai's extensive retail network (including over 2,000 sites) helps it hold a 19% market share in the retail betting market and 14% in the retail gaming market. This omni-channel capability gives Flutter a significant advantage, allowing it to fully leverage online and offline assets in a market where consumers still prefer to make deposits and withdrawals in physical stores.

Synergies and Flutter Advantages

One of the key drivers of this acquisition is the potential for operational cost synergies. Flutter expects to achieve at least 70 million euros in operational cost synergies through the integration of technology, procurement, and content between Snai and the Flutter Group. These synergies are expected to be realized within three years of the transaction's completion, with 10% in the first year and 50% in the second year. On the revenue side, Flutter aims to enhance customer experience by leveraging its proprietary technology platform (known as "Flutter Edge") to improve pricing, risk management, and in-house casino content, thereby achieving more impressive performance.

Flutter has an enviable record of extracting value from acquisitions. The acquisition of Sisal is a prime example, achieving 17% revenue synergies between the second quarter of 2022 and the second quarter of 2024. Flutter expects Snai to achieve similar results. The company's proprietary platform not only provides a technological edge but also unleashes scale economies and offers a better user experience, which is crucial for driving customer loyalty and growth. This is particularly important in Italy, where Snai enjoys a 74% high brand recognition, making it the third most recognized brand in a strictly regulated market with severe advertising restrictions.

Financial Impact and Shareholder Value

This acquisition is expected to immediately increase Flutter's earnings per share, indicating its near-term profitability. Snai generated 947 million euros in regulated revenue and 256 million euros in adjusted EBITDA in 2023, with 50% coming from online, significantly boosting Flutter's revenue. This move strengthens Flutter's balance sheet and supports its broader strategy of acquisitions aimed at creating long-term shareholder value.

From a post-synergy perspective, the transaction's price-to-earnings ratio is attractive, similar to Flutter's prior acquisition of Sisal. Additionally, the cost to achieve the expected synergies is relatively low at 1.25 times, further highlighting the financial prudence of this transaction. As of June 30, 2024, Flutter's leverage ratio is 2.6 times, with a net debt of 5.5 billion USD, fully capable of managing this acquisition. Although the company's leverage ratio will rise in the short term, given the strong earnings potential from organic growth and acquisition growth opportunities, its management expects the leverage ratio to quickly decrease.

Positioning for Long-Term Growth

One of the most notable aspects of this acquisition is how it prepares Flutter for long-term growth in Italy and other regions. Italy remains the frontier of digital gaming growth, and Snai's extensive retail network gives Flutter a unique advantage in integrating online and offline channels. The company will leverage Snai's existing infrastructure to drive online penetration, a key growth lever in markets where digital gaming is still in its infancy.

Furthermore, Flutter's multi-brand strategy (already successful in the UK and Australia) will play a significant role in Italy. Snai's dominant position in the retail sector, coupled with Sisal's leadership among Italy's most recognized brands, offers a diversified "local hero" brand portfolio that attracts a broad customer base. With this strategy, Flutter can optimize its market coverage and meet the needs of different customer groups through targeted localized products.

Local advertising restrictions hinder international competitors from shining in the media, which also benefits Flutter. With strong brand loyalty for Snai and Sisal, the company can rely on customer retention and word-of-mouth growth rather than traditional advertising methods. This creates a higher barrier to entry for competitors and gives Flutter an opportunity to consolidate its market leadership position in the coming years.

Execution Risks and Regulatory Oversight

However, any acquisition carries risks. The transaction requires merger control approval and other regulatory approvals, expected to be completed in the second quarter of 2025. Additionally, while Flutter's successful acquisition history is encouraging, integrating Snai into its broader portfolio requires careful management. Achieving targeted synergies and coordinating the operational cultures between Snai and Flutter are crucial. Moreover, navigating Italy's complex regulatory environment poses broader challenges, especially as the government continues to scrutinize gambling behavior and tighten regulations.

Other economic factors, such as rising interest rates, inflation, and consumer sentiment towards gambling, may also affect the speed of integration and future growth. Nonetheless, Flutter's robust financial condition and experience in strictly regulated markets should help mitigate some of these risks.

A Transaction that Changes the Industry Landscape

Flutter's acquisition of Snai is not just about increasing market share but a carefully planned move to consolidate its position in Europe's largest gambling market and pave the way for long-term growth. By combining Snai's omni-channel coverage with Flutter's technological strength and proven merger execution experience, the company will be well-positioned to capture Italy's growing online market.

As the transaction unfolds, Flutter's ability to execute integration strategies and realize synergies will be crucial. If successful, this acquisition can generate significant shareholder value and serve as a blueprint for future international expansion, especially in markets with low online penetration rates. Flutter has proven it can thrive in competitive environments, and with Snai, it now holds a gold medal in the Italian gambling industry.